This site contains affiliate links to products. I may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read my disclaimers page for more information.

What is a zero-based budget?

A zero-based budget is a budget where your income minus your expenses equals zero- in other words, you’re making a plan for every dollar that you make.

Your total expenses will equal your total income.

Total Expenses = Total Income

With zero-based budgeting, you’ll be budgeting for everything that you spend money on. This helps prevent overspending (your expenses being more than your income) and going into debt.

It’s great because you can make sure you’re putting money towards your goals first, then you can budget the rest of it for your other spending (like online shopping or eating out). So if you’re worried that this type of budgeting sounds restrictive, it actually takes away a lot of money stress!

You can spend money on things you enjoy while knowing that you’re still taking care of your goals.

Why should you use zero-based budgeting?

Zero-based budgeting is a very effective way to budget because you’re putting all of your money to work for you.

Instead of money being mindlessly spent, you can budget for things like shopping or entertainment- while putting as much as possible towards your goals!

You also won’t forget to put money in savings or to make an extra payment on your debt- it will already be a part of your plan.

How can zero-based budgeting help you pay off debt or save money?

Following a zero-based budget means you already have a plan for saving your money or paying off your debt.

Plus, you’ll know that even after taking care of your savings and debt, you’re still covering all of your other expenses.

Your finances won’t feel as confusing anymore- you’ll know exactly how much is being spent in every area of your budget!

How to Make Your Zero-Based Budget

Ready to put your budget together? You can use a spreadsheet, a printable template, or a sheet of paper. The important thing is having your plan laid out somewhere!

I’m a big fan of using a spreadsheet for my budget, and here’s why:

-All of the calculations are done for you (if you’ve ever sat down and added up every single one of your expenses, you’ll know how much time this can save you!)

-With a zero-based budget, you can instantly see how much money is left to work with as you make your budget

-It’s easy to change your budget as you go

-You can simply make a new copy for every new budget, without needing to rewrite the same budget categories every time

