This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Is there a little voice in the back of your head nagging you about your debt?

You don’t like to think about it, but you know you know you owe money.

But you can ignore it for now, right?

Everyone has debt- what’s the rush?

Not long ago, I had these thoughts, too. I had over $30,000 in student loans. And they didn’t seem to be going anywhere.

The thought of sitting down and getting started felt overwhelming.

After years of feeling the weight of my student loans on my shoulders, I was ready to get started and pay them off, once and for all.

3 months later, I had paid off 12k in debt (one of two loans)- and it felt amazing!

I read stories from others who had paid off debt really quickly, but I didn’t realize that I could do it, too.

I always thought that I didn’t make enough money to make it happen (I was fresh out of university).

For the first couple of years after university, I blamed the high cost of living in my city. How could I get out of debt quickly when my rent was eating up my income?

I remember being 23 and setting a goal to pay it all off by the time I was 30. I finally figured it out and got started when I was 26. Now I have completely paid off one loan for $12k (yes, in just 3 months) and am just as quickly getting through my last loan ($17k left to go now!).

At this rate, I will easily be debt free at the age of 27. Yes, I’m kicking myself- why didn’t I just figure this out when I first thought about it, four years ago?

How were my projections so wrong? I definitely didn’t need 7 whole years to accomplish this.

You have two choices. You can ignore your debt, and let the monthly payments continue for longer and longer. Or you can rip off the bandaid, assess the damage, and get out of debt now.

When you no longer owe someone else money every month, that money becomes yours.

Yes, all yours!

Even with just one monthly payment gone, I feel such a weight off my shoulders. And for the first time, I am starting to imagine what I will do next in my life.

What do you dream about? What’s your next step in life?

Do you want a comfortable retirement, a dream vacation, or your first home? Or do you just hate that feeling of dread you get when you check your bank account?

No matter what your personal goals are, here’s how you can do exactly what I did…

Look at the Numbers & Make a Budget

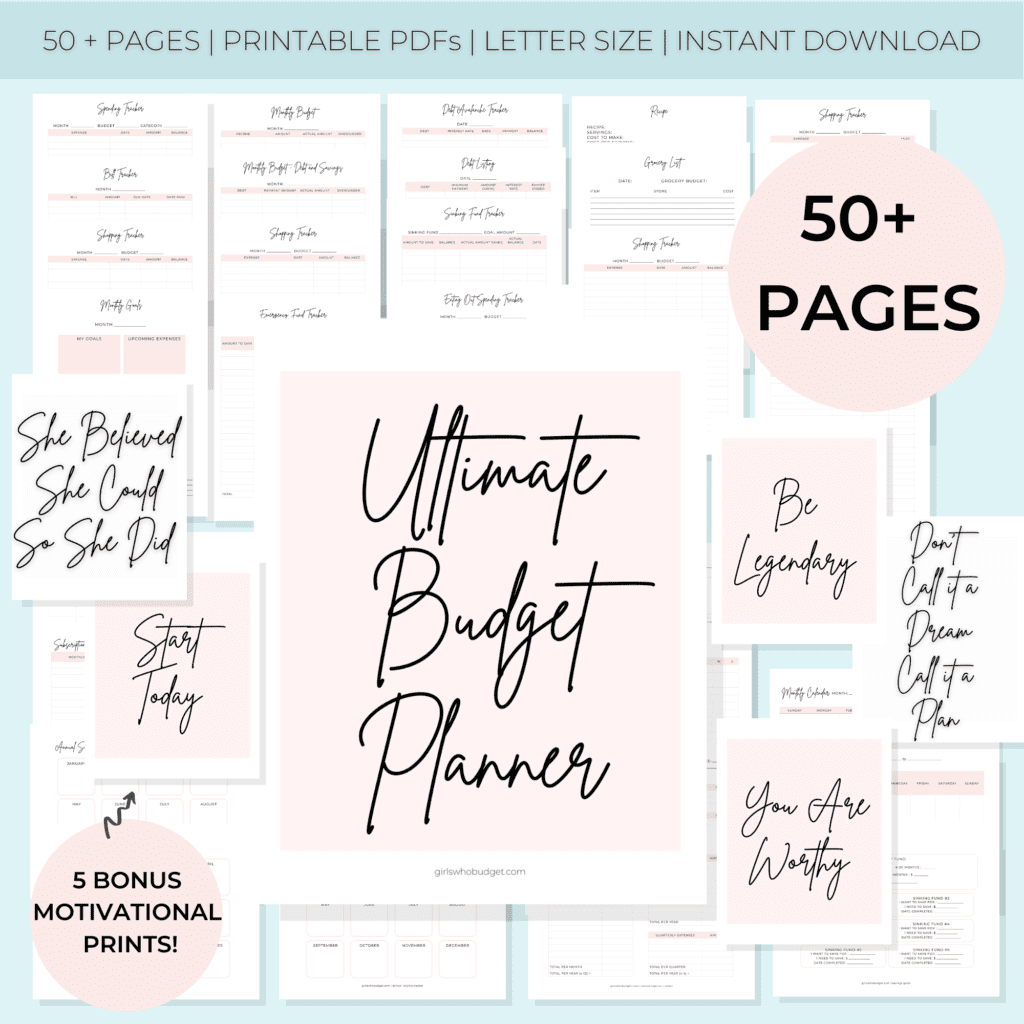

If you’re going to fix your finances, you’ve got to rip off that bandaid and look at the numbers. Put pen to paper (maybe with a calculator, too) and write everything down. I really recommend starting with a template, like the one I used from our Ultimate Budget Planner.

Start by adding up all of your monthly income sources. You will need to know how much money you have to work with.

The second step is to list your monthly expenses/bills. Keep debt repayments out of the equation for now. If it helps, look at your list of recent bill payees on your online banking or credit card statements.

You may have more than these, but here are some typical monthly expenses:

-Rent/mortgage payment

-Other housing costs (ie. rental or house insurance)

-Phone

-Internet

-Netflix

-Gym membership

-Hydro

-Heat

-Transportation (bus, subway, or car)

-Groceries

-Eating Out

Some of these expenses are going to be more difficult than others to predict. Especially if this is your first time thinking about it.

You might have no idea how much you spend a month on eating out or on gas for your car.

You have found the perfect time to figure it out!

Add up all of your expenses for the last month from your online banking.

This should give you a rough idea. It’s totally fine if this is a work in progress, and you can fine tune these numbers as time goes on. If you want to really narrow in to figure out how much you spend on each category going forward, Mint is great for keeping track of this.

One more expense item I added (and continue to use today) is an amount for wiggle room.

If little expenses come up outside of your monthly norm, you will be prepared. Don’t make this a big amount at all (you will have an emergency fund for that- we’ll dive into that soon!). I use $100 a month.

And if I don’t need to spend it? I can roll it into my debt payment each month.

I really recommend writing all of these numbers down so you have a rock-solid plan that you can keep track of.

In addition to this, I have opened separate savings accounts so I can put my money where I need it to go, as soon as I get paid.

I have savings accounts for:

-Rent

-Food

-Emergency Fund

-Wiggle Room Money

I simply use a basic, free savings account (no need for a Tax-Free Savings Account, or any other type of account). Ensure you use a savings accounts that is free and that you can withdraw and deposit money whenever you need to. Many banks allow you to open multiple accounts, and you can even personalize the account name.

Next, list the payments you make towards your debt each month (this would be your minimum payment that you need to make).

Is there any money leftover? If so, add this to your debt repayments. This will help you to pay off your debt as quickly as possible.

But wait- what about your savings?

How are you going to continue to save money if you’re using every last cent to be debt-free?

Make Cuts Wherever You Can

When you look at your finances, are you not super happy with what you have left over every month? Not to worry- look at this as an opportunity to create more money in your budget.

When I started my debt-free journey, I did what you’re doing now, and I listed each expense.

Then I figured out which bills could be removed entirely or reduced.

In the past, I would always get discouraged when my budget “didn’t work”. I was trying to follow a plan, but it felt like there wasn’t enough money.

Turns out that I was over-spending on a lot of things- my phone bill, my internet bill, and definitely on eating out.

-I found a promotional phone plan with another provider that saved me $40 a month.

-I switched internet providers and saved $50 a month (I went with a ‘budget’ provider- which was actually providing the same internet speed I already had)

-I decided I was going to continue eating out, but on Friday nights only. I also only made dinners that gave me leftovers for lunch the next day. This was one was HUGE for me- I saved over $400 a month.

I had found an extra $500 in my budget!

Even the smallest changes can add up fast.

Go through your list and see how much extra money you can come up with. Remember that getting rid of something for now doesn’t mean you can’t have it again, once you’re debt-free.

Still Not Happy? You Can Make More Money, Too

Another way to throw more money at your debt is to make more money. There are so many side hustles that you can start to get you there.

