This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Do you want to save $5,000 in 2021?

As with any savings goal, it’s totally possible- as long as you have a plan.

You’ll need to know:

-What you’re saving for

-When you want to have $5000 saved

-How much you’ll need to save each month to get there

We’ll also review how you can speed up your plan to make sure you get there on time.

I spent years struggling to save any money (my savings account was usually $0), but with a few changes I found myself easily saving over $10,000 (and it’s still growing!).

The biggest lesson I learned along the way? The main difference between a ‘spender’ and a ‘saver’ is having a savings plan. That means knowing what you’re saving for, how much you want to save, and what you’ll be setting aside each and every month to get there.

Let’s get you started on a savings plan that takes your savings account where you want it to be 🙂

Here’s how you can save $5,000 in one year!

How long does it take to save $5,000?

If you want to save $5,000, here’s how much you’ll need to save every month:

Save $5,000 in one year: $417 a month

Save $5,000 in 6 months: $833 a month

Save $5,000 in 3 months: $1,667 a month

What can you do with $5,000 in savings?

There’s a lot you could do with $5,000 in savings- some examples are:

-Buying a used car

-Taking a vacation

-Renovating your home

-Paying off a credit card

-Saving up for a rainy day

The more important question is: what do you want to do with $5,000? Or how could $5,000 get you closer to achieving your financial goals?

If you feel like there’s a million things you could do with that much money and you’re not sure how to prioritise, here’s the simple plan I use:

- The first thing to save is an emergency fund, which is savings for unexpected expenses, like losing your job or your car breaking down. You should have 3-6 months of worth of living expenses saved here (note: these should be necessary living expenses only, so think rent and groceries, and not entertainment or random shopping). If you are also paying off your debt, you can consider saving less than that, like $1,000- but remember to add to your emergency fund once you’re debt-free.

- Once you’re not worried about an emergency popping up, you can start to save for expected expenses, in sinking funds. You can have many sinking funds for multiple items you’re saving up for (like a down payment on a home or tuition at school).

- If you are prepared for both unexpected and expected expenses, you can start to save for retirement. It’s never too early to start- the sooner you do, the more time your savings have to grow (thanks to compound interest!).

So, where are you at in your savings journey? Take a moment to reflect and decide what you should save for right now.

How you can save $5,000 in a year

To save $5,000 in a year, you’ll need to save $417 every month.

Here’s how you can make a plan to save $417 a month:

If you haven’t already, start by making a monthly budget.

This is as simple as adding up your monthly income, and subtracting all of your monthly expenses.

P.S.- if you’ve never made a monthly budget before, check out our monthly budget template for beginner’s here! It has all of the categories you will need to get started.

Do you have enough leftover to save $417 a month?

If you do, that’s fantastic! Work this amount into your budget each month, and transfer it into a savings account. Remember what you’re saving this money for, and in 12 months time, you will have reached your goal!

If you’re not sure if you can save that much each month, you may be surprised how much you can save by reviewing your spending habits.

How to save money on food every month

When I first started to save money, I knew I needed to completely change how I spent money on food. I thought that my spending habits were ‘normal’, but it turns out I was wasting a ton of money on dining out.

Think about it- even just 3 $20 dinners out a week adds up to $240 a month. And that’s before grabbing lunches, going out for drinks, or buying a coffee each morning!

When each purchase feels so small, it’s hard to believe how quickly it all adds up.

Take a look at your debit or credit card statement for the last month and add up your total food spending- the total may surprise you!

Here are the changes I made to save over $500 a month on food:

-I only ate out for dinner on Fridays, cutting this habit back to once a week (monthly savings: $160)

-I made double batches of dinner at home, and always brought the leftovers to work the next day for lunch (monthly savings: $300)

-I started to make my coffee at home instead of going out to buy one (monthly savings: $40)

–Bonus tip: I also had a habit of buying breakfast with my coffee, too, which really added up every day! I started bringing my own bagel (or bread!) to work with me, and kept some peanut butter there. It was crazy simple way to save an extra $100 a month!

My total monthly savings on food: $600

As you can see, this is even more than the $417 needed a month to save $5,000 in a year.

If you want to start cooking at home now, I highly recommend signing up for $5 meal plan.

For $5 a month, they send you affordable, healthy, and delicious recipes that you can make at home (seriously, each meal only costs $2 a person on average!). This is a genius way to always stay inspired to make your food at home!

Make a small investment in yourself by picking up some meal prep containers, too! A set of cute containers can make packing up leftovers a little more fun 😉

How to save more money on your monthly bills

If you want to save more money, it’s a perfect time to think about your monthly bills.

Are you over-spending on any of your recurring expenses?

Do you have any that you forgot you’re paying for, or just aren’t using at all?

Make a list of your monthly bills and see if there are any you can get rid of or cut back on.

For example, if you have a fitness app on your phone that you’re paying $20 a month for, but you haven’t used it in 3 months- you can consider cancelling it.

Or if you’re paying $80 a month for your phone but you think you can get a cheaper plan with a different provider, you can call your current provider to negotiate a cheaper plan.

If they think you are cancelling, they may offer you a lower monthly price! If they don’t budge, you can cancel and start using a cheaper plan with a different carrier.

The alternative to doing all of this yourself is to sign up for Trim!

Trim is an app that connects to your debit or credit cards and helps you to identify where you can save more money.

Trim can help you to:

-Cancel subscription services you’re no longer using

-Track your spending habits

-Negotiate your bills for you!