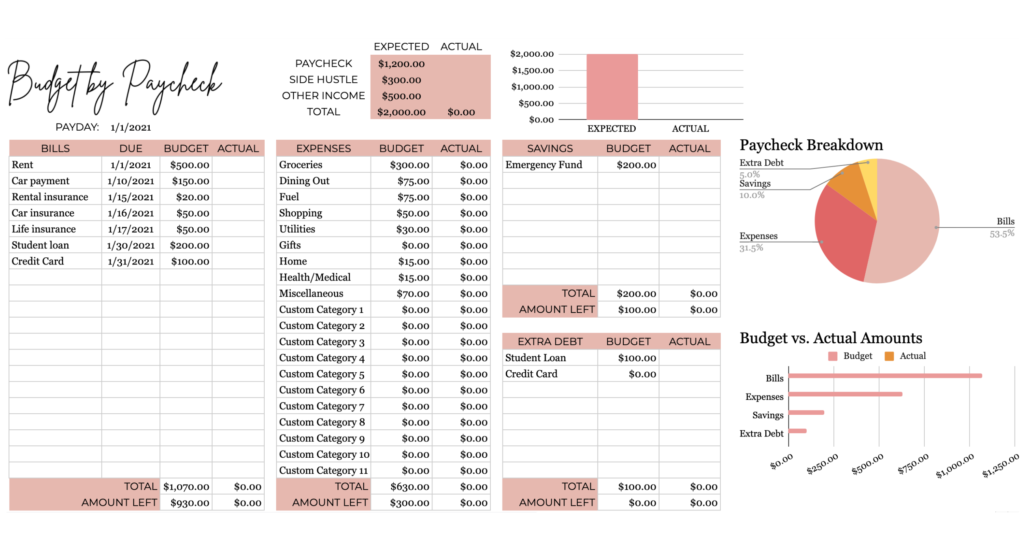

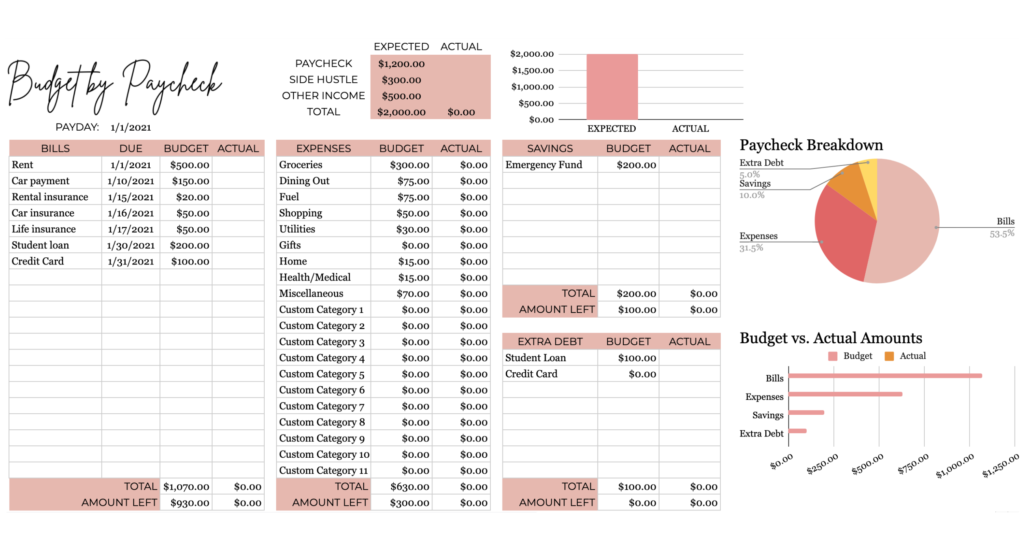

To show you exactly how to follow a zero based budget, I’m going to use our best-selling budget spreadsheet as an example. This Budget by Paycheck spreadsheet is perfect for a zero-based budget because it lets you know how much money is left to work with as you plan your budget.

Prefer to budget on a monthly basis instead? You can also follow along with our Monthly Budget template– it’s also zero-based budget friendly 🙂

If you’re not sure if you should budget by paycheck or by month, check out this post here on the Budget by Paycheck method. Keep in mind that this is a personal choice, and as long as you have a budget, you’re on the right track.

Example of a zero-based budget

Here is an example zero-based budget:

What to include in your budget:

There are five basic categories you should include in any budget:

Income – this is how much money you have to spend, and includes your regular paycheck, income from side hustles, one-time payments like bonuses or tax returns, etc.

Bills – these are your recurring payments, like your rent, minimum payment on a credit card, car payment, insurance, phone bill, internet bill, etc.

Variable Expenses – also known as your spending- these are the amounts that can change from budget to budget, like groceries, dining out, shopping, medical expenses, etc.

Savings – include regular savings contributions in your budget. If it is in your plan, you are much more likely to make it a habit!

Extra Debt Payments – If you have money leftover to pay off your debt (this is above and beyond the minimum payment that you have to make), include this in your budget so you can become debt-free faster.

How much to spend in each area of your budget:

It is difficult to say exactly how much you should spend in each budget category- this is because budgeting is personal! Even if two people make the exact same amount of money, they probably have different amounts of debt or savings goals.

That being said, there are a few rough guidelines to keep in mind when making a budget. Let’s use our example zero-based budget again:

• Housing (rent/mortgage payment) should be no more than 25% of your budget

• As a guideline, no more than 10% of your budget should be spent on insurance

• Food or groceries should not exceed 15% of your income

• Aim to save 10-15% of your income. Just remember that paying your bills on time and buying necessities like food and utilities should be prioritized before saving money! If you are in debt, you can also focus on this before saving money (remember to save an emergency fund first, however- even if it is just $1000 until you are debt-free. You can learn more about emergency funds here). Don’t sacrifice other important goals just to try and save as much money as possible.

You can read more about budget percentages (and download a free list of over 90 budget categories) here.

Now, let’s walk through the steps to making a zero-based budget!

Step 1: List your expected income

Start by listing your expected income for your paycheck, as well as any side hustles or extra income sources you have.

Step 2: Enter your monthly bills

Record the monthly bills you need to cover with this paycheck. These are the recurring expenses you have that are (usually) the same amount each time.

Examples of bills are:

Rent

Car payment

Car insurance

Credit card minimum payment

Student loan minimum payment

Monthly bus pass

Netflix

Monthly gym membership

Phone

Internet

We will start with these expenses since we know we need to cover them, no matter what.

It is also important to list the due date for each bill so you can pay them on time.

Are you not sure which bills to cover with each paycheck? The easiest solution is to have a monthly calendar for your bills and your paydays.

