This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Let me ask you something- what are your money goals?

When you think about your finances, what’s the number one thing you want to feel good about?

Do you want to breathe a sigh of relief because you have a monthly budget that works for you?

Do you want to be free from monthly credit card payments, and become debt-free?

Do you want to make a savings plan that you feel confident about?

I’ve got good news for you, friend- not only can you do this, but you can do it easily- all from the comfort of your home.

Alllll of your financial goals can be achieved while sitting in your PJs.

I know it’s possible because I’ve done it myself- with a pen and paper (and a little ambition), I went from:

-No savings to over $10,000 in a savings account

–$35,000 in debt to $17,000 in debt (and hopefully soon NO debt ;))

Oftentimes, the biggest thing standing between you and your money goals is a plan. More importantly, a solid plan with goals that you WANT to achieve!

Once I had my plan written down in front of me, I knew what I wanted to do and how badly I wanted to get there.

Ask yourself- what do you really want to achieve? Imagine yourself with no debt, or with money put away for a rainy day. Once you know what is motivating you, the planning part is easy.

And to make it easier yet, I put together a complete budget binder system that you can print off at home!

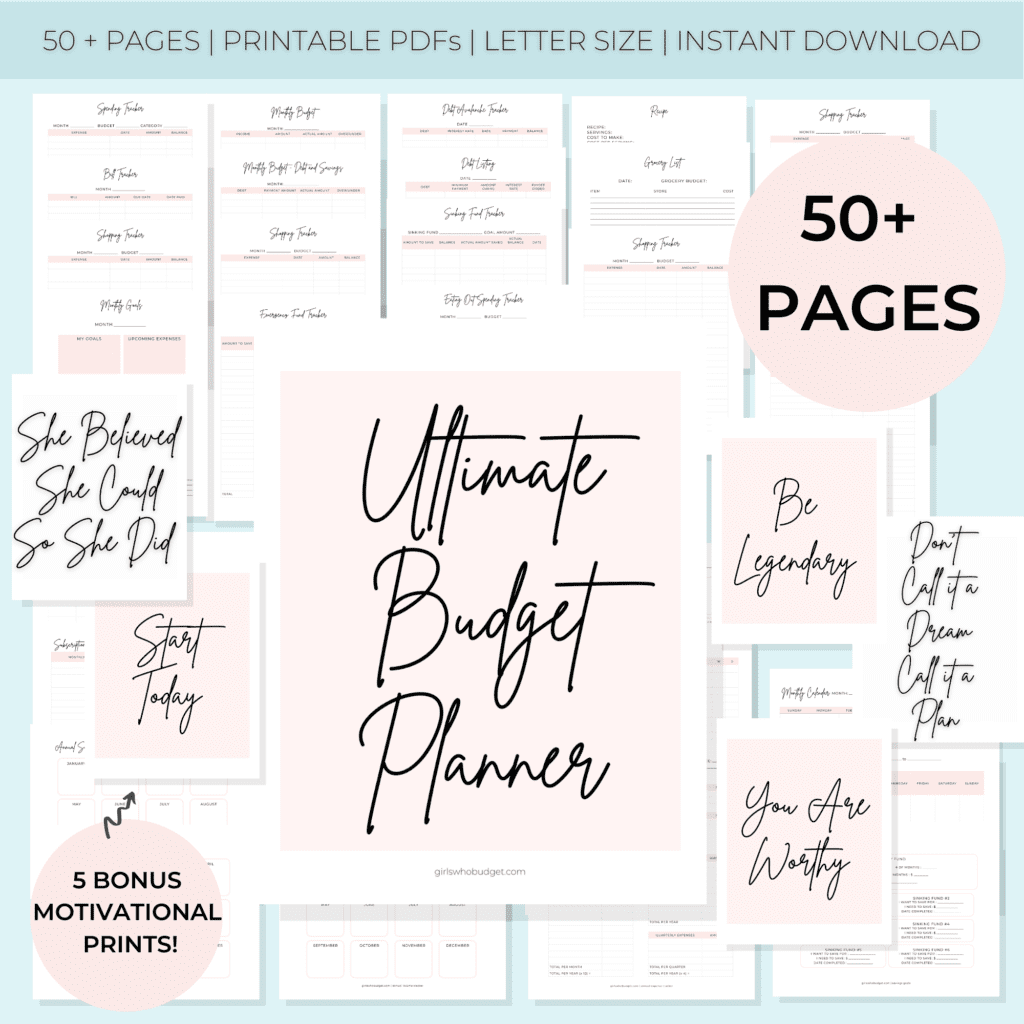

The Ultimate Budget Planner is a complete money planning guide- it’s over 50 budget printables that can be printed off at home (or at your local print shop if you don’t have a printer). Put them in your favourite binder, add some dividers if you want to, and you have a budget binder system that’s ready to go!

It’s crazy easy, and it helps that the pages are super cute, too 🙂

P.S.– there is also a black and white version (no colour ink required) that you can check out here!

P.P.S.– this is the exact binder system I use! As someone who has had to work through creating a budget, paying off debt, and learning how to save money, this is something I really put a lot of heart into.

So how do you get started with a budget binder?