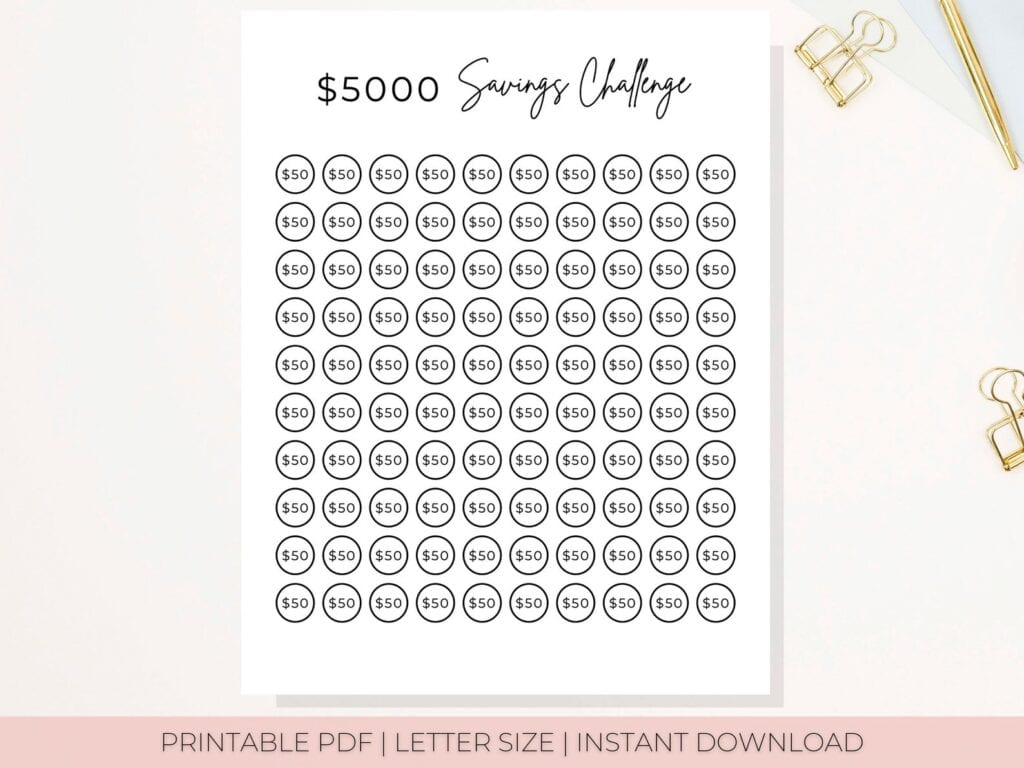

Use a savings tracker to save $5,000 in a year

Another great way to save $5,000 this year is to track your progress as you go. Saving money is easy when you can see your goal!

Check out our collection of savings trackers– including this one that keeps you on track to saving exactly $5,000.

Print it out and keep it where you can see it, like at your desk or in your budget binder. If you have a note-taking app on your tablet or phone (like Goodnotes, for example), you can also easily use any of our trackers on the app.

How to save $5,000 with a 52 week challenge

A 52 week challenge is a savings challenge where you save money every single week, in order to save as much as possible at the end of the year.

If you wanted to save $5,000 in 52 weeks, you would need to save $97 a week.

Here is our 52 Week Savings Challenge printable you can use to get started now:

How to save $5,000 in a year with envelopes

Have you heard of the 100 envelope challenge yet?

This money-saving challenge has been gaining popularity online, and it’s been helpful for some in reaching $5,000 in savings.

The rules are simple- take 100 envelopes, and number them $1-$100 (write $1 on the first envelope, $2 on the second, $3 on the next, and so on until you’re at the 100th envelope).

Shuffle your envelopes and keep them in together in a box or container.

Every day for 100 days, take out an envelope- whatever number on the envelope is the amount you will stuff in that envelope to save.

After 100 days, you will have saved $5050.

This is a fun way to kickstart a savings journey, and to build a habit of saving regularly.

Important: make sure you shuffle your envelopes well, so that you’re less likely to pull out two numbers that are close together in a row (ie. pulling out envelope 90 on the first day and then envelope 91 on the second).

If you do pull out two higher envelopes in a row and worry you can’t afford it, simply skip the day or save the amount you can afford that day. As long as you are saving money, you are moving in the right direction! Perfection isn’t necessary in your savings journey, especially if it gets in the way of affording necessities in life, like food or rent.

You could stretch it out and pull out an envelope once every 2 days instead of every day- this would still get you to $5,000 in under a year!

What do you want to save $5,000 for this year? Let me know in the comments- I’d love to hear what goals you’re working on!

Want to save more money? Here are my favourite money-saving resources:

Swagbucks: Swagbucks is one of my favourite ways to earn free gift cards online! (it takes less than a minute to sign up) and start to earn rewards for things you’re already doing, like surfing the web and shopping online. You’ll also be rewarded for answering surveys & watching videos! Your rewards can be redeemed for gift cards at popular retailers like Amazon, Walmart, and Starbucks.

Drop: is a rewards program that links to your debit or credit card- you’ll earn points every time you shop at your favourite retailers, which can be turned into gift cards. You can also earn points by taking surveys and playing games. Sign up for Drop here!

Trim: Trim is an app that constantly works to help save you money. Here’s how it works: once you link your credit or debit card, Trim helps you to cancel old subscriptions, set spending alerts, check how much you’re spending in certain areas, and automatically fight fees. They can even negotiate your monthly bill costs for you! Sign up for Trim here!

$5 Meal Plan: $5 Meal Plan is a convenient, affordable way to save money on food! It’s only $5 a month for 30 days worth of delicious recipe ideas- that only cost about $2 a person for every meal. You can dine out less while making at-home meals that are affordable. Sign up for $5 Meal Plan here!

I see something truly special in this web site.

Excellent web site. A lot of helpful info here. I am sending it to a few pals ans also sharing in delicious. And obviously, thanks in your sweat!

I have not checked in here for some time since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

I believe this internet site has very superb pent written content blog posts.

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

F*ckin’ awesome issues here. I’m very glad to look your article. Thanks a lot and i’m taking a look forward to contact you. Will you kindly drop me a e-mail?

It¦s actually a nice and useful piece of information. I¦m glad that you just shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

Usually I do not read post on blogs, but I wish to say that this write-up very pressured me to take a look at and do it! Your writing style has been amazed me. Thanks, very nice post.

Great blog here! Also your website rather a lot up very fast! What web host are you using? Can I am getting your associate link in your host? I wish my web site loaded up as quickly as yours lol

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

With havin so much content and articles do you ever run into any problems of plagorism or copyright violation? My site has a lot of unique content I’ve either written myself or outsourced but it looks like a lot of it is popping it up all over the web without my permission. Do you know any methods to help prevent content from being stolen? I’d definitely appreciate it.

I found your weblog site on google and verify just a few of your early posts. Proceed to keep up the excellent operate. I just additional up your RSS feed to my MSN Information Reader. In search of ahead to reading extra from you afterward!…

Hi would you mind letting me know which hosting company you’re using? I’ve loaded your blog in 3 completely different browsers and I must say this blog loads a lot faster then most. Can you suggest a good internet hosting provider at a honest price? Kudos, I appreciate it!

Thank you for another great post. Where else may anybody get that type of information in such an ideal means of writing? I have a presentation next week, and I am on the search for such info.

Wow! This could be one particular of the most beneficial blogs We have ever arrive across on this subject. Actually Great. I’m also a specialist in this topic therefore I can understand your hard work.

Excellent site. Lots of helpful information here. I am sending it to a few friends ans also sharing in delicious. And obviously, thanks in your effort!

Youre so cool! I dont suppose Ive read something like this before. So nice to search out someone with some original thoughts on this subject. realy thank you for beginning this up. this web site is one thing that is needed on the web, somebody with just a little originality. helpful job for bringing one thing new to the internet!

Very interesting information!Perfect just what I was searching for!

I simply wanted to say thanks all over again. I do not know the things that I would’ve followed without the suggestions documented by you over that theme. Certainly was an absolute daunting scenario in my circumstances, but looking at the very well-written mode you managed it forced me to cry with fulfillment. I am just grateful for this help and have high hopes you find out what a powerful job you’re carrying out training others all through your webblog. Probably you have never got to know any of us.

Of course, what a great site and educative posts, I will bookmark your website.Have an awsome day!

What i do not realize is in fact how you’re now not actually a lot more neatly-liked than you may be right now. You are so intelligent. You recognize thus significantly on the subject of this matter, produced me in my view imagine it from numerous numerous angles. Its like men and women are not interested unless it?¦s one thing to accomplish with Woman gaga! Your individual stuffs outstanding. All the time handle it up!

You have noted very interesting points! ps decent website . “By their own follies they perished, the fools.” by Homer.

I have read a few good stuff here. Definitely worth bookmarking for revisiting. I surprise how much effort you put to make such a magnificent informative web site.

Hi there! Would you mind if I share your blog with my myspace group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Many thanks

You got a very wonderful website, Sword lily I noticed it through yahoo.

I am usually to blogging and i really respect your content. The article has really peaks my interest. I am going to bookmark your web site and hold checking for brand new information.

Cool blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple tweeks would really make my blog jump out. Please let me know where you got your design. Thanks a lot

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

Hello! I know this is kinda off topic however I’d figured I’d ask. Would you be interested in exchanging links or maybe guest authoring a blog article or vice-versa? My blog addresses a lot of the same subjects as yours and I feel we could greatly benefit from each other. If you might be interested feel free to send me an email. I look forward to hearing from you! Superb blog by the way!

Thanks a bunch for sharing this with all of us you really know what you’re talking about! Bookmarked. Please also visit my website =). We could have a link exchange agreement between us!

I’d incessantly want to be update on new posts on this internet site, saved to bookmarks! .

excellent post, very informative. I ponder why the opposite specialists of this sector do not understand this. You should continue your writing. I am sure, you’ve a great readers’ base already!

Somebody essentially assist to make seriously articles I might state. That is the first time I frequented your web page and so far? I surprised with the research you made to make this particular post incredible. Wonderful task!

Hello. remarkable job. I did not expect this. This is a impressive story. Thanks!

Sweet internet site, super pattern, really clean and utilise friendly.

I have been reading out some of your stories and i can claim clever stuff. I will make sure to bookmark your site.

The crux of your writing while sounding agreeable in the beginning, did not work well with me personally after some time. Someplace within the paragraphs you actually were able to make me a believer but just for a short while. I however have a problem with your leaps in assumptions and you might do nicely to help fill in all those gaps. In the event you can accomplish that, I could surely end up being amazed.

The next time I learn a weblog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to learn, however I actually thought youd have something fascinating to say. All I hear is a bunch of whining about one thing that you may repair for those who werent too busy searching for attention.

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

I envy your work, thanks for all the interesting blog posts.

Lovely site! I am loving it!! Will come back again. I am taking your feeds also

There is noticeably a bundle to know about this. I assume you made certain good points in options also.

I think this web site contains some real superb info for everyone :D. “Laughter is the sun that drives winter from the human face.” by Victor Hugo.

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

Have you ever considered writing an e-book or guest authoring on other sites? I have a blog based upon on the same topics you discuss and would love to have you share some stories/information. I know my viewers would enjoy your work. If you are even remotely interested, feel free to shoot me an e-mail.

I am glad to be a visitant of this perfect weblog! , appreciate it for this rare information! .

Woah! I’m really loving the template/theme of this site. It’s simple, yet effective. A lot of times it’s challenging to get that “perfect balance” between usability and visual appeal. I must say that you’ve done a amazing job with this. Additionally, the blog loads super fast for me on Firefox. Outstanding Blog!

Saved as a favorite, I really like your blog!

Wow that was unusual. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say superb blog!

Very interesting info!Perfect just what I was searching for!

Hey there! I’m at work surfing around your blog from my new iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the fantastic work!

I just like the helpful information you provide for your articles. I’ll bookmark your blog and take a look at again right here frequently. I’m slightly sure I will be informed plenty of new stuff right right here! Good luck for the next!

you’re truly a good webmaster. The web site loading speed is incredible. It seems that you are doing any unique trick. Furthermore, The contents are masterwork. you’ve done a wonderful activity on this topic!

Hi! I know this is kind of off topic but I was wondering if you knew where I could get a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having trouble finding one? Thanks a lot!

Woah! I’m really digging the template/theme of this website. It’s simple, yet effective. A lot of times it’s difficult to get that “perfect balance” between usability and visual appearance. I must say that you’ve done a excellent job with this. In addition, the blog loads very fast for me on Opera. Excellent Blog!

I like the helpful info you provide in your articles. I will bookmark your weblog and check again here regularly. I’m quite sure I will learn plenty of new stuff right here! Best of luck for the next!

Well I really liked studying it. This post procured by you is very helpful for correct planning.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Great – I should definitely pronounce, impressed with your website. I had no trouble navigating through all tabs and related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, website theme . a tones way for your customer to communicate. Nice task.

Hello my loved one! I wish to say that this article is amazing, nice written and include approximately all important infos. I would like to peer more posts like this .

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

You actually make it seem so easy with your presentation but I find this topic to be actually something that I think I would never understand. It seems too complicated and very broad for me. I’m looking forward for your next post, I will try to get the hang of it!

Great ?V I should certainly pronounce, impressed with your web site. I had no trouble navigating through all the tabs and related information ended up being truly simple to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task..

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Its good as your other posts : D, thanks for putting up. “A great flame follows a little spark.” by Dante Alighieri.

I’d incessantly want to be update on new articles on this site, saved to bookmarks! .

This really answered my drawback, thank you!

It’s really a great and helpful piece of information. I am glad that you shared this helpful info with us. Please keep us informed like this. Thanks for sharing.

Wow! This could be one particular of the most helpful blogs We’ve ever arrive across on this subject. Actually Wonderful. I’m also an expert in this topic therefore I can understand your hard work.

magnificent points altogether, you just received a new reader. What might you recommend about your submit that you just made a few days ago? Any positive?

I’ve recently started a web site, the info you provide on this site has helped me greatly. Thanks for all of your time & work. “Yield not to evils, but attack all the more boldly.” by Virgil.

I am impressed with this website , rattling I am a fan.

Wow, amazing blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is great, let alone the content!

As a Newbie, I am always browsing online for articles that can benefit me. Thank you

Well I sincerely enjoyed reading it. This tip procured by you is very helpful for proper planning.

It’s a shame you don’t have a donate button! I’d without a doubt donate to this fantastic blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will talk about this site with my Facebook group. Chat soon!

Great post. I was checking continuously this blog and I am impressed! Extremely useful info specially the last part 🙂 I care for such information a lot. I was seeking this certain information for a very long time. Thank you and best of luck.

It’s truly a great and useful piece of info. I’m satisfied that you simply shared this useful info with us. Please keep us informed like this. Thanks for sharing.

Undeniably imagine that which you said. Your favorite reason appeared to be at the net the simplest factor to remember of. I say to you, I definitely get annoyed while folks think about worries that they plainly do not recognize about. You controlled to hit the nail upon the highest and defined out the entire thing with no need side-effects , other folks can take a signal. Will likely be again to get more. Thanks

Great tremendous issues here. I?¦m very satisfied to look your post. Thank you so much and i am looking forward to contact you. Will you please drop me a e-mail?

I dugg some of you post as I cerebrated they were extremely helpful extremely helpful

Regards for helping out, excellent info .

I respect your work, regards for all the great blog posts.

You really make it seem really easy with your presentation but I to find this topic to be actually something that I feel I would never understand. It seems too complex and extremely wide for me. I am taking a look ahead for your next submit, I will try to get the dangle of it!

Keep functioning ,terrific job!

Great write-up, I’m regular visitor of one’s website, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

Sweet internet site, super style and design, real clean and utilise genial.

Great beat ! I wish to apprentice at the same time as you amend your site, how can i subscribe for a weblog website? The account helped me a acceptable deal. I were a little bit familiar of this your broadcast provided vibrant clear idea

At this time it appears like BlogEngine is the top blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your site when you could be giving us something informative to read?

I¦ve recently started a site, the info you offer on this site has helped me greatly. Thanks for all of your time & work.

Aumente o público das suas transmissões! Compre visualizações para live no YouTube e ganhe mais engajamento, credibilidade e alcance na plataforma.

naturally like your web site however you need to test the spelling on several of your posts. Many of them are rife with spelling problems and I in finding it very troublesome to inform the reality then again I will definitely come back again.

This is a topic close to my heart cheers, where are your contact details though?

I want to express my affection for your kindness in support of individuals that absolutely need assistance with this issue. Your personal dedication to passing the message across has been astonishingly useful and have surely allowed girls like me to get to their desired goals. Your helpful guidelines denotes much to me and still more to my mates. Thanks a ton; from each one of us.

Valuable information. Lucky me I found your web site by accident, and I am shocked why this accident did not happened earlier! I bookmarked it.

The layout is visually appealing and very functional.

Usually I do not read post on blogs, but I would like to say that this write-up very forced me to try and do it! Your writing style has been surprised me. Thanks, very nice article.

It’s a shame you don’t have a donate button! I’d certainly donate to this outstanding blog! I guess for now i’ll settle for bookmarking and adding your RSS feed to my Google account. I look forward to new updates and will share this website with my Facebook group. Chat soon!

This website is amazing, with a clean design and easy navigation.

Very interesting points you have remarked, regards for putting up. “The best time to do a thing is when it can be done.” by William Pickens.

I’m really impressed by the speed and responsiveness.

FitSpresso is a dietary supplement designed to aid weight loss, improve energy levels, and promote overall wellness. It targets key areas of weight management by enhancing metabolism, controlling appetite, and supporting fat-burning processes.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

The content is well-organized and highly informative.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

I reckon something genuinely special in this web site.

Hi there! I could have sworn I’ve been to this site before but after checking through some of the post I realized it’s new to me. Nonetheless, I’m definitely happy I found it and I’ll be bookmarking and checking back often!

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

The Ice Water Hack has gained popularity as a simple yet effective method for boosting metabolism and promoting weight loss.

Hello, i think that i saw you visited my weblog so i came to “return the favor”.I am attempting to find things to enhance my website!I suppose its ok to use some of your ideas!!

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

ProstaVive is a dietary supplement designed to promote prostate health, support urinary function, and improve overall well-being in men, especially as they age.

Greetings from Florida! I’m bored at work so I decided to browse your website on my iphone during lunch break. I love the knowledge you provide here and can’t wait to take a look when I get home. I’m shocked at how quick your blog loaded on my mobile .. I’m not even using WIFI, just 3G .. Anyways, superb site!

I got what you intend, regards for posting.Woh I am happy to find this website through google.

great post, very informative. I wonder why the other experts of this sector don’t notice this. You must continue your writing. I’m sure, you’ve a great readers’ base already!

I’ve been absent for some time, but now I remember why I used to love this blog. Thank you, I’ll try and check back more often. How frequently you update your website?

I’ve learn a few excellent stuff here. Certainly price bookmarking for revisiting. I wonder how a lot attempt you put to make the sort of excellent informative web site.

I am really impressed with your writing talents and also with the structure in your blog. Is that this a paid theme or did you customize it your self? Anyway stay up the excellent high quality writing, it is rare to see a great blog like this one today..

of course like your web-site but you need to check the spelling on several of your posts. Several of them are rife with spelling issues and I find it very troublesome to tell the truth however I will certainly come back again.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

As I website owner I think the content material here is very fantastic, thanks for your efforts.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

What i don’t understood is in reality how you are no longer really much more well-liked than you may be now. You’re very intelligent. You recognize thus considerably when it comes to this topic, made me in my view imagine it from a lot of varied angles. Its like women and men aren’t involved until it¦s one thing to accomplish with Woman gaga! Your personal stuffs excellent. Always take care of it up!

Loving the information on this website , you have done great job on the blog posts.

I really appreciate this post. I?¦ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thx again

AI is evolving so fast! I can’t wait to see how it transforms our daily lives in the next decade. The possibilities are endless, from automation to medical advancements.

