This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

I’m SO excited to be able to offer you 2 FREE budget spreadsheet templates!

Let’s get your budget movin’ in the right direction! 🎉

With these easy to use, free templates your budget experience will be simple and stress-free (oh, and lightning fast) 😊

Free Simple Budget Template

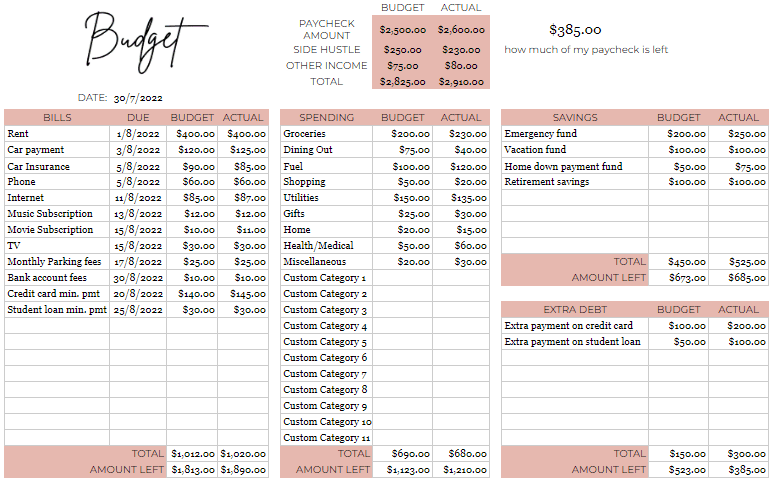

The simple budget template will get your budget done in 5 minutes in Google Sheets- it’s ready to go and even includes the budget categories you’ll need to use. It’s also extremely flexible, so you can use it to budget for the entire month, or just to budget your paycheck.

Free Emergency Fund Calculator

We’ve also included our emergency fund calculator- in my opinion, starting an emergency fund goes hand in hand with starting a budget.

An emergency fund is your savings for unexpected expenses, like living expenses after losing your job. Having one can keep you out of debt when a money emergency pops up (because you can use your savings instead).

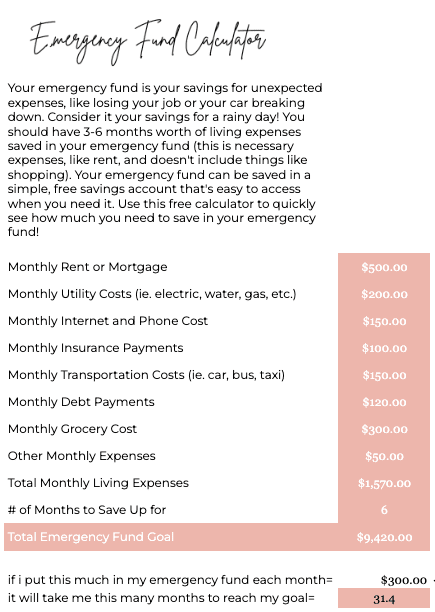

Our free emergency fund calculator will show you exactly how much you need to save, and how much to put aside in it each month in your budget.

It’s so easy to get overwhelmed by finances- having a pre-made template makes the process of budgeting way quicker and easier. It will do the math for you, so no need for a calculator (or an eraser- budget changes are no problem)!

Our free budget spreadsheets are designed to motivate you AND take the legwork out of making a budget.

Let’s dive in! Here’s how to set up your budget using our FREE simple budget template!