Let’s walk through it, step-by-step- I’m so excited for you to tackle your goals!!

What is a budget binder?

You’ve probably heard of people using budget binders or budget planners at home, but you might not know what it is they’re talking about.

A budget binder is a bundle of printable PDF pages- you download them to your computer, hit save, and you have access to the files for life. You can print off as many copies as you like.

Why should I use one?

Many of us have experienced money struggles or just felt like we needed a real plan for our money.

I love using a budget binder because:

-It’s easy- I can download the files to my computer and start printing off the pages I want

-It’s super customizable- I can print off only the pages I need

-It’s really affordable- you will need a binder, a hole punch, and access to a printer. That’s it! Dividers and highlighters are a nice addition, too, but not required 😉

How to get yours:

Simply visit our Etsy shop, click Add To Basket, and then complete the check out process. As soon as you’re done, your printables will be ready for download under “Purchases and Reviews” on your Etsy account.

What pages should I use?

I’ll be showing you the pages that everyone should start with- after that, you can pick and choose from the remaining pages based on your unique goals, like saving money or paying off debt.

And if these goals ever change- you can simply print off new pages!

When should I start?

Right away!

To avoid any confusion, start to plan for the upcoming month. That way you can start the next month on a clean slate.

How do I set up my budget binder?

Although you could just print off the pages on their own, you can feel extra organized by putting your pages in a binder.

Once the pages you want to use are ready to go, simply hole punch and insert in your binder.

Here is what you’ll need:

–Binder (note: all pages are US Letter size [8.5” x 11”], so keep this in mind when selecting a binder)

–Hole punch

Optional:

–A printer and paper at home (you can also visit your local print shop)

–Dividers

–Highlighters

–Stickers

Let’s dive into the fun part, now- drum roll, please!