Thanks for sharing excellent informations. Your web-site is very cool. I am impressed by the details that you have on this blog. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the information I already searched everywhere and just could not come across. What an ideal website.

Rattling nice pattern and great subject material, very little else we require : D.

Hi there this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding knowledge so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

Hey there! This is my first comment here so I just wanted to give a quick shout out and say I genuinely enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Many thanks!

I like the efforts you have put in this, thanks for all the great content.

I like this weblog very much, Its a rattling nice position to read and find info . “God cannot alter the past, but historians can.” by Samuel Butler.

Hi, Neat post. There’s a problem with your site in internet explorer, would check this… IE still is the market leader and a large portion of people will miss your great writing due to this problem.

What i do not understood is in fact how you’re not really much more smartly-liked than you may be right now. You are very intelligent. You know thus considerably in the case of this subject, made me for my part imagine it from numerous numerous angles. Its like men and women aren’t fascinated except it is something to do with Woman gaga! Your own stuffs outstanding. Always care for it up!

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how could we communicate?

Thank you for sharing superb informations. Your website is very cool. I am impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched everywhere and simply could not come across. What a perfect web site.

Very interesting topic, appreciate it for putting up.

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

I’ve recently started a website, the information you offer on this website has helped me tremendously. Thanks for all of your time & work. “Never trust anybody who says ‘trust me.’ Except just this once, of course. – from Steel Beach” by John Varley.

You are my aspiration, I have few web logs and sometimes run out from brand :). “The soul that is within me no man can degrade.” by Frederick Douglas.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Some truly great articles on this internet site, thank you for contribution. “Be absolutely determined to enjoy what you do.” by Sarah Knowles Bolton.

I loved as much as you’ll receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an edginess over that you wish be delivering the following. unwell unquestionably come more formerly again as exactly the same nearly a lot often inside case you shield this increase.

Hi, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam responses? If so how do you protect against it, any plugin or anything you can suggest? I get so much lately it’s driving me insane so any support is very much appreciated.

I am always invstigating online for articles that can benefit me. Thanks!

We are a gaggle of volunteers and opening a brand new scheme in our community. Your web site offered us with useful info to work on. You’ve performed a formidable task and our entire community will be grateful to you.

Howdy very nice website!! Man .. Excellent .. Amazing .. I’ll bookmark your site and take the feeds also…I’m happy to seek out a lot of helpful information here within the put up, we’d like develop more techniques on this regard, thank you for sharing. . . . . .

I will right away grab your rss as I can’t find your e-mail subscription link or e-newsletter service. Do you’ve any? Please let me know so that I could subscribe. Thanks.

Hello would you mind letting me know which hosting company you’re using? I’ve loaded your blog in 3 different internet browsers and I must say this blog loads a lot quicker then most. Can you suggest a good web hosting provider at a reasonable price? Cheers, I appreciate it!

Definitely, what a great website and instructive posts, I will bookmark your blog.Best Regards!

Everyone loves what you guys are usually up too. This type of clever work and coverage! Keep up the terrific works guys I’ve included you guys to my blogroll.

I reckon something really interesting about your site so I saved to bookmarks.

I have been exploring for a bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this website. Reading this info So i’m happy to convey that I have a very good uncanny feeling I discovered exactly what I needed. I most certainly will make certain to don’t forget this website and give it a glance regularly.

I have learn a few good stuff here. Certainly value bookmarking for revisiting. I wonder how a lot effort you place to create the sort of excellent informative website.

There is noticeably a lot to know about this. I consider you made some nice points in features also.

پارتیشن سازه ، تولید کننده انواع پارتیشن اداری و سایر دکوراسیون اداری، با حدود سه دهه سابقه. با افتخار مجرئ انواع پروژهها در اکثریت شرکتها و ادارات. سفارش مستقیم از تولید کننده بدون واسطه

I have recently started a site, the info you offer on this web site has helped me greatly. Thanks for all of your time & work.

Nitric Boost Ultra is a dietary supplement designed to enhance cardiovascular health, energy levels, and endurance by increasing nitric oxide (NO) production in the body.

Definitely, what a splendid website and revealing posts, I surely will bookmark your site.All the Best!

Hiya, I’m really glad I have found this information. Nowadays bloggers publish only about gossips and web and this is actually annoying. A good site with exciting content, this is what I need. Thanks for keeping this web site, I’ll be visiting it. Do you do newsletters? Can’t find it.

I was studying some of your posts on this website and I conceive this internet site is real informative ! Retain posting.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

I truly enjoy examining on this web site, it holds great articles. “Never fight an inanimate object.” by P. J. O’Rourke.

ProDentim is a cutting-edge oral health supplement designed to improve dental and gum health by leveraging natural probiotics and nutrientes.

This is really fascinating, You’re an overly skilled blogger. I’ve joined your feed and look forward to in the hunt for more of your magnificent post. Additionally, I have shared your website in my social networks!

Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a little bit, but instead of that, this is excellent blog. A great read. I will definitely be back.

But wanna input on few general things, The website style and design is perfect, the subject material is really great : D.

There’s noticeably a bundle to learn about this. I assume you made certain good factors in features also.

I’ve recently started a blog, the information you offer on this website has helped me greatly. Thank you for all of your time & work.

Hi! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any tips?

You are a very intelligent individual!

What i do not realize is in reality how you are not actually a lot more smartly-liked than you might be right now. You’re very intelligent. You know thus significantly on the subject of this subject, produced me in my view believe it from numerous varied angles. Its like men and women aren’t fascinated until it is something to do with Lady gaga! Your personal stuffs nice. At all times take care of it up!

You completed various nice points there. I did a search on the subject and found the majority of persons will go along with with your blog.

This really answered my drawback, thanks!

Some truly great information, Gladiolus I observed this. “No men can be lords of our faith, though they may be helpers of our joy.” by John Owen.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

of course like your web site but you need to test the spelling on several of your posts. Many of them are rife with spelling issues and I to find it very bothersome to tell the truth on the other hand I’ll definitely come back again.

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I’m quite sure I will learn many new stuff right here! Best of luck for the next!

We’re a gaggle of volunteers and opening a brand new scheme in our community. Your site offered us with helpful info to work on. You’ve performed an impressive job and our entire community will be grateful to you.

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

You can definitely see your skills in the work you write. The world hopes for even more passionate writers like you who are not afraid to say how they believe. Always go after your heart.

