This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Sometimes, I love getting a second opinion.

Which colour shirt looks best on me?

Should I actually take the plunge and get more than a trim at the salon?

Sometimes there are just too many options to pick from. And sometimes I’m not confident in my ability to make the right decision.

After I talk it over with a friend, I feel better about it.

When it comes to your money, though, it’s really important to start to feel confident in your own decisions.

You will be the one who needs your retirement savings someday- no one else will!

You will be debt free and feeling financially comfortable, because that’s your goal. Your friends may not share the same goals, and that’s okay.

If you’ve been trying to budget, save more money, or pay off debt- and are getting some puzzling looks from your friends- here’s some things to keep in mind.

Your Finances are Super Personal

As you’ve probably noticed, finances aren’t a dinner table topic yet. We are often quite private when it comes to our money issues. Although it would be nice if the dialogue opened up more someday, we’re not there yet.

You probably don’t know that much about your friends’ financial situations, because they’re not talking about it very much. Likewise, they probably don’t know your situation very well, either.

Personal finances can be so complex. It’s so much more than how much money someone makes. How much does their salary fluctuate year to year? What are their expenses? What are their personal savings? Retirement savings? How much debt do they have, and how well are they managing it?

I think this is an important topic because we live in a consumerist society.

When someone is shopping or trying to keep up with the Jones’, it feels like thats what we’re supposed to do as we progress in life. You become more successful, you make more money, and then you spend more money.

But if you’re trying to live a life of financial freedom and escape debt and overspending- well, you’re not the norm! You may feel like you’re being judged by others in the process.

Why can’t you go out to dinner tonight? You already declined last week.

Remind yourself that they might not be fully aware of your situation, and that you probably know what is best for your budget.

Also remember that there a ton of free or low-cost activities you can recommend instead, like going for a walk, getting a coffee, or having a movie night in.

Don’t Feel Pressured to Over-Share About Your Finances, Either

You should absolutely be transparent with your friends and family if you are working on a financial goal right now.

If you’ve been working overtime to be debt-free, you can give them a heads up. Especially if you were okay going shopping with them before, and your attitude towards money has since changed.

It doesn’t mean they need to copy exactly what you’re doing. But maybe they’ll be more open to grabbing a coffee vs. going to the mall and spending the day shopping.

Keep these conversations within your comfort level. It’s not necessary to share specific numbers or details in order to be more open about money.

I tell people I’m paying off my student loans and I’m not going to be buying any extras at the moment. I’ve gotten some confused looks, especially when it’s something small like going out for lunch- but usually people are still understanding.

It’s Good to Practice Feeling Empowered about your Money

This brings me to an important point.

You are the most familiar with your money situation, and you know it best.

It doesn’t matter if you’ve made a million and one mistakes with your finances before. Honestly, this can be the best way to learn what you don’t want from your money.

After living with hefty student loan payments for years, I knew that I don’t want to owe people money for the rest of my life.

Once you have made a money decision, stand firm! Even if you don’t have all of the answers yet yourself.

Keep learning and educating yourself.

You will always be your best advocate!

You are also the only one who has to live with your choices- so it doesn’t matter if your choice isn’t a popular one.

Budgeting in real life can be hard- but it gets easier the longer you practice!

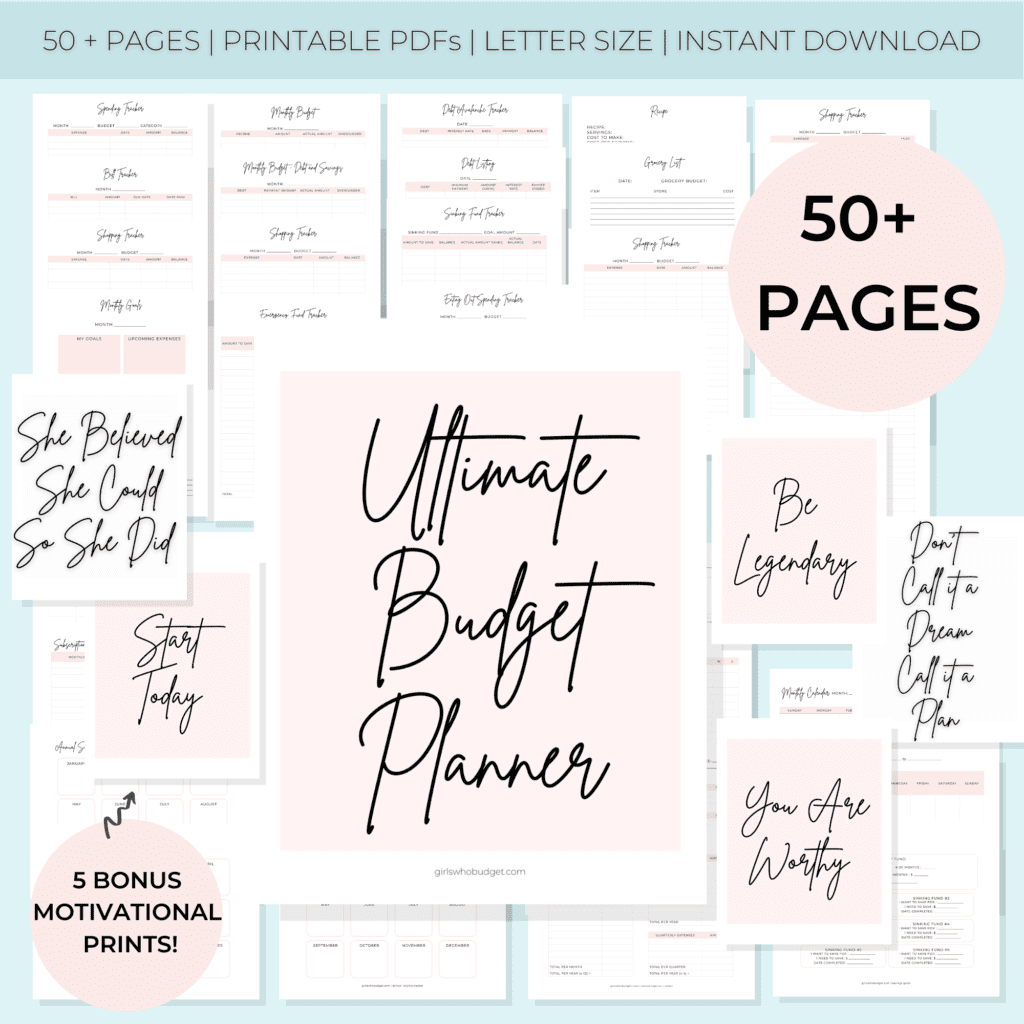

If you want to make budgeting a whole lot easier, we have an Ultimate Budget Planner system for you- 50+ printables that cover your monthly budget, bills, expenses, goals, savings, meal planning, and more!

Related Posts: