This site contains affiliate links to products. I may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read my disclaimers page for more information.

What is the debt snowball method?

The debt snowball method is a debt repayment method where you pay off your debts in order from smallest (lowest balance owing) to largest (highest balance owing). When the smallest debt is paid off, you roll its payment into the next debt- paying each one off faster and faster.

It’s great because you’ll be able to pay off the smaller debts quickly, so you’ll be motivated to keep going!

Here’s how the debt snowball method works:

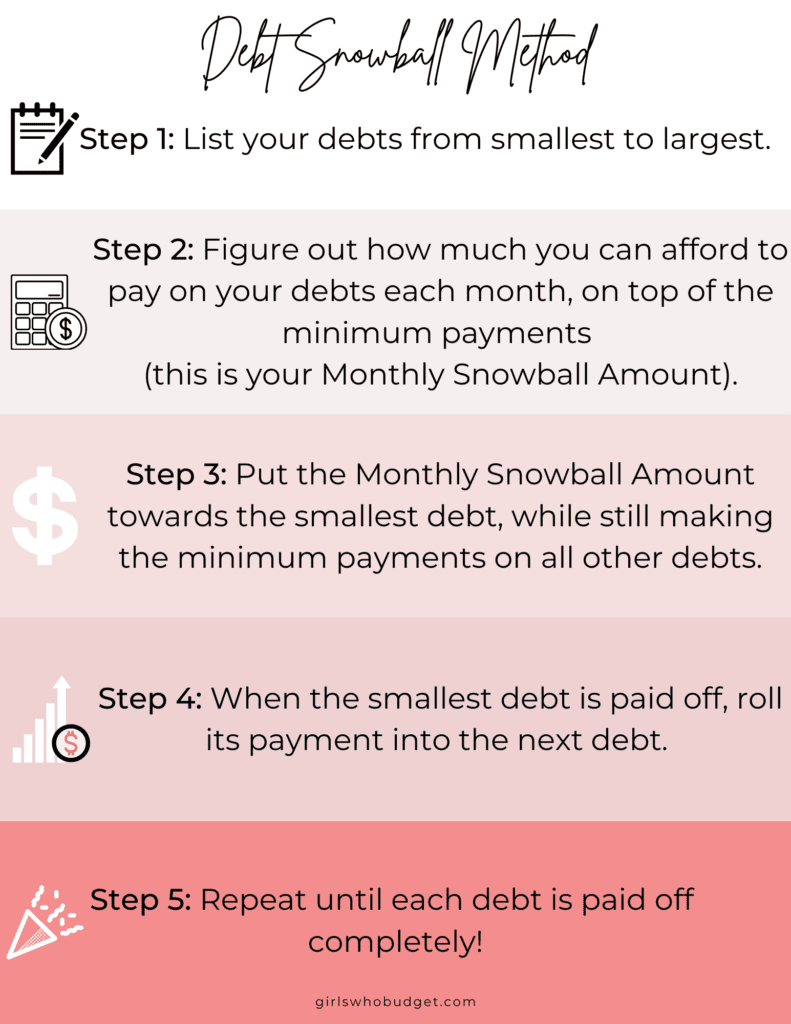

Step 1: List your debts from smallest to largest.

This is based on the balance owing, and not on the interest rate or monthly payment.

Step 2: Figure out how much you can afford to pay on your debts each month, on top of the minimum payments (this is your Monthly Snowball Amount).

You will need to make a budget (monthly income – monthly expenses) in order to see how much is left over to pay off your debt.

Step 3: Put the Monthly Snowball Amount towards the smallest debt, while still making the minimum payments on all other debts.

Always continue to make the minimum payments on your debt, but only focus on paying off one debt at a time with your Monthly Snowball Amount.

Step 4: When the smallest debt is paid off, roll its payment into the next debt.

When debt 1 (the smallest) is paid off, pretend that you still need to make the minimum payment on it- but instead, put that money towards debt 2 (the next largest debt). You will also start putting your Monthly Snowball Amount towards debt 2.

Step 5: Repeat until each debt is paid off completely!

Repeat the steps until each debt has been completely paid off! Each time one is paid off, you will have more money to roll into the payment on the next one.

Example of the debt snowball method:

- List debts in order from smallest to largest.

Credit Card: $1,000

Line of Credit: $2,000

Student Loan: $10,000

- Figure out how much you can afford to pay on your debts each month.

Monthly Snowball Amount: $500

After making a budget, we see that we have an extra $500 each month that can be put towards debt.

Credit Card minimum payment: $25

Line of Credit minimum payment: $50

Student Loan Minimum Payment: $150

Monthly Snowball Amount: $500

Total amount each month going towards debt: $725

- Put the Monthly Snowball Amount towards the smallest debt, while still making the minimum payments on all other debts.

The smallest debt is the credit card with the $1,000 balance- while continuing to make the minimum payments on all debts, we will pay an extra $500 a month (Monthly Snowball Amount) on the credit card until it is paid off.

- When the smallest debt is paid off, roll its payment into the next debt.

When the credit card is paid off, we will start to pay off the Line of Credit next. Since the Student Loan is the largest, we will pay it off last.

We will continue to make the minimum payments on the Line of Credit and the Student Loan.

We will take the $25 that was being spent on the credit card minimum payment, and will add that to the Line of Credit payment- plus the Monthly Snowball amount of $500.

When we add the line of credit’s minimum payment of $50, we are now paying $575 a month on it each month! Plus- we have already paid off one debt, with just two more to go.

- Repeat until each debt is paid off completely!

When the line of credit is paid off, we will do the same thing again, until it is gone!

Does the debt snowball method actually work?

Absolutely! The debt snowball method is how I was able to pay off $12,000 in debt in just 3 months.

There are a few reasons it works so well:

-By starting with the smallest debt first, you can completely pay off one of your debts as quickly as possible. This is a great motivator to keep going.

-As each debt is paid off, you can roll more and more money into the next debt, making bigger payments on them than ever before.

Which is better: the debt snowball method or the debt avalanche method?

You may be wondering why the debt snowball method doesn’t consider interest rates at all.

The debt avalanche method is similar to the debt snowball method, except you pay off your debts in order from highest interest rate to the lowest interest rate.

This method can work for you if you hate spending money on interest, and this motivates you to get rid of high interest debts.

Remember: since the debt avalanche method doesn’t look at balances owing, you could start by paying off your largest debt first. It may take longer before you can say you have paid off a debt in full.

This is why the debt snowball method can keep you motivated- you can succeed in paying off a debt as quickly as possible.

Once one is gone, you’ll know you can pay off a second one (and so on and so forth!).

Remember that you need to find what works best for you! At the end of the day, you need to find a method that will keep you going until all of your debts are at $0.

I know that the debt snowball method was a game-changer for me in my debt-free journey. Honestly, it kept me on track to pay off debt when I didn’t even know if I could do it.

This is your journey, so don’t worry about trying to go about it one way and failing. If you fail, just dust yourself off and try it another way. I believe in you! If I can do it, I know that you can, too.

When should you start your debt snowball?

You should start your debt snowball as soon as possible- the sooner you do, the sooner you’ll be debt-free!

Before you start, you should save a small emergency fund to keep you protected from financial emergencies along the way. $1000 is a good place to start.

This can be savings in a simple savings account (make sure it is a free savings account with no monthly fees).

If an unexpected expense comes up while you’re paying off your debt, you can pay for it with your emergency fund instead of with a credit card. This will help keep you from getting in to more debt along the way.

Keep in mind that an emergency fund should typically have 3-6 months’ worth of living expenses in it (so if you lose your job, you’ll be able to cover the necessities until you’re back on your feet).

Once you are debt free, make sure to top up your emergency fund.

How do you stick to your debt-free journey?

1. Make a budget.

You can grab a ready-to-go budget template on our shop. You’ll need to know exactly where your money is going so you can stay on track.

2. Stop using credit cards.

If you not only want to get out of debt, but also stay out of debt- it’s essential that you stop relying on plastic! If you’re not using the cards, there’s no way for them to start racking up a balance again.

3. Change your spending habits.

If you cut up all of your cards and change nothing else about your spending- it’s going to be difficult to keep them out of your wallet. Start with a few small changes to your spending habits:

- Only buy what you need

- If you do need something, try to get it second-hand or on sale first

- When you see something you want to buy, add it to your spending wish list. This is where you list everything you want to buy and their prices; once you have enough money saved for it, you can buy it!

- Start to make free activities a regular part of your life. Instead of going out to the movies, make popcorn at home and find a movie online. Replace weekend trips to the mall with nature walks with friends. Stop going out for dinner at restaurants, and invite friends over to cook a meal with you instead!

- Commit to cooking more meals at home. Eating out is expensive, especially if you compare the cost of a restaurant meal to the cost of making that same meal at home. Try giving yourself one night a week where you can eat out, and commit to making the rest of your meals at home. Plan out what you’ll eat for each meal, make a grocery list for the ingredients, and spend a few hours prepping your food for the next few days.

Not sure what to make or how to make meals that are the most affordable? 5 Dollar Meal Plan gives you 30 days worth of delicious recipes that only cost $2 per person per meal on average. And with a price point of five bucks a month, it’s super affordable, too! You can learn more about 5 Dollar Meal Plan here.

- Start a side hustle – keep the momentum going! By taking on a second job or starting a side hustle of your own, you’ll be able to throw even more money at your debt (which means you’ll be out of debt sooner!)

- Think about what you can achieve once you’re debt-free. Add up all of the money you spend each month on debt repayments- when you’re debt-free, all of that money will be yours every month. You can start to use that money towards other, more exciting goals, like saving up for a down payment on a home, going on a vacation, or going back to school. And the sooner you’re debt-free, the earlier you can start to save for your retirement.

When will you be debt-free?

We have the tools you need to crush your debt!

Here are the debt snowball calculators and trackers to help you find out when you can be debt-free:

Debt Snowball Calculator – Google Sheets – use this calculator to find out your debt-free date in minutes! All you’ll need is a free Google account.

Debt Snowball Calculator – Excel – this is the Excel-friendly version of our calculator if you prefer to use Excel.

Debt Snowball Tracker printable – print this template off at home or at a local print shop- you can print as many copies as you like while keeping track of your debt snowball plan!

1 Comment on How To Use The Debt Snowball Method to Crush Your Debt