I would like to thank you for the efforts you have put in writing this site. I’m hoping the same high-grade blog post from you in the upcoming as well. Actually your creative writing abilities has encouraged me to get my own web site now. Actually the blogging is spreading its wings rapidly. Your write up is a good example of it.

I’ve been browsing on-line greater than 3 hours these days, but I never discovered any attention-grabbing article like yours. It is lovely value enough for me. Personally, if all website owners and bloggers made good content as you probably did, the web will be a lot more useful than ever before.

I believe other website proprietors should take this website as an model, very clean and excellent user friendly style and design.

What’s Taking place i am new to this, I stumbled upon this I have discovered It absolutely helpful and it has helped me out loads. I am hoping to contribute & help different users like its helped me. Good job.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Keep working ,great job!

Yesterday, while I was at work, my sister stole my iphone and tested to see if it can survive a thirty foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

I wanted to make a small remark to be able to appreciate you for some of the lovely tips and hints you are sharing here. My considerable internet lookup has at the end been paid with reasonable facts and strategies to go over with my great friends. I ‘d mention that many of us site visitors are truly lucky to live in a fine website with many awesome professionals with good techniques. I feel very much privileged to have encountered the website page and look forward to plenty of more brilliant times reading here. Thanks a lot once more for a lot of things.

Very efficiently written story. It will be valuable to everyone who utilizes it, including myself. Keep doing what you are doing – i will definitely read more posts.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

Hi, Neat post. There is an issue along with your website in web explorer, may check this… IE still is the marketplace leader and a big portion of people will omit your excellent writing because of this problem.

My brother suggested I may like this website. He was once entirely right. This post actually made my day. You can not imagine just how a lot time I had spent for this info! Thank you!

Hi would you mind stating which blog platform you’re using? I’m going to start my own blog soon but I’m having a tough time making a decision between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your layout seems different then most blogs and I’m looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Very interesting details you have mentioned, thanks for posting.

The crux of your writing while sounding agreeable in the beginning, did not work properly with me personally after some time. Someplace within the paragraphs you actually managed to make me a believer unfortunately just for a very short while. I nevertheless have a problem with your jumps in logic and you would do well to fill in all those gaps. If you can accomplish that, I will definitely be amazed.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

I’ve been exploring for a bit for any high quality articles or weblog posts on this kind of space . Exploring in Yahoo I finally stumbled upon this website. Reading this information So i’m satisfied to convey that I’ve an incredibly good uncanny feeling I discovered just what I needed. I most definitely will make certain to don’t disregard this web site and provides it a glance regularly.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

What i do not realize is actually how you are now not actually a lot more well-preferred than you may be right now. You’re very intelligent. You know therefore considerably with regards to this topic, made me in my opinion imagine it from so many numerous angles. Its like women and men are not fascinated unless it is something to do with Girl gaga! Your individual stuffs nice. All the time handle it up!

I went over this web site and I think you have a lot of fantastic information, bookmarked (:.

Magnificent website. Plenty of useful information here. I am sending it to a few friends ans also sharing in delicious. And obviously, thanks for your effort!

I think that is among the such a lot vital information for me. And i am happy studying your article. However should remark on few normal issues, The web site style is great, the articles is truly great : D. Good job, cheers

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

Hello, Neat post. There is a problem with your site in internet explorer, might check this?K IE still is the market chief and a large part of other people will omit your excellent writing due to this problem.

I know this if off topic but I’m looking into starting my own blog and was wondering what all is needed to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web smart so I’m not 100 certain. Any suggestions or advice would be greatly appreciated. Kudos

you’re really a good webmaster. The website loading speed is incredible. It seems that you’re doing any unique trick. Furthermore, The contents are masterwork. you’ve done a excellent job on this topic!

Woah! I’m really enjoying the template/theme of this site. It’s simple, yet effective. A lot of times it’s tough to get that “perfect balance” between user friendliness and visual appearance. I must say that you’ve done a awesome job with this. In addition, the blog loads extremely fast for me on Chrome. Excellent Blog!

Someone essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I amazed with the research you made to make this particular publish extraordinary. Magnificent job!

But wanna input on few general things, The website pattern is perfect, the subject material is real great : D.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Hiya very cool web site!! Man .. Excellent .. Superb .. I will bookmark your web site and take the feeds also…I am glad to seek out a lot of helpful information here within the publish, we’d like develop more techniques on this regard, thank you for sharing. . . . . .

Wow that was unusual. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear. Grrrr… well I’m not writing all that over again. Anyways, just wanted to say wonderful blog!

You are my intake, I possess few blogs and occasionally run out from to post .

Enjoyed looking through this, very good stuff, regards. “All of our dreams can come true — if we have the courage to pursue them.” by Walt Disney.

I found your blog website on google and test a few of your early posts. Proceed to maintain up the excellent operate. I simply additional up your RSS feed to my MSN Information Reader. Seeking forward to studying more from you in a while!…

I just couldn’t leave your website prior to suggesting that I extremely loved the usual info a person provide on your guests? Is gonna be again regularly to investigate cross-check new posts

Real instructive and good bodily structure of written content, now that’s user pleasant (:.

You are a very bright person!

This is very attention-grabbing, You’re a very professional blogger. I’ve joined your feed and sit up for in the hunt for extra of your magnificent post. Additionally, I’ve shared your web site in my social networks!

I savour, lead to I discovered just what I was having a look for. You have ended my 4 day long hunt! God Bless you man. Have a great day. Bye

Whats Happening i’m new to this, I stumbled upon this I have discovered It positively helpful and it has aided me out loads. I’m hoping to contribute & help other users like its helped me. Great job.

This is very interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your great post. Also, I have shared your web site in my social networks!

What i do not understood is in reality how you’re not actually a lot more well-appreciated than you might be right now. You’re very intelligent. You recognize thus considerably with regards to this subject, produced me for my part consider it from a lot of various angles. Its like women and men don’t seem to be involved until it is something to do with Girl gaga! Your personal stuffs excellent. At all times handle it up!

Hey there! This post could not be written any better! Reading through this post reminds me of my old room mate! He always kept chatting about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

I got good info from your blog

Precisely what I was looking for, thanks for posting.

I’d forever want to be update on new content on this site, saved to bookmarks! .

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

I’m still learning from you, while I’m trying to reach my goals. I definitely liked reading all that is written on your website.Keep the posts coming. I liked it!