Each time you get paid, check to see what bills are due between now and your next paycheck.

You can also color-code your paydays and bills so you know what bills go with what payday.

For example, your first payday of the month is pink, and any bills that need to be paid with it will also be pink on your calendar.

Your second payday of the month is green, and all of the remaining bills that month will also be green. This color-coding system makes it easy to see which bills need to be paid each payday.

If you want to take your bill organization to the next level, try our Bill Tracker spreadsheet (available in Google Sheets and in Excel). It’s an effortless system to keep on top of your monthly, quarterly, and annual bills- so you’re never late on a bill again.

Step 3: Budget for variable expenses

Once you know what bills you need to pay, it’s time to cover your variable expenses. Consider this the spending category of your budget.

Variable expenses are costs that will change with each budget, like groceries, eating out, and fuel for your car. The amounts you will spend in these areas will change based on your spending habits.

Other examples of variable expenses are:

Shopping

Utilities, like electricity

Home purchases, like cleaning products or decor

Gifts

Health/medical expenses

The tricky part with variable expenses is knowing how much you might spend.

Start by looking at your bank and credit card statements for the last 30 days to see how much you spent in each category (ie. groceries, eating out, shopping).

If you get paid twice a month, cut the amount for the last 30 days in half- this is how much you can (roughly) expect to spend per paycheck.

P.S. here’s a list of budget categories (and a guide on how much to spend) to get you started.

If this is the first time you’re looking at these amounts and you’re shocked by how much you spent- you’re not alone!

Adding up your expenses for the first time is an eye-opening experience, but don’t get discouraged and walk away! You don’t need to have a strict budget- you’ll actually want your budget to be a realistic portrayal of your spending habits.

When your budget is realistic, you can easily fit in things like savings and debt repayments on a regular basis. Even if you can only afford to save a small amount- you’ll be able to plan for it and save it consistently.

If you want to cut back on your grocery spending, for example, try to spend just a bit less next time- like 10-15% less than before. If you try to cut it in half and you fail, you’ll end up feeling like you suck at budgeting and you’ll want to give up.

When I first started budgeting, I did more of my grocery shopping at bulk stores and even at the dollar store. I froze food before it expired, and I ate leftovers for lunch the next day.

As time went on, I learned what foods I actually ate (and didn’t let go to waste), and what my favourite cheap meals to make were.

Try 5 Dollar Meal Plan if you want a head start on making affordable, healthy recipes at home. 5 Dollar Meal Plan is a meal planning service that sends you low-cost recipes and shopping lists for 5 dollars a month. It’s a really convenient way to start saving money on your groceries!

Please also keep in mind that your budget should help you to consistently put money towards your goals, like saving money and paying off debt.

As long as you’re consistently adding to your savings account or putting extra payments on your debt, you’ll keep moving in the right direction.

So if you spend a lot on putting fuel in your car to get to work, but you’re always including extra credit card payments in your budget, that’s 100% okay! You are still working towards your goals, and that’s the most important part of any budget.

Step 4: Include savings contributions

Make sure to include savings in your budget! If you plan to put money in your savings account, you’ll be more likely to make it a habit.

There are three types of savings you should have:

• Emergency fund, for unexpected expenses, like losing your job. Save 3-6 months worth of living expenses here.

• Sinking funds for planned purchases, like a vacation

• Retirement savings

Start by focusing on building up your emergency fund– once you are ready for a financial emergency, you can start to focus on saving up for other things.

If you are in debt, you should save an emergency fund before paying it off. This stops you from using your credit card when something unexpected happens.

Since it can take time to save 3-6 months worth of living expenses, you can start with a smaller amount (like $1000) until you’re out of debt.

Note: if you have saved your emergency fund and are paying off debt, it’s okay to not put anything under savings in your budget. It’s also okay to put money in a sinking fund (ie. a planned purchase like a laptop you need to replace soon) while you’re paying off debt- this means you’re not going further in debt to buy what you want, which is a win!

Step 5: Plan for any extra payments on your debt

The minimum payments for your debt should be listed under “Bills”, since this is a regular, recurring expense for you.

If there is extra money leftover to put extra payments on your debt, write this into your budget, too.

If you’re ready to start paying off your debt, check out these posts:

How to Use the Debt Snowball Method to Crush Your Debt

Exactly How to Start Your Debt-Free Journey

Step 6: Track your spending

Once you have made your budget, it’s time to start tracking your money!

When you get paid, write down the actual amount you get paid.

Start by paying the bills you need to cover with that paycheck.

As you spend your money, add up your spending in each expense category (ie. groceries and fuel). If you are using our Budget by Paycheck spreadsheet, you’ll have access to an Expense Tracker that adds up all of your spending for you, by expense category (this has been a LIFE SAVER for me in keeping track of my budget!).

The final step is adding money to your savings and making any extra debt payments. If you are new to following a budget, I recommend waiting for your next paycheck and seeing how much money is left before adding money to savings or debt. This ensures you won’t over-spend in these areas and run out of money for necessities like food.

Zero-based Budgeting FAQs:

I still have money leftover in my budget- I’ve already budgeted for bills, expenses, savings and debt. What do I do?

Ask yourself this: what is my biggest financial goal right now?

If it’s to save money, add extra money to your savings.

If it’s to get out of debt, add more money to your debt payments.

You can also add a “miscellaneous” spending category to your expenses to cover any extra spending you might have. Just try to avoid putting a large amount of money here, since that money could be better used for savings for debt.

Help! My expenses are actually more than my income, what should I do next?

If this is you, know that you’re not alone! This is how many of us end up getting in debt- we are spending more than we make.

The good news is that you have made a budget, so you can quickly make a plan to fix it.

Start by reviewing your monthly bills- highlight the ones you can cancel, and the ones you can lower by negotiating a lower rate or changing to a cheaper plan.

The next step is to look at your variable expenses. Where are you spending the most money? Food and transportation tend to be the largest expenses, so start by focusing on these areas.

Another option is to increase your income, by starting a side hustle or second job- you can also work more hours at your current job or negotiate a raise.

Where should you keep your zero based budget plan?

In this example, I used a spreadsheet (available in both Google Sheets and Excel) for a zero-based budget. Spreadsheets are perfect if you’re making a budget for the first time, because you can easily make changes to the numbers until your income – expenses equals zero!

If you’re not comfortable with technology and prefer to use a pen, paper, and calculator, that is also completely fine!

This is your budget, so make one that works for you- don’t worry about what might work for someone else.

Zero-Based Budgeting Resources

Here’s our most popular zero-based budget templates (our top sellers that have been downloaded hundreds of times!)

Budget by Paycheck Spreadsheet (used for the example budget in this post) (in Google Sheets and Excel)

Ultimate Budget by Paycheck Spreadsheet (our best-selling Budget by Paycheck spreadsheet, plus a monthly bill calendar, sinking funds tracker, and a debt snowball calculator!) (in Google Sheets and Excel)

Budget by Paycheck Printable Template

Monthly Budget Spreadsheet (in Google Sheets and Excel)

Here are some helpful budgeting resources to help you master your money:

aBLAjwfE

TZqweIvNSykc

TvpwzNEZjBSds

Whats up very cool blog!! Guy .. Beautiful .. Amazing .. I will bookmark your site and take the feeds also…I’m happy to seek out a lot of helpful information here within the submit, we want develop more techniques on this regard, thank you for sharing.

Heya i’m for the primary time here. I found this board and I to find It truly helpful & it helped me out much. I’m hoping to present one thing back and aid others such as you aided me.

xi4jpp

There is evidently a bundle to identify about this. I feel you made certain nice points in features also.

Thank you for all of your effort on this site. Ellie enjoys making time for internet research and it is easy to understand why. Almost all know all of the lively means you produce rewarding thoughts by means of the blog and as well as boost contribution from people on the theme while my simple princess is really learning a whole lot. Have fun with the remaining portion of the new year. You’re the one performing a glorious job.

7qw2hd

Wonderful beat ! I wish to apprentice while you amend your website, how could i subscribe for a blog site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear idea

I am really impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the nice quality writing, it’s rare to see a great blog like this one today..

Hey, you used to write magnificent, but the last few posts have been kinda boringK I miss your super writings. Past several posts are just a bit out of track! come on!

Hello, you used to write magnificent, but the last several posts have been kinda boring?K I miss your super writings. Past few posts are just a bit out of track! come on!

Only a smiling visitant here to share the love (:, btw great style. “Reading well is one of the great pleasures that solitude can afford you.” by Harold Bloom.