Don’t rule out getting a part-time job, either. Even if you only add 10 hours of work per week, this can add up to hundreds of dollars a month that you didn’t have before.

Don’t Skip the Emergency Fund

One of the scariest parts of starting a budget is the realization that you could fail. Your heart could be in the right place, but one day, your cat might need to go to the vet (been there!) or your car might break down.

You’ll need to pull out your credit card, go further in debt, and then you’ll fall behind on your other bills.

The answer to this is both practical and a great lesson in saving money. Start an emergency fund.

You don’t need to spend years building this, and there isn’t a magic number you need to aim for.

3-6 months of expenses is a great start, and will cushion you from life’s surprises.

If you want to get started on paying off your debt now, and you don’t want spend a lot of time on this step, start with $1000. It is great practice, and you will get a taste of what it feels like to have a little extra security.

Then, when you have reached your goal, bulk up your emergency fund to 3-6 months. $1000 is not enough for your forever emergency fund (for example, if you lose your job, you won’t have 3-6 months of income there for you).

Open another savings account (make sure it is free), and start to save.

You know the leftover money in your budget, that you’re planning to throw at your debt? Start by using this to build your emergency fund. Once you have the amount saved you’re happy with, leave that money alone (emergencies only!) and start to allocate that monthly money towards debt.

When I had my first emergency fund in place, even though I still had debt, I felt a sense of relief that was foreign to me. If something happened, it would be an inconvenience to me- but not really an emergency anymore. It also made my budget feel a lot less strict. No matter how low my monthly grocery budget felt, I knew I had a few months worth of cash hidden away, and it would all be okay if I went over it a bit.

Plus, you’ll get to flex your savings muscle and get comfortable with seeing money in your account- without spending it!

Help- how much do I allocate to each debt?

Do you have more than one type of debt?

I’m all about staying motivated and keeping on track. If you’re looking to get debt-free fast, you just need to keep the momentum going for a short period of time!

Choosing a strategy that will keep you motivated is important. Two common debt repayment methods are:

-Debt Avalanche

-Debt Snowball

The trick to picking a debt repayment method is understanding what motivates you more:

-Paying off high interest loans first

-Paying off individual debts as quickly as possible

Let’s take a closer look at each method to see what will work for you:

Debt Avalanche Method

Using the Debt Avalanche, you will pay off your debts in order from the highest interest rate to the lowest. If you hate paying crazy-high interest rates on your debt, this method will keep you going!

Debt Snowball Method

With the Debt Snowball, you work your way from the smallest debt to the largest (without considering the interest rate).

This is a great method if you’re goal-oriented; start by aiming to pay off the smallest debt, you’ll pay it off quickly, and then you’ll be motivated to keep going!

How it works:

-List your debts in order from first to last, based on the method you choose.

-Continue making the minimum payments on all debts.

-Take your extra money for debt repayment each month and make a bigger payment on the first loan until its gone (and so on and so forth, until you’re debt-free).

The snowball method of debt repayment is by far my favourite and has worked the best for me.

I started with paying off my smallest debt first.

Once that one was paid off, I took the money I was using to pay it off, and rolled it into debt #2 (the second largest debt). Now I was making an even bigger payment on the next one.

And so on and so forth, until you’re debt free!

The monthly payment on my first student loan was $160. Once I paid it off, I added $160 to my payment on my second loan. It feels like it is disappearing faster than the first loan.

This is the beauty of this method. Start with the smallest debt, and pay it off quickly (quick win!). You can celebrate and stay motivated, as you continue to pay off the next one.

High-five, girl!

You now know exactly how much money you have to pay off your debt each month.

You are going to start an emergency fund so your plan won’t go off the rails.

Now that you’re here- take a moment and feel proud of yourself! Not everyone takes the time to do this. I know I’m glad I did.

I still remember they day I made my last payment for my loan. I transferred the money to my loan, and the balance was zero. I stared at the balance for longer than I want to admit (haha!). It just didn’t feel real.

I would never have to think about it again, ever. It felt freeing, and so so motivating.

I didn’t even stick to my budget perfectly during these 3 months (spoiler alert- this will never happen, and you don’t even need it to happen to do big things with your money).

Now I’m starting to plan the fun things I can do with my money. My goal is to buy my first home, and I’m already dreaming about what I want.

If you can walk away with anything today, figure out your why. Figure out what you can gain by being debt-free.

How will you put your money to work for you?

Let me know your goals in the comments!

Related posts:

1 Comment on How I Quickly Paid Off $12k in Debt in 3 Months (Beginner’s Guide)