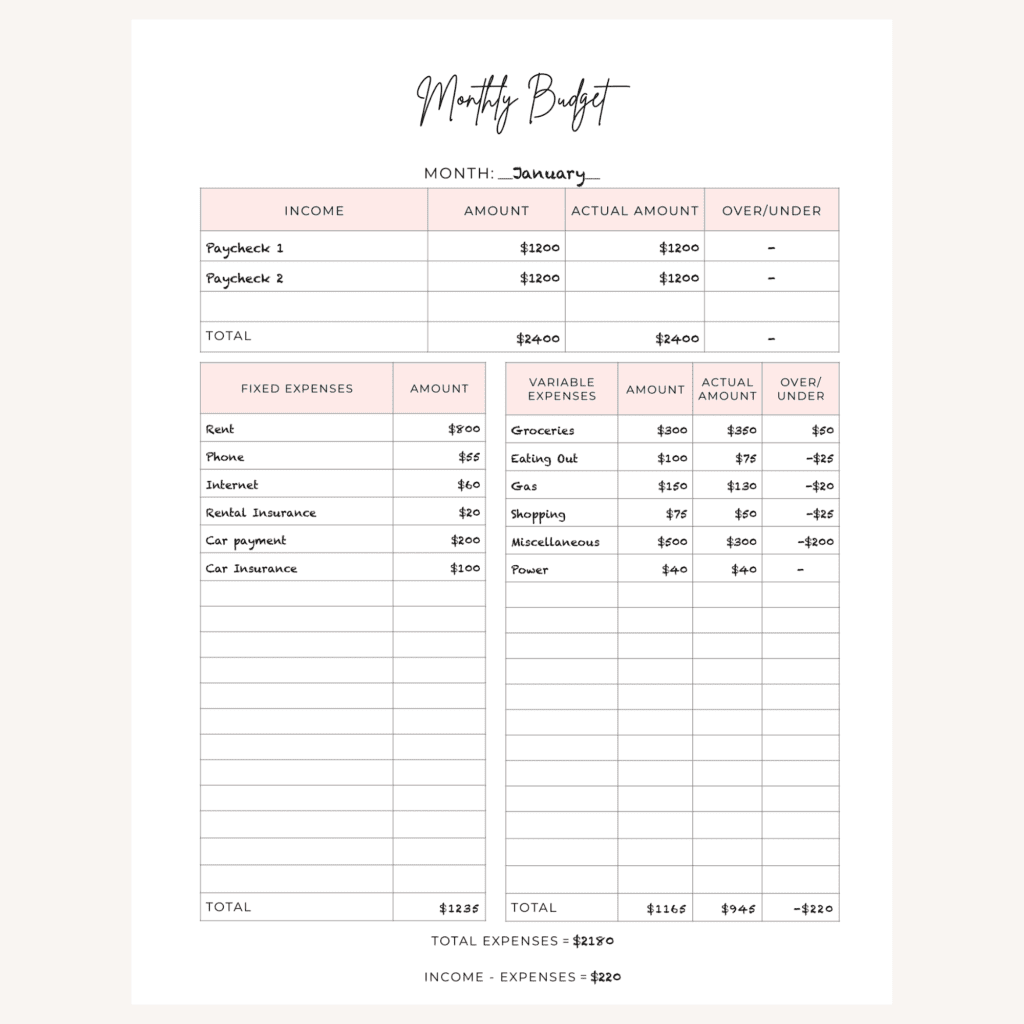

Monthly Budget

A monthly budget is essential to any money plan. Before you can start on any other goals, you need to understand what money is coming in, and where exactly that money is going.

This allows you to determine if your money is being over or under spent in certain places.

It’s also the first step in feeling confident about how you’re spending your money.

Income: Begin by writing down your income for the month, which is how much money you expect to make.

Expenses: Step 2 involves seeing where you want to spend the money you’re making- how much of it do you want to go towards bills, groceries, debt repayments, or savings?

Start with your fixed expenses, which are the ones that are the same every month. Some examples of this are your internet bill, phone bill, and rent.

Now let’s tackle your variable expenses, which are the ones that can vary month to month (think of groceries, gas money, or a power bill that varies based on usage).

Take some time to think of how much you want to spend on these categories (perhaps with extra money leftover for savings or extra debt payments). Check your online banking history if you’re not sure how much you typically spend.

Note: you can put savings and debt repayments in this column, but there is also an optional second page that gives you more room to list these amounts.

Put these numbers in the Amount column. Then once the month is over, you can update the Actual Amount column with how much you really spent.

If you go over budget on something the first month or two, don’t sweat it! It can take time to nail down how much you really spend in an average month.

Once you’re done filling in your income and expenses, total each category up, and subtract expenses from your income (Income – Expenses = Leftover Amount).

You have 2 options here! The first is to leave the budget as it is, and use the leftover money as you see fit during the month.

The next option is to put this amount in your Variable Expenses as Miscellaneous spending for the month (my personal preference), or by putting it towards other expenses.

The choice is yours, as long as you don’t have a Leftover Amount that is negative (ie. your expenses are more than your income!). If you make a budget and find that you’re in this situation, it’s time to reduce your expense, so that you are living within your means.

Of course another option here is to look at increasing your income, but this can be a lot harder to control.

At the end of the month, pull out this page again and fill in the actual amounts for the month.

Then, start a fresh new page for the new month!

Feel free to play around with the numbers until you are happy with them- and don’t expect to have the “perfect” budget the first time around, or even the first few times. Your budget will never be perfect, and it will change over time.