I conceive other website owners should take this site as an model, very clean and excellent user friendly design.

After study a few of the blog posts on your website now, and I truly like your way of blogging. I bookmarked it to my bookmark website list and will be checking back soon. Pls check out my web site as well and let me know what you think.

Real nice layout and wonderful written content, very little else we want : D.

We stumbled over here different page and thought I might as well check things out. I like what I see so i am just following you. Look forward to looking at your web page yet again.

I would like to thank you for the efforts you have put in writing this site. I am hoping the same high-grade website post from you in the upcoming as well. Actually your creative writing skills has encouraged me to get my own site now. Really the blogging is spreading its wings rapidly. Your write up is a good example of it.

bub0lz

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 sure. Any recommendations or advice would be greatly appreciated. Appreciate it

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

I¦ve recently started a blog, the info you provide on this website has helped me tremendously. Thank you for all of your time & work.

pdspnp

Hey there! This is my first visit to your blog! We are a team of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a marvellous job!

I have been exploring for a little bit for any high-quality articles or weblog posts in this kind of house . Exploring in Yahoo I finally stumbled upon this web site. Reading this info So i am satisfied to express that I’ve an incredibly just right uncanny feeling I came upon just what I needed. I so much certainly will make certain to don’t fail to remember this site and provides it a glance on a constant basis.

obviously like your web site but you need to check the spelling on several of your posts. Several of them are rife with spelling issues and I find it very bothersome to tell the truth nevertheless I will definitely come back again.

It is actually a great and helpful piece of info. I am satisfied that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

Great blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog jump out. Please let me know where you got your theme. Cheers

I¦ll immediately snatch your rss as I can not find your e-mail subscription link or newsletter service. Do you have any? Kindly let me recognize in order that I could subscribe. Thanks.

I¦ve recently started a blog, the info you provide on this site has helped me tremendously. Thanks for all of your time & work.

I am glad to be one of several visitors on this outstanding site (:, thankyou for putting up.

Hello my family member! I want to say that this article is amazing, nice written and include approximately all important infos. I¦d like to look more posts like this .

I’d should check with you here. Which is not something I often do! I get pleasure from studying a publish that can make folks think. Also, thanks for allowing me to remark!

I went over this internet site and I believe you have a lot of fantastic info, saved to favorites (:.

After examine a couple of of the blog posts in your website now, and I truly like your means of blogging. I bookmarked it to my bookmark website checklist and shall be checking again soon. Pls take a look at my web site as properly and let me know what you think.

It is in point of fact a great and useful piece of info. I am happy that you shared this useful information with us. Please stay us informed like this. Thanks for sharing.

Hello there! Do you use Twitter? I’d like to follow you if that would be okay. I’m undoubtedly enjoying your blog and look forward to new posts.

a2k60c

You made some clear points there. I did a search on the topic and found most guys will go along with with your site.

I was just searching for this information for a while. After six hours of continuous Googleing, finally I got it in your web site. I wonder what’s the lack of Google strategy that don’t rank this type of informative sites in top of the list. Usually the top sites are full of garbage.

Loving the information on this web site, you have done outstanding job on the blog posts.

I like what you guys are up also. Such intelligent work and reporting! Carry on the superb works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

Some genuinely quality articles on this website , saved to bookmarks.

Thankyou for this grand post, I am glad I found this website on yahoo.

I am impressed with this website , real I am a big fan .

hello!,I like your writing very much! share we communicate more about your article on AOL? I require an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

obviously like your web site but you need to check the spelling on quite a few of your posts. Several of them are rife with spelling problems and I find it very troublesome to tell the truth however I will definitely come back again.

I simply couldn’t depart your website before suggesting that I really enjoyed the usual info a person supply for your guests? Is going to be again continuously in order to inspect new posts.

You made some nice points there. I did a search on the topic and found most individuals will approve with your blog.

What i do not understood is actually how you are not actually much more well-liked than you may be now. You are so intelligent. You realize thus significantly relating to this subject, produced me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it’s one thing to do with Lady gaga! Your own stuffs great. Always maintain it up!

I really appreciate your work, Great post.

Great post and straight to the point. I am not sure if this is really the best place to ask but do you people have any thoughts on where to employ some professional writers? Thanks in advance 🙂

Absolutely composed subject matter, regards for selective information. “He who establishes his argument by noise and command shows that his reason is weak.” by Michel de Montaigne.

