This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Grab a beverage and get cozy- welcome to your emergency fund crash course!

Absolutely everyone needs an emergency fund, but only the financially savvy actually have one.

If you don’t have one yet, you’re in the right place.

You can now consider yourself one of the financially savvy ones. Welcome to the club!

When I finally had my first emergency fund in place, all of my other financial stresses seemed to disappear.

It didn’t matter anymore if an unexpected expense came up, or if I over-spent one month. I had money ready to go to save myself. And I didn’t need to ask anyone else for it.

It really is the first time I felt empowered about my money, even though I still had debt.

If you read my post on how I paid off $12,000 in just 3 months, you’ll know that having my emergency fund in place first helped me do this so quickly.

It won’t take you long to get started on this financial goal, but there are some things you’ll need to know first.

Let’s jump into it!

What is an Emergency Fund?

Emergency funds are really easy to understand. They’re a savings account that you only use for emergencies.

Examples of emergencies are:

-Your car breaking down or needing work

-Losing your job

-An unexpected vet bill for your pet

-Your refrigerator stops working and you need a new one

These are all unexpected events that you need to pay for.

How Much Do I Need to Save in my Emergency Fund?

An emergency fund should have 3-6 months worth of living expenses. Once you know how much money you need to live each month, simply multiply this by a figure between 3 and 6. This is the number you’ll be aiming for.

You’re probably wondering if you should aim for 3 months, 4 months, or even 6? Maybe 12?

The answer: be honest with yourself. For me, I don’t have a whole lot of unexpected expenses that can come up. I don’t own a home, I don’t have kids, and I don’t own a vehicle.

I am a cat mom, however, and sometimes a surprise vet bill pops up.

3 months worth ended up being more than enough for me.

If you have a lot of financial responsibilities, like a car or a home, consider saving closer to 6 months worth.

If you have a money goal you want to meet quickly, like paying off debt or saving up for something (like starting school in the near future), its understandable that you can’t spend forever building your emergency fund first.

If this is the case, start with a smaller fund- $1000 is a great starting point.

Then once you meet your goal, bulk it up to 3-6 months worth of savings. $1000 is not enough for an emergency fund in the long-term.

I would also recommend that you don’t over-save for emergencies, either. If you want to save as much as possible (kudos to you!), 12 months is probably a good maximum. Otherwise, you won’t be able to meet your other financial goals.

Why Do You Need One?

Your emergency fund is for emergencies only. I can’t state this enough.

It allows you to do other productive things with your money, like pay off debt or save for a home, without going off track.

Life will always happen, and we’ll never be able to predict it.

It’s always best to be prepared for the unexpected.

Think about the unexpected in life and save for it now- and then you won’t need to think about it again, until something happens.

Emergency funds also have this neat way of turning emergencies into simple inconveniences.

Your car breaks down and needs $1000 of work?

You’re not scrambling to find out which credit cards have enough room to cover it, or how much your minimum payment will go up because of it.

You won’t have to swallow your pride and call your friends and family to ask for a loan.

You’ll just withdraw what you need from your emergency fund.

Seriously, that’s it.

It also eliminates your dependence on credit cards. Many people view their credit cards as their emergency funds- this is a mindset that needs to change. Going into more debt when emergencies happen is not good for your bottom line. And if you’re here, you’re probably trying to get out of debt.

Trust me– you will feel so much more secure and responsible with an emergency fund there.

How Long Should it Take You to Save Enough Money?