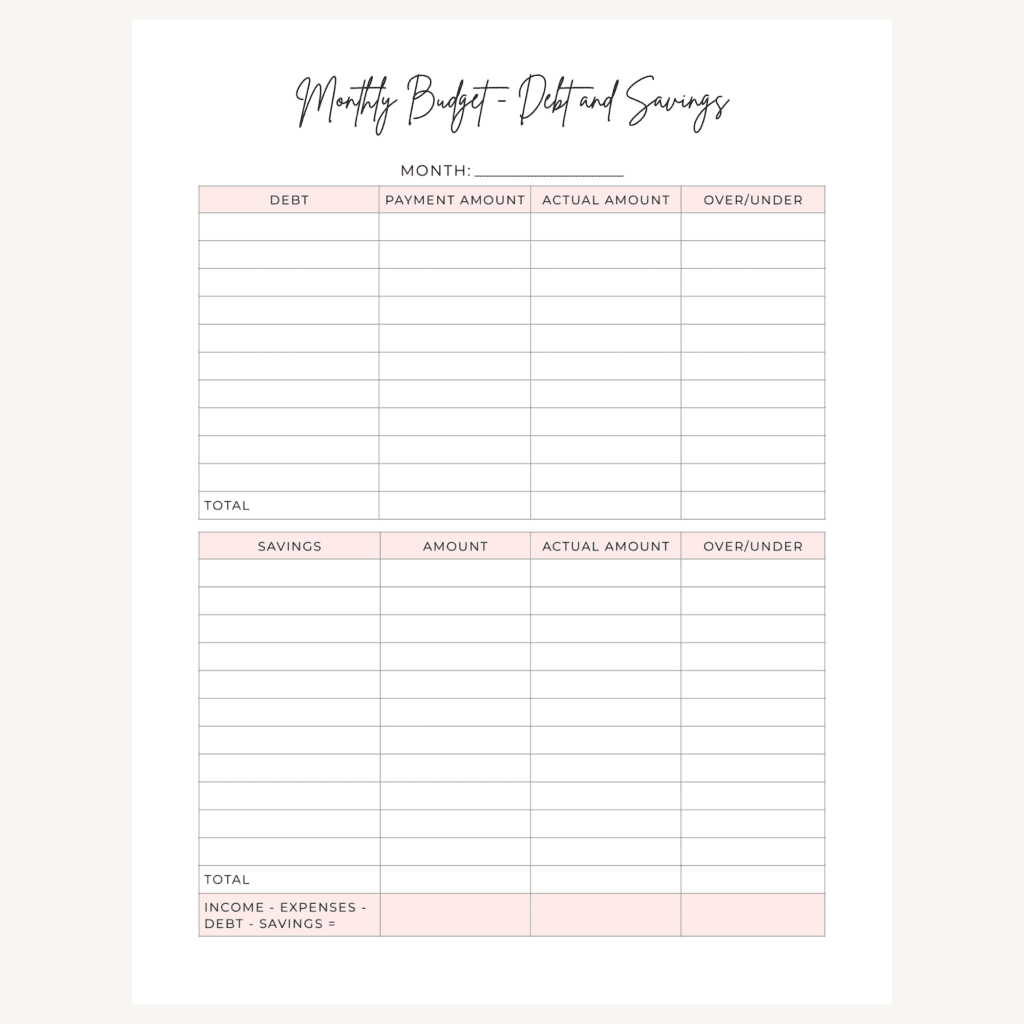

Optional: Use a separate page for your debt payments and savings contributions.

Although this is not necessary, it is my preferred method of budgeting. If your goals are focused on either of these things, you may want to consider it, too.

I like looking at how much I am spending on paying off my debt, as well as how much I am putting in my savings. The reason for this is simple- I want to get rid of the debt payments and turn them into more savings each month!

So if I see that I’m spending $500 on paying off my student loans, I know that once that loan is paid off, I will have $500 extra every month that I can put straight in my savings!

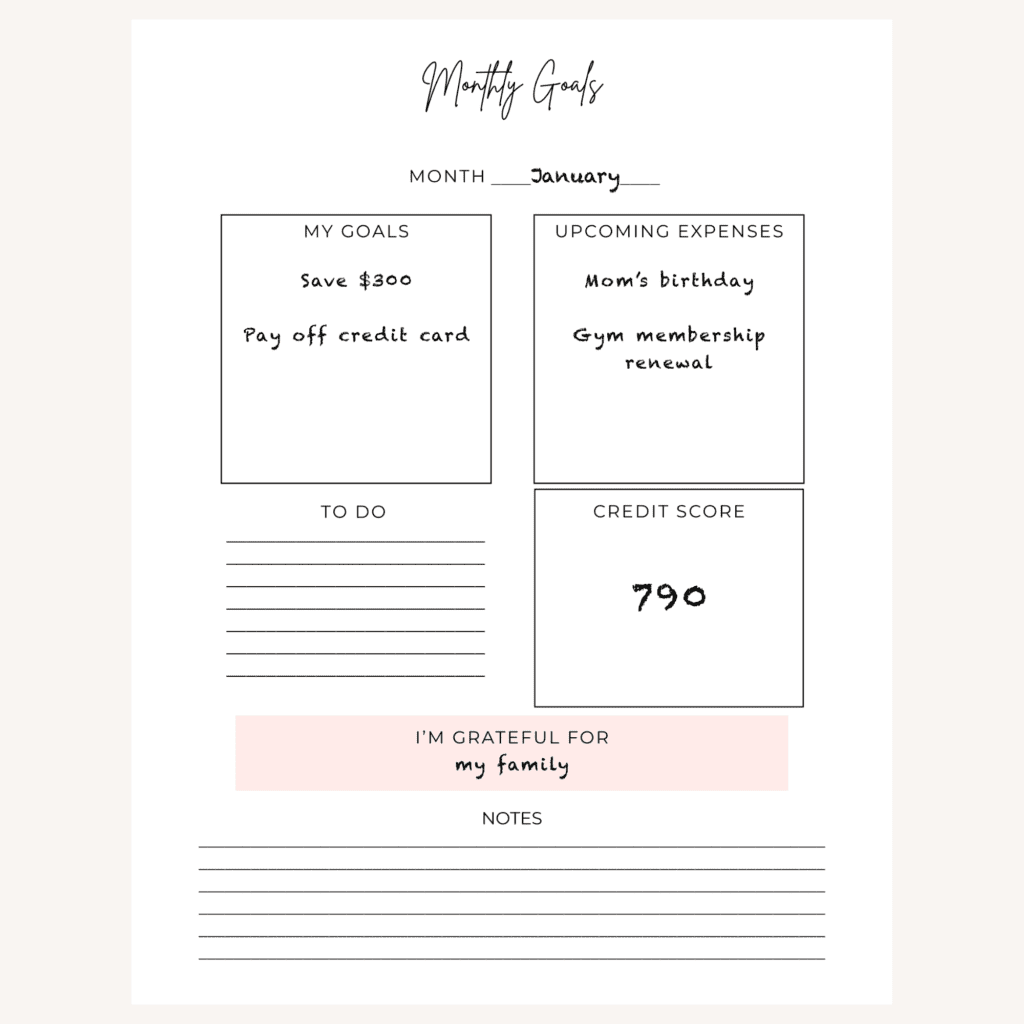

Monthly Goals

Two key parts of your budget will be motivation and accountability. This Monthly Goals page checks off both of these boxes for you.

Start the month by reminding yourself of your goals (why are you doing this?). These can be long-term or short-term goals.

Plan for any upcoming expenses for that month, like a birthday or a holiday. You will be prepared to spend a little extra on these things and can plan for them.

What would you like to get done in the next 30 days? Do you need to cancel a subscription, meet with your financial advisor, or even make a dentist appointment? Make sure you get everything done by putting them in the To Do section.

Check your credit score and write it down. Don’t be concerned by minor fluctuations in this number from month to month, but it is good to be aware of it.

Think of one thing you are grateful for this month, even if it’s just that you are able to make the minimum payments on a credit card.

Monthly Calendar

I don’t know about you, but I’m a visual person. If I have a place to see when payday and bill days are, it makes me feel so much more organized.

Feel free to use this calendar each month for any important dates. You can get creative and add some stickers, too.