Have you ever thought about writing an e-book or guest authoring on other websites? I have a blog based upon on the same subjects you discuss and would love to have you share some stories/information. I know my viewers would value your work. If you are even remotely interested, feel free to send me an e mail.

With havin so much content do you ever run into any problems of plagorism or copyright infringement? My site has a lot of completely unique content I’ve either authored myself or outsourced but it seems a lot of it is popping it up all over the web without my agreement. Do you know any solutions to help stop content from being stolen? I’d definitely appreciate it.

My coder is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the costs. But he’s tryiong none the less. I’ve been using Movable-type on a number of websites for about a year and am worried about switching to another platform. I have heard very good things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be greatly appreciated!

Keep working ,fantastic job!

Outstanding post, you have pointed out some wonderful points, I also believe this s a very superb website.

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

Howdy! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us beneficial information to work on. You have done a extraordinary job!

Awsome post and right to the point. I am not sure if this is actually the best place to ask but do you guys have any ideea where to employ some professional writers? Thanks 🙂

I like what you guys are up also. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my site 🙂

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! However, how could we communicate?

I have been exploring for a bit for any high-quality articles or blog posts in this sort of space . Exploring in Yahoo I finally stumbled upon this web site. Reading this info So i am satisfied to express that I’ve an incredibly excellent uncanny feeling I discovered just what I needed. I so much surely will make certain to do not forget this web site and provides it a look on a constant basis.

Very interesting points you have remarked, thanks for posting.

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

I like what you guys are up too. Such smart work and reporting! Carry on the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my website 🙂

That is very interesting, You’re a very professional blogger. I’ve joined your feed and stay up for in search of more of your excellent post. Additionally, I’ve shared your site in my social networks!

Well I really liked reading it. This information procured by you is very effective for proper planning.

excellent points altogether, you simply gained a new reader. What would you suggest about your post that you made some days ago? Any positive?

I have been surfing online greater than three hours as of late, yet I never discovered any interesting article like yours. It is beautiful price sufficient for me. In my view, if all web owners and bloggers made excellent content as you probably did, the web will probably be a lot more useful than ever before. “I thank God for my handicaps, for through them, I have found myself, my work and my God.” by Hellen Keller.

Woh I enjoy your blog posts, saved to fav! .

I do love the manner in which you have framed this issue plus it does indeed supply me some fodder for consideration. However, because of just what I have experienced, I really trust when the actual remarks pack on that people remain on issue and don’t start on a soap box regarding the news du jour. Yet, thank you for this excellent piece and whilst I do not necessarily agree with it in totality, I value the perspective.

My brother suggested I might like this blog. He was entirely right. This publish truly made my day. You can not imagine simply how a lot time I had spent for this information! Thanks!

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

I love it when people come together and share opinions, great blog, keep it up.

Keep functioning ,fantastic job!

Thank you for the auspicious writeup. It in truth used to be a leisure account it. Look complex to more introduced agreeable from you! By the way, how could we communicate?

Hello.This post was extremely interesting, especially because I was looking for thoughts on this subject last Thursday.

Purdentix review

Purdentix reviews

Purdentix review

Real fantastic info can be found on web blog. “Life without a friend is death without a witness.” by Eugene Benge.

Purdentix review

Purdentix

Purdentix

What i don’t understood is if truth be told how you are no longer actually much more smartly-favored than you may be now. You’re very intelligent. You understand therefore considerably with regards to this matter, produced me personally imagine it from a lot of varied angles. Its like men and women don’t seem to be involved unless it’s one thing to accomplish with Woman gaga! Your individual stuffs outstanding. At all times maintain it up!

Purdentix

Purdentix

Purdentix reviews

This website is amazing, with a clean design and easy navigation.

I love how user-friendly and intuitive everything feels.

This website is amazing, with a clean design and easy navigation.

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

I’m really impressed by the speed and responsiveness.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

It provides an excellent user experience from start to finish.

This site truly stands out as a great example of quality web design and performance.

The layout is visually appealing and very functional.

The layout is visually appealing and very functional.

I’m really impressed by the speed and responsiveness.

It?¦s really a cool and useful piece of information. I am happy that you simply shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

This site truly stands out as a great example of quality web design and performance.