Hey, you used to write wonderful, but the last several posts have been kinda boringK I miss your super writings. Past several posts are just a bit out of track! come on!

wonderful points altogether, you just gained a brand new reader. What would you suggest about your post that you made a few days ago? Any positive?

I’ve recently started a web site, the info you offer on this website has helped me greatly. Thank you for all of your time & work.

Just wish to say your article is as surprising. The clarity to your post is just great and that i can think you are an expert on this subject. Fine along with your permission allow me to clutch your RSS feed to stay up to date with forthcoming post. Thanks one million and please continue the rewarding work.

Great wordpress blog here.. It’s hard to find quality writing like yours these days. I really appreciate people like you! take care

I do believe all the ideas you have presented to your post. They are very convincing and will definitely work. Still, the posts are too short for starters. Could you please prolong them a bit from subsequent time? Thanks for the post.

F*ckin’ amazing things here. I’m very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you please drop me a e-mail?

Exactly what I was looking for, appreciate it for putting up.

I’m not sure exactly why but this blog is loading very slow for me. Is anyone else having this problem or is it a problem on my end? I’ll check back later and see if the problem still exists.

Deference to op, some excellent entropy.

I will immediately clutch your rss as I can not find your email subscription hyperlink or newsletter service. Do you’ve any? Kindly allow me realize in order that I could subscribe. Thanks.

As I website possessor I conceive the subject matter here is real good, thanks for your efforts.

I am extremely impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the excellent quality writing, it is rare to see a nice blog like this one these days..

I see something really special in this website.

very nice put up, i definitely love this web site, carry on it

I am forever thought about this, appreciate it for posting.

Very great visual appeal on this site, I’d rate it 10 10.

I am not sure where you’re getting your info, but great topic. I needs to spend some time learning much more or understanding more. Thanks for fantastic info I was looking for this info for my mission.

Outstanding post, you have pointed out some good details , I also think this s a very excellent website.

Exceptional post but I was wanting to know if you could write a litte more on this subject? I’d be very grateful if you could elaborate a little bit further. Bless you!

Please let me know if you’re looking for a article writer for your blog. You have some really good articles and I think I would be a good asset. If you ever want to take some of the load off, I’d love to write some material for your blog in exchange for a link back to mine. Please shoot me an e-mail if interested. Thanks!

I really appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thank you again

Aw, this was a really nice post. In concept I want to put in writing like this moreover – taking time and precise effort to make an excellent article… but what can I say… I procrastinate alot and in no way seem to get one thing done.

I have read a few good stuff here. Certainly worth bookmarking for revisiting. I surprise how much effort you put to create such a fantastic informative site.

You actually make it seem so easy with your presentation but I find this topic to be really something which I think I would never understand. It seems too complex and very broad for me. I’m looking forward for your next post, I will try to get the hang of it!

Hey! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new updates.

Wow that was strange. I just wrote an very long comment but after I clicked submit my comment didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say wonderful blog!

Thanks for your marvelous posting! I actually enjoyed reading it, you are a great author.I will make sure to bookmark your blog and may come back down the road. I want to encourage yourself to continue your great writing, have a nice evening!

Sweet internet site, super design, real clean and apply pleasant.

Whats Happening i’m new to this, I stumbled upon this I’ve discovered It positively helpful and it has helped me out loads. I hope to contribute & aid other customers like its aided me. Great job.

I don’t unremarkably comment but I gotta admit appreciate it for the post on this great one : D.

You are my aspiration, I have few blogs and occasionally run out from to brand : (.

Yesterday, while I was at work, my cousin stole my iphone and tested to see if it can survive a 30 foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

Thank you for helping out, great info. “Considering how dangerous everything is, nothing is really very frightening.” by Gertrude Stein.

I’m really impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the nice quality writing, it is rare to see a nice blog like this one these days..

We’re a group of volunteers and starting a new scheme in our community. Your site provided us with valuable info to paintings on. You have performed a formidable process and our whole neighborhood can be thankful to you.

Thanks for sharing excellent informations. Your web site is very cool. I’m impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the info I already searched all over the place and simply couldn’t come across. What an ideal web-site.

I am not certain the place you are getting your information, but good topic. I must spend some time finding out more or working out more. Thanks for fantastic info I was on the lookout for this information for my mission.

What’s Taking place i’m new to this, I stumbled upon this I’ve found It positively useful and it has aided me out loads. I hope to contribute & help other users like its helped me. Great job.

Good write-up, I?¦m regular visitor of one?¦s web site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

Sweet blog! I found it while surfing around on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

Hey! This is my first comment here so I just wanted to give a quick shout out and say I really enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Thanks for your time!

Hi , I do believe this is an excellent blog. I stumbled upon it on Yahoo , i will come back once again. Money and freedom is the best way to change, may you be rich and help other people.

My coder is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using WordPress on numerous websites for about a year and am anxious about switching to another platform. I have heard very good things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any help would be greatly appreciated!

Wohh exactly what I was searching for, thankyou for posting.

Its such as you learn my thoughts! You seem to know a lot approximately this, like you wrote the e-book in it or something. I feel that you can do with some p.c. to pressure the message house a bit, but instead of that, that is wonderful blog. A fantastic read. I will certainly be back.

A formidable share, I just given this onto a colleague who was doing just a little evaluation on this. And he the truth is purchased me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the deal with! But yeah Thnkx for spending the time to debate this, I really feel strongly about it and love reading more on this topic. If possible, as you turn out to be experience, would you mind updating your blog with more particulars? It is highly useful for me. Big thumb up for this blog post!

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

I think this is one of the most vital information for me. And i am glad reading your article. But wanna remark on some general things, The website style is wonderful, the articles is really great : D. Good job, cheers

I am continually invstigating online for ideas that can benefit me. Thx!

As a Newbie, I am always searching online for articles that can be of assistance to me. Thank you

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

Excellent site. Lots of helpful information here. I am sending it to several buddies ans additionally sharing in delicious. And of course, thank you on your sweat!

I am not real excellent with English but I get hold this really easy to understand.

I’ve been browsing online greater than 3 hours nowadays, yet I never discovered any fascinating article like yours. It’s pretty worth sufficient for me. In my opinion, if all website owners and bloggers made excellent content material as you probably did, the internet might be a lot more helpful than ever before. “Oh, that way madness lies let me shun that.” by William Shakespeare.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thanks again!

Appreciate it for helping out, excellent info. “Whoever obeys the gods, to him they particularly listen.” by Homer.

I want looking at and I conceive this website got some genuinely useful stuff on it! .