Bill Reminder Sheet

One of the best feelings is knowing that you are ON TOP of your bills, all of the time. You’re never wondering if you paid your phone bill this month, or if you’re late on it this time.

This is one of my favourite pages for this reason! It’s so easy to use, too.

List your recurring monthly bills, and when you pay it, check off the corresponding monthly box. At the end of every month, check in and make sure you didn’t miss any. So easy and so helpful!

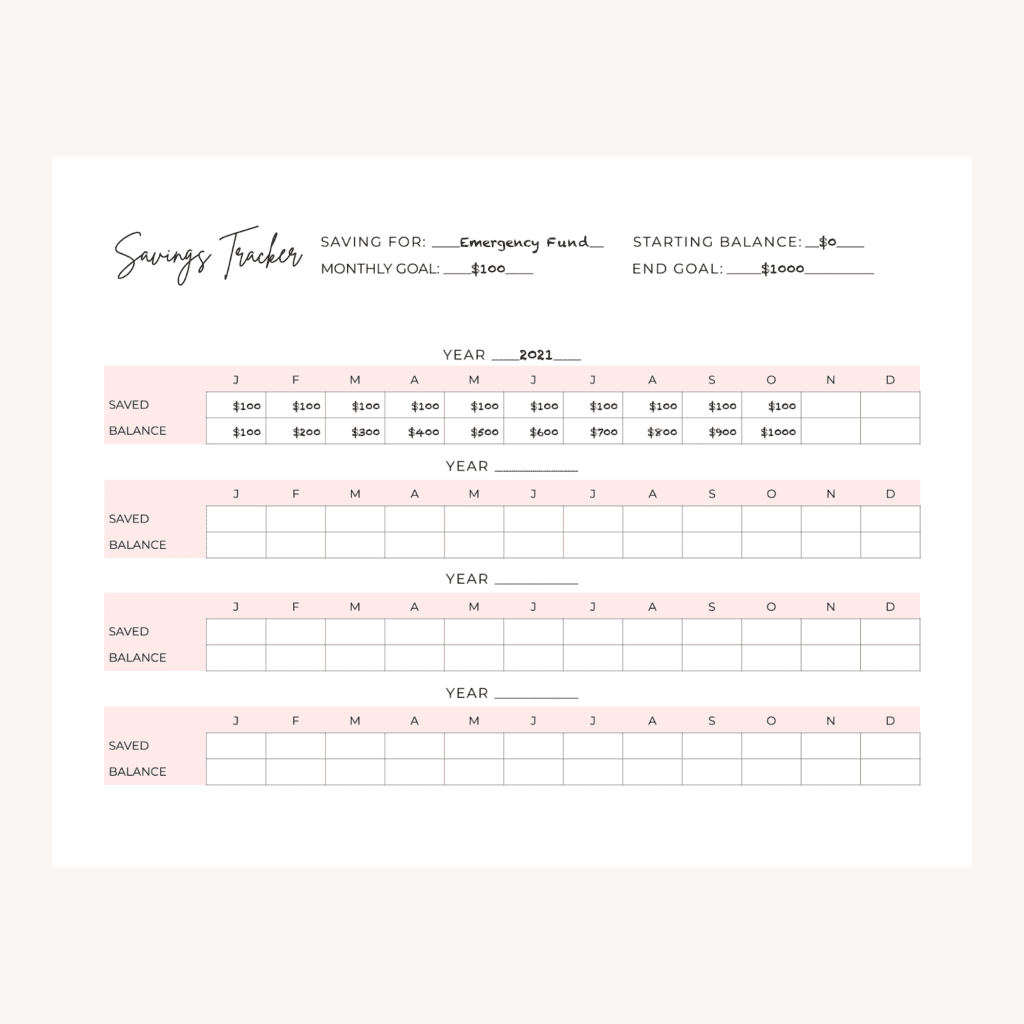

Savings Tracker

Back to me being a visual person- this savings tracker makes saving money very visually appealing.

Saving money sounds like a good idea, but it can be boring- why put money in your savings account when you could buy literally anything else in the world with that money?

I get it.

In order to save money, you need to know exactly why you want to save it- you need to be motivated to save it instead of spending it on something else.