The design and usability are top-notch, making everything flow smoothly.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

Perfectly written written content, Really enjoyed reading through.

I like this weblog so much, saved to my bookmarks. “American soldiers must be turned into lambs and eating them is tolerated.” by Muammar Qaddafi.

The content is engaging and well-structured, keeping visitors interested.

Excellent goods from you, man. I have consider your stuff previous to and you’re simply too great. I really like what you’ve bought right here, certainly like what you’re saying and the way in which wherein you assert it. You’re making it entertaining and you continue to care for to stay it wise. I cant wait to learn much more from you. That is actually a wonderful web site.

I love how user-friendly and intuitive everything feels.

It provides an excellent user experience from start to finish.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Hi! I know this is kind of off topic but I was wondering if you knew where I could locate a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m having difficulty finding one? Thanks a lot!

It’s hard to find educated individuals on this topic, but you sound like you know what you’re talking about! Thanks

I’m not that much of a internet reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later. Cheers

Great website! I am loving it!! Will come back again. I am bookmarking your feeds also.

The content is well-organized and highly informative.

Does your website have a contact page? I’m having trouble locating it but, I’d like to shoot you an email. I’ve got some creative ideas for your blog you might be interested in hearing. Either way, great blog and I look forward to seeing it expand over time.

The content is well-organized and highly informative.

I love how user-friendly and intuitive everything feels.

The design and usability are top-notch, making everything flow smoothly.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

AQUA SCULPT REVIEW

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

I’m still learning from you, while I’m trying to reach my goals. I certainly enjoy reading everything that is posted on your website.Keep the information coming. I loved it!

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

The layout is visually appealing and very functional.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

I love how user-friendly and intuitive everything feels.

The design and usability are top-notch, making everything flow smoothly.

The content is engaging and well-structured, keeping visitors interested.

I saw a lot of website but I think this one holds something extra in it in it

A perfect blend of aesthetics and functionality makes browsing a pleasure.

It provides an excellent user experience from start to finish.

I’m really impressed by the speed and responsiveness.

I dugg some of you post as I cerebrated they were very helpful handy

This website is amazing, with a clean design and easy navigation.

I see something truly interesting about your website so I saved to my bookmarks.

The layout is visually appealing and very functional.

The content is engaging and well-structured, keeping visitors interested.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Absolutely written subject matter, appreciate it for information. “The last time I saw him he was walking down Lover’s Lane holding his own hand.” by Fred Allen.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

The layout is visually appealing and very functional.

It provides an excellent user experience from start to finish.

The content is well-organized and highly informative.

The content is well-organized and highly informative.

I love how user-friendly and intuitive everything feels.

I keep listening to the reports lecture about getting free online grant applications so I have been looking around for the best site to get one. Could you advise me please, where could i find some?

It provides an excellent user experience from start to finish.

Only wanna input that you have a very decent web site, I love the pattern it really stands out.

But a smiling visitor here to share the love (:, btw outstanding design.

I love how user-friendly and intuitive everything feels.

ICE WATER HACK

The layout is visually appealing and very functional.

Howdy this is kind of of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding expertise so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

Thanks for sharing excellent informations. Your web site is so cool. I am impressed by the details that you have on this website. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my pal, ROCK! I found just the info I already searched all over the place and just could not come across. What an ideal website.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Very interesting topic, thankyou for posting.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Great amazing things here. I am very satisfied to see your article. Thank you so much and i’m taking a look ahead to contact you. Will you kindly drop me a e-mail?

It provides an excellent user experience from start to finish.

This site truly stands out as a great example of quality web design and performance.

I like what you guys are up also. Such intelligent work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my web site :).

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

The content is well-organized and highly informative.

Of course, what a splendid blog and instructive posts, I definitely will bookmark your blog.Best Regards!

I’m really impressed by the speed and responsiveness.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Great write-up, I’m normal visitor of one’s blog, maintain up the nice operate, and It’s going to be a regular visitor for a lengthy time.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

I have to express my affection for your kindness giving support to men who really want assistance with that content. Your personal dedication to getting the solution around turned out to be particularly useful and has frequently empowered individuals much like me to attain their targets. Your personal useful report indicates so much to me and additionally to my peers. Regards; from each one of us.

I love how user-friendly and intuitive everything feels.