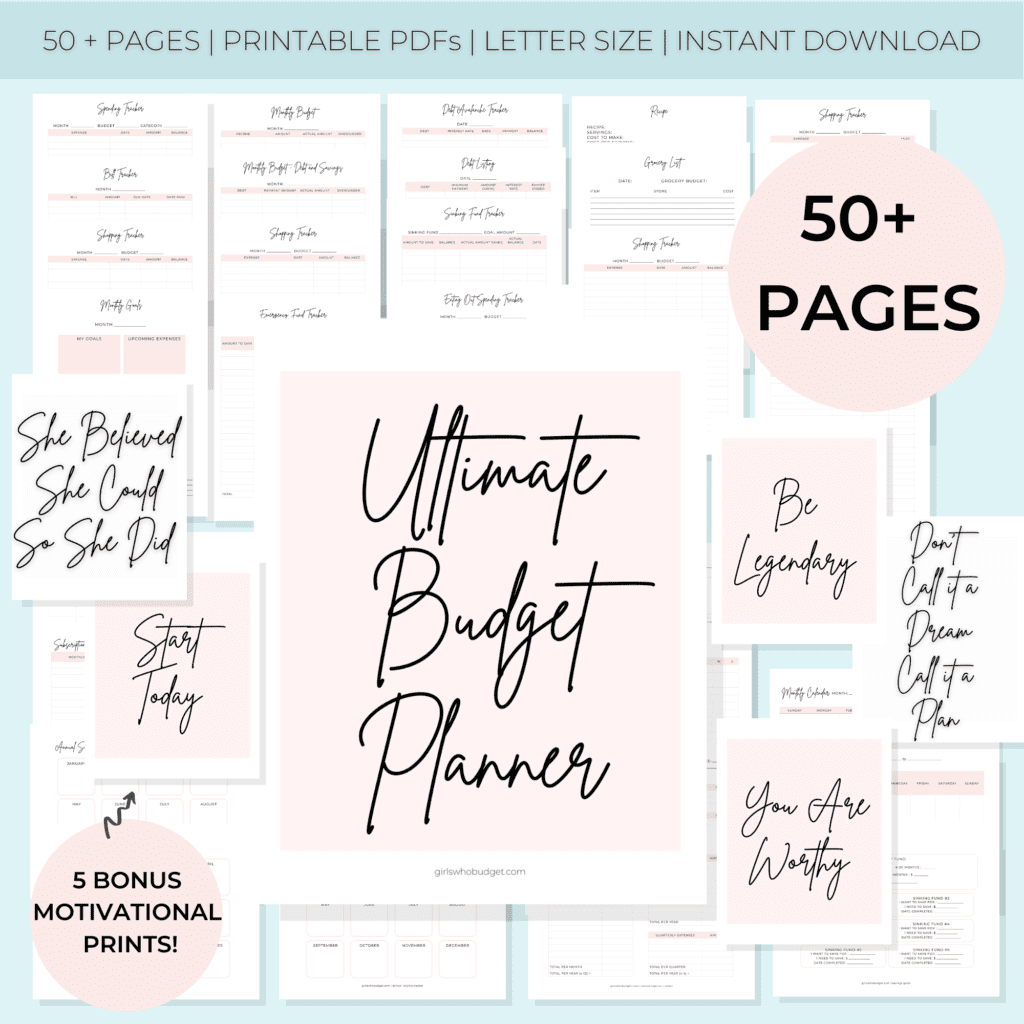

Find out how much money you have to work with every month after your expenses (if you haven’t done this, already). You can use the Budget Template in our Ultimate Budget Planner (it’s perfect for this!).

Let’s say you have an extra $300 every month, after all of your expenses.

You also know that $3000 equals 3 months of living expenses for you.

A $3000 emergency fund goal divided by $300 in monthly contributions = 10 months to reach your goal.

Being motivated while getting financially on track is everything.

We all know we need to save money, get out of debt, and have a monthly budget.

I would not be able to have such a solid plan in place if it wasn’t for writing everything down and being able to look at it as time went on.

Check out our Ultimate Budget Planner– it includes every printable you’ll need to take control of your finances. Yup- over 50 pages at your disposal.

Write it all down and walk away feeling satisfied- knowing that you have a plan and can reference it any time.

Hopefully you found this information useful, and I really hope you feel inspired to get started.

Where are you at with your emergency fund? Let us know in the comments below!

Happy Saving!

Emily

Related Posts:

1 Comment on How to Start Your First Emergency Fund