So ask yourself, what are you saving for? What is your starting balance (have you already saved money for this)?

Write down how much you want to save for this every month, and how much money you want to have saved at the end.

Fill in the tracker with the monthly amount every month, followed by what your balance will be every time you save more.

I also like to fill each square in with a highlighter when I’m done, so I can see the progress I’m making.

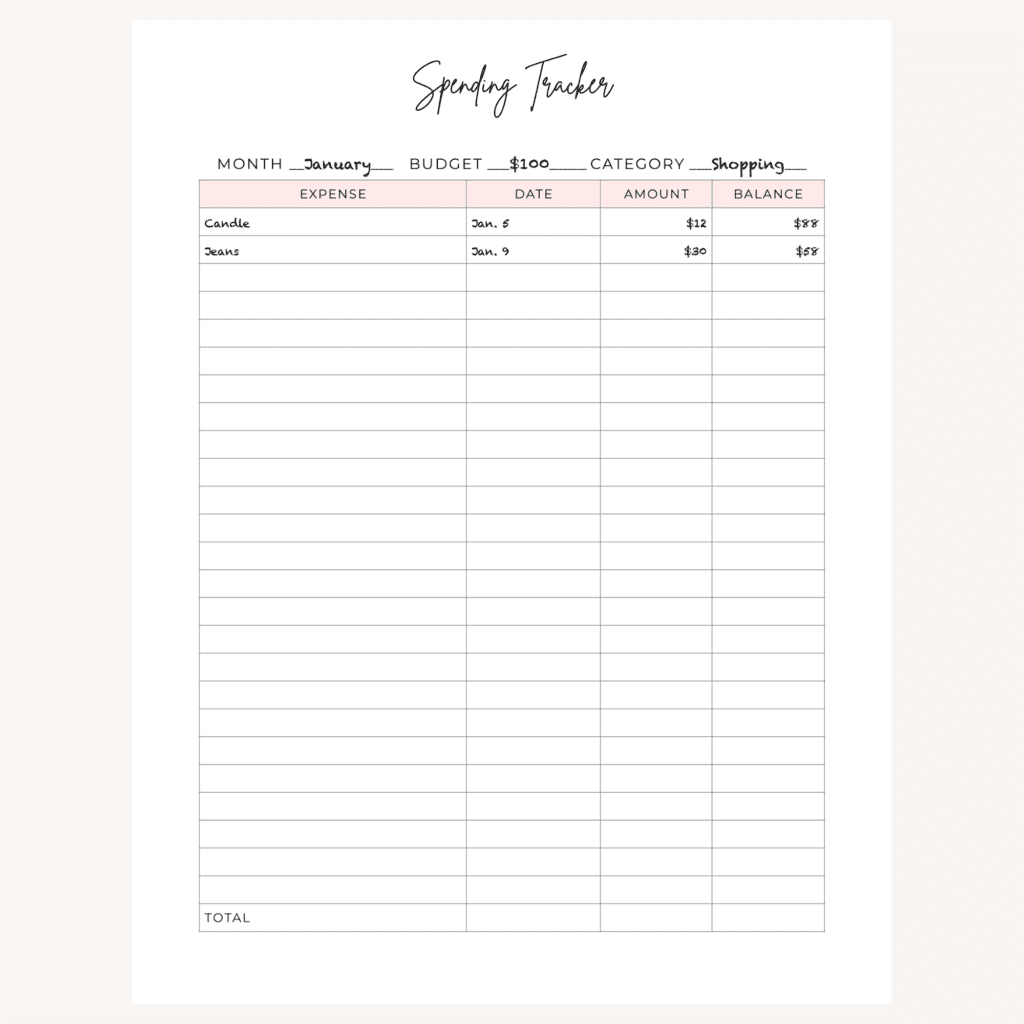

Spending Tracker

Want to know another reason reaching financial goals can be hard?

Over-spending. Specifically, mindless over-spending.

You think you only spend a little on eating out, but in reality, your 3 times a week $20 dinners is costing you over 200 bucks a month.

This Spending Tracker is easy to customize for different spending categories, like eating out or groceries (pssst- the bundle also includes trackers for eating out, groceries, gas, and shopping!).