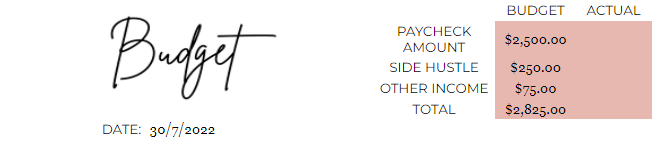

1. Enter your expected income and the date of your payday (you can add any other income as well!)

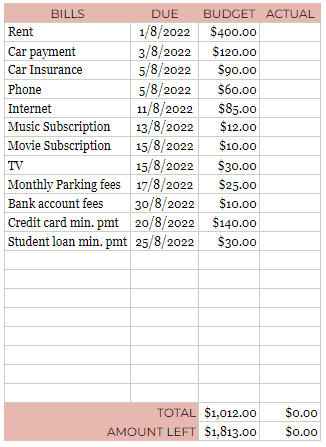

2. Next, enter your bills, when they are due and how much you expect them to cost

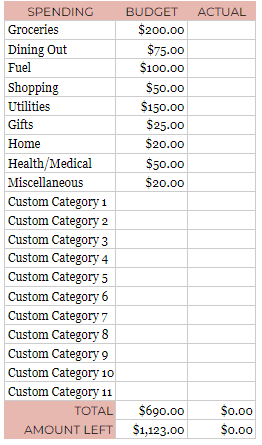

3. Plan your spending by category (ps: you can change custom category names by double clicking them and typing your new category name)

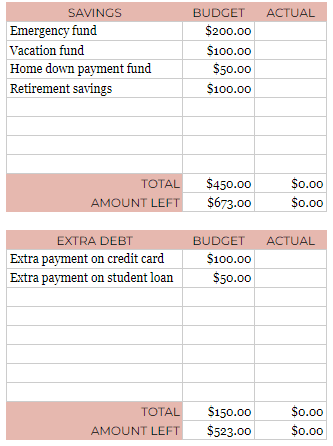

4. Don’t forget to plan to grow your savings and add extra payments to your debt! 🤓

You’ve now successfully made a well-planned, goal-crushing budget- ta-daaa! 🎖😍

Your next task is to track where your money actually ends up going- so you can compare this to your budget later on.

If you’re budgeting for one paycheck at a time, you’ll start to track your spending on payday.

If you’re budgeting for the whole month, you’ll start to track your spending on the first day of the month.

5. Track your spending by entering the actual amounts you spend in the “Actual” columns under Bills, Spending, Savings, and Extra Debt. You’ll also record your paychecks under “Actual” in the income area at the top. Enter the actual amounts you pay for bills as you pay them, and add up your spending as you go. Make sure to note any contributions to your savings, and any extra debt payments!

After entering your actual amounts, your template will look something like this.

It’s normal to have some difference between your budgeted and actual amounts- life can be unexpected!

Don’t give up when this happens- as long as you’re paying your bills on time, keeping an eye on your spending, adding money to savings, and making extra payments on your debt to pay it off faster- you are a success!

And that’s it! You can right-click on the “Budget” tab and click “Duplicate” to make a new copy of your budget, making future budgets a breeze (all of your bills and categories will already be there for next time!)

Here’s how to use our emergency fund calculator 🤓

So, what’s an emergency fund?

An emergency fund is your savings for unexpected expenses, like losing your job or having your car break down unexpectedly.

It’s recommended to have 3-6 months worth of basic living expenses saved for your emergency fund. Your basic living expenses are things that you need to get by, like rent and food- and not unnecessary spending like shopping or entertainment.

You can put your emergency fund in a free savings account and access it whenever you need to! Having an emergency fund is the foundation of a good budget, because it prevents you from going further into debt when life happens.

I feel so much relief from having my emergency fund- and I experience WAY less stress about money than before! 😌

Here’s how to use our calculator:

1. Enter your monthly living expenses, and decide how many months you would like to save up for! (3-6 months of basic living expenses is the amount I generally recommend. Less than 3 months may not be enough, and more than 6 months may be a bit too much money- for example, that money might serve you better going towards another goal instead)

This will show you how much you need to save for, and under this total you’ll see how many months it will take you to save up! (Depending on how much you contribute monthly)💰

Simply put the monthly amount in your budget each month to reach your goal (put it under “Emergency Fund” under the “Savings” section of your budget)

This free calculator will take the guesswork out of how much of your money to save! 😊

Ready to get started with these free templates?

Sign up for our free resource library to snag them both- you’ll find them in the “Start a Budget” section🥰

You’ll also get free budget printables (like our monthly budget and life planners), a FULL list of budget categories to help you start your budget with confidence, a beginner’s budgeting challenge, and SO much more!

Happy budgeting- I’m cheering you on! ❤️

1 Comment on Free Budget Spreadsheet Templates