Very interesting topic, regards for posting.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Nearly all of the things you state happens to be astonishingly accurate and that makes me wonder why I had not looked at this with this light previously. This particular piece truly did turn the light on for me personally as far as this specific issue goes. Nonetheless at this time there is actually just one factor I am not really too comfy with so whilst I try to reconcile that with the central idea of your position, allow me observe just what the rest of your readers have to say.Very well done.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Some really superb info , Glad I noticed this.

Perfectly composed subject matter, appreciate it for entropy. “He who establishes his argument by noise and command shows that his reason is weak.” by Michel de Montaigne.

I like this post, enjoyed this one regards for posting. “What is a thousand years Time is short for one who thinks, endless for one who yearns.” by Alain.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

Utterly written subject material, Really enjoyed looking at.

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Fantastic site. Lots of useful information here. I’m sending it to several friends ans also sharing in delicious. And certainly, thanks for your effort!

I?¦ve been exploring for a little for any high quality articles or weblog posts in this sort of house . Exploring in Yahoo I eventually stumbled upon this site. Studying this information So i?¦m happy to exhibit that I have a very excellent uncanny feeling I found out exactly what I needed. I so much undoubtedly will make sure to don?¦t disregard this website and give it a glance regularly.

I have been exploring for a little for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i am happy to convey that I have an incredibly good uncanny feeling I discovered exactly what I needed. I most certainly will make certain to don’t forget this site and give it a look on a constant basis.

Enjoyed looking at this, very good stuff, regards. “I will do my best. That is all I can do. I ask for your help-and God’s.” by Lyndon B. Johnson.

You have brought up a very wonderful points, regards for the post.

Thanks a lot for sharing this with all people you really recognize what you are speaking about! Bookmarked. Please additionally consult with my site =). We can have a link change arrangement between us!

After study a number of of the weblog posts in your web site now, and I actually like your approach of blogging. I bookmarked it to my bookmark website listing and can be checking again soon. Pls take a look at my web site as properly and let me know what you think.

Hmm is anyone else experiencing problems with the images on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely useful and it has aided me out loads. I hope to contribute & help other users like its aided me. Great job.

Unquestionably believe that which you stated. Your favorite justification seemed to be on the web the easiest factor to take note of. I say to you, I certainly get irked at the same time as other people consider worries that they plainly do not recognize about. You controlled to hit the nail upon the top as neatly as defined out the whole thing with no need side-effects , other people can take a signal. Will probably be again to get more. Thanks

I think this is one of the most important info for me. And i am glad reading your article. But should remark on some general things, The site style is great, the articles is really great : D. Good job, cheers

Nice read, I just passed this onto a friend who was doing a little research on that. And he actually bought me lunch since I found it for him smile Therefore let me rephrase that: Thank you for lunch!

Compre visualizações e espectadores reais para suas lives no YouTube, Instagram, Twitch, TikTok e Facebook. Aumente seu engajamento e credibilidade online com serviços seguros e confiáveis. Impulsione suas transmissões ao vivo hoje!

Its such as you read my thoughts! You seem to grasp a lot about this, such as you wrote the e-book in it or something. I believe that you just can do with some to pressure the message home a little bit, however other than that, that is excellent blog. An excellent read. I will definitely be back.

Hmm it looks like your blog ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to the whole thing. Do you have any helpful hints for inexperienced blog writers? I’d certainly appreciate it.

Whats up very nice site!! Guy .. Beautiful .. Superb .. I’ll bookmark your web site and take the feeds additionally…I am satisfied to find a lot of useful information here within the put up, we’d like work out extra strategies on this regard, thanks for sharing.

Choosing the Nursing Professionals Certificates online website is a wise decision for individuals seeking to advance their careers in the healthcare field. This platform offers a comprehensive range of courses designed by industry experts, covering topics such as patient care, disease prevention, and healthcare technology. The website provides an interactive and user-friendly learning experience, with resources including videos, quizzes, and discussion forums to enhance understanding and retention of key concepts. In addition, the site offers flexible scheduling options for busy professionals looking to further their education while working full-time. With its accreditation and recognition within the nursing community, choosing Nursing Professionals Certificates online ensures that learners receive quality education and relevant skills that can be immediately applied in clinical settings. By investing in this reputable platform, individuals can position themselves for success in today’s competitive healthcare landscape.

Some genuinely nice and useful info on this web site, besides I think the design has got superb features.

Have you ever thought about publishing an ebook or guest authoring on other sites? I have a blog based upon on the same ideas you discuss and would really like to have you share some stories/information. I know my subscribers would appreciate your work. If you’re even remotely interested, feel free to shoot me an email.

Hello my loved one! I wish to say that this article is awesome, nice written and come with almost all vital infos. I’d like to peer extra posts like this .

You have remarked very interesting details ! ps nice website .

You have remarked very interesting points! ps nice internet site.

This is a topic close to my heart cheers, where are your contact details though?

Thanks a lot for providing individuals with a very brilliant possiblity to discover important secrets from this site. It is usually very lovely and also packed with amusement for me personally and my office mates to visit your blog at the least three times per week to see the new things you have. Not to mention, we are always fascinated with all the outstanding strategies you give. Selected 3 facts in this posting are particularly the most effective we’ve had.

Thanks for helping out, great information.

Very excellent info can be found on web blog. “Life without a friend is death without a witness.” by Eugene Benge.

I was looking through some of your articles on this website and I think this internet site is rattling instructive! Continue posting.

Hey this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding skills so I wanted to get advice from someone with experience. Any help would be greatly appreciated!

The Salt Trick is a natural technique that involves using specific salts, such as Blue Salt, to enhance male performance

The Ice Water Hack has been gaining popularity as a simple method to aid weight loss. After reading about its potential benefits, I decided to give it a shot and see how it worked for me. Here’s what I found!

Someone essentially lend a hand to make significantly posts I might state. This is the very first time I frequented your web page and to this point? I amazed with the research you made to create this particular post incredible. Fantastic job!

Of course, what a splendid website and illuminating posts, I will bookmark your website.All the Best!

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but certainly you are going to a famous blogger if you are not already 😉 Cheers!

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

I am really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Either way keep up the excellent quality writing, it is rare to see a great blog like this one today..

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Very interesting subject, appreciate it for posting.

If you’ve been looking for a way to unlock your full mental potential and attract wealth effortlessly, Billionaire Brain Wave might just be the breakthrough you’ve been waiting for!