You can determine the spending category and your budget for it that month. Then write down every time you spend money in this category, followed by how much is left now in your budget (the balance).

Subscriptions Tracker

If you don’t want to be caught off-guard by an annual subscription that you forgot about renewing, this one’s for you.

List each of your monthly, annual, and quarterly subscriptions (think apps on your phone, memberships, or subscription boxes), and the cost of each.

Here’s the important part- find out when each of these items renews, and record this renewal date. Then if you want to cancel it, you can do so on time.

Plus you get to see just how much money you spend a year on these things (you might decide to cancel a few).

Whew, thanks for sticking that one out! As you can see, each page can help you in so many ways.

And we only covered a handful- the Ultimate Budget Planner has over 50 pages!

As I mentioned, this is really something I put a lot of thought into, and I know you will love yours!

If you have any questions, know that I’m always here for you- leave a comment below, message me on Etsy, or shoot me an email here.

Happy Budgeting!

Greate articles. I am really impressed with your article. Some article is clearly read but others are not read. But it is greate.

obviously like your web-site but you have to test the spelling on several of your posts. A number of them are rife with spelling issues and I to find it very bothersome to inform the reality then again I?¦ll certainly come back again.

I like this site its a master peace ! Glad I noticed this on google .

Yay google is my king assisted me to find this outstanding website ! .

Have you ever considered using unconventional materials, like recycled materials or items from nature, to create a unique and eco-friendly budget binder at home? Share your creative ideas and tips for making a budget binder that not only helps you stay organized financially, but also aligns with your values of sustainability.”,

“refusal

Where can I get these sheets?

obviously like your web site but you have to check the spelling on quite a few of your posts. Several of them are rife with spelling problems and I in finding it very troublesome to inform the reality nevertheless I?¦ll certainly come back again.

Nice blog here! Also your site loads up fast! What host are you using? Can I get your affiliate link to your host? I wish my website loaded up as quickly as yours lol

I like the valuable info you provide in your articles. I will bookmark your weblog and check again here regularly. I’m quite sure I’ll learn a lot of new stuff right here! Best of luck for the next!

Hi, Neat post. There is a problem with your website in internet explorer, would test this… IE nonetheless is the marketplace leader and a good portion of folks will leave out your magnificent writing due to this problem.

There is clearly a bunch to know about this. I consider you made various good points in features also.

I am not rattling superb with English but I come up this real leisurely to read .

Hmm it appears like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to everything. Do you have any points for rookie blog writers? I’d genuinely appreciate it.

I really enjoy studying on this internet site, it has wonderful posts. “Sometime they’ll give a war and nobody will come.” by Carl Sandburg.

Absolutely indited subject matter, thanks for entropy.

Lovely just what I was searching for.Thanks to the author for taking his clock time on this one.

I believe this site has got some rattling fantastic info for everyone :D. “A friend might well be reckoned the masterpiece of nature.” by Ralph Waldo Emerson.

I got what you mean , regards for posting.Woh I am delighted to find this website through google. “Since the Exodus, freedom has always spoken with a Hebrew accent.” by Heinrich Heine.

Thanks for a marvelous posting! I definitely enjoyed reading

it, you can be a great author.I will ensure that I bookmark your blog and will eventually come back later in life.

I want to encourage yourself to continue your great job, have a nice

afternoon! https://menbehealth.wordpress.com/

Very interesting info !Perfect just what I was looking for! “I have great faith in fools — self confidence my friends call it.” by Edgar Allan Poe.

I am forever thought about this, appreciate it for putting up.

hello!,I like your writing so much! share we communicate more about your post on AOL? I need an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

It?¦s in point of fact a great and useful piece of information. I?¦m satisfied that you simply shared this useful info with us. Please stay us up to date like this. Thank you for sharing.

I simply could not go away your site prior to suggesting that I really loved the standard info an individual supply for your visitors? Is gonna be back frequently to check out new posts

Nice post. I was checking constantly this blog and I am impressed! Extremely useful information specially the final part 🙂 I take care of such information much. I was looking for this particular info for a very lengthy time. Thank you and best of luck.

achat kamagra: livraison discrète Kamagra – commander Kamagra en ligne