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

The Genius Wave Reviews

Java Burn Reviews

Gluco6 Reviews

This website is amazing, with a clean design and easy navigation.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Hello, you used to write great, but the last few posts have been kinda boring… I miss your super writings. Past several posts are just a bit out of track! come on!

I love your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz answer back as I’m looking to construct my own blog and would like to know where u got this from. thanks

Hello. magnificent job. I did not imagine this. This is a impressive story. Thanks!

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

AI is evolving so fast! I can’t wait to see how it transforms our daily lives in the next decade. The possibilities are endless, from automation to medical advancements.

You actually make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand. It seems too complex and very broad for me. I’m looking forward for your next post, I will try to get the hang of it!

I truly appreciate this post. I¦ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thanks again

Every expert was once a beginner. Keep pushing forward, and one day, you’ll look back and see how far you’ve come. Progress is always happening, even when it doesn’t feel like it.

Christopher Nolan’s storytelling is always mind-blowing. Every movie feels like a masterpiece, and the way he plays with time and perception is just genius.

I don’t unremarkably comment but I gotta say thanks for the post on this one : D.

I would like to show thanks to this writer for bailing me out of this particular circumstance. Because of scouting through the world-wide-web and finding principles that were not beneficial, I was thinking my life was over. Existing without the presence of answers to the problems you’ve fixed by means of the short post is a serious case, as well as ones which could have in a negative way affected my entire career if I hadn’t encountered the blog. Your own personal training and kindness in dealing with all areas was crucial. I’m not sure what I would have done if I hadn’t come across such a solution like this. It’s possible to at this time look ahead to my future. Thank you so much for this expert and result oriented help. I won’t think twice to refer your site to anyone who should have guidelines on this subject.

Every expert was once a beginner. Keep pushing forward, and one day, you’ll look back and see how far you’ve come. Progress is always happening, even when it doesn’t feel like it.

Thanks a lot for sharing this with all of us you really know what you’re talking about! Bookmarked. Kindly also visit my site =). We could have a link exchange contract between us!

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

You have observed very interesting details! ps decent web site. “In music the passions enjoy themselves.” by Friedrich Wilhelm Nietzsche.

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

Great post. I was checking continuously this blog and I am impressed! Extremely helpful information particularly the last part 🙂 I care for such information a lot. I was looking for this certain information for a very long time. Thank you and good luck.

Thankyou for helping out, great info .

As I site possessor I believe the content matter here is rattling magnificent , appreciate it for your efforts. You should keep it up forever! Good Luck.

you are really a good webmaster. The web site loading speed is incredible. It seems that you are doing any unique trick. Furthermore, The contents are masterwork. you have done a magnificent job on this topic!

Enjoyed looking at this, very good stuff, thanks. “I will do my best. That is all I can do. I ask for your help-and God’s.” by Lyndon B. Johnson.

Very interesting subject, regards for posting.

I’m also writing to let you be aware of of the beneficial experience my cousin’s girl undergone visiting yuor web blog. She realized some pieces, most notably what it is like to possess an amazing giving mindset to have many more very easily understand several specialized issues. You undoubtedly exceeded our own desires. Thank you for supplying those good, trusted, explanatory not to mention cool thoughts on your topic to Julie.

I think other site proprietors should take this web site as an model, very clean and fantastic user friendly style and design, as well as the content. You are an expert in this topic!

I have been examinating out some of your posts and i must say nice stuff. I will make sure to bookmark your blog.

Somebody essentially lend a hand to make severely posts I might state. This is the first time I frequented your website page and to this point? I surprised with the research you made to create this particular submit amazing. Excellent job!

Only a smiling visitant here to share the love (:, btw outstanding layout.

I?¦m not sure where you are getting your info, however good topic. I needs to spend a while studying much more or working out more. Thank you for excellent info I was searching for this info for my mission.

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how could we communicate?

superb post.Never knew this, regards for letting me know.

Hello.This article was extremely fascinating, particularly since I was looking for thoughts on this issue last Saturday.

You completed various nice points there. I did a search on the theme and found the majority of folks will have the same opinion with your blog.

v39drj

Hiya very cool website!! Man .. Beautiful .. Superb .. I’ll bookmark your website and take the feeds additionally…I am satisfied to seek out a lot of helpful info here in the submit, we want develop extra techniques on this regard, thank you for sharing.

I dugg some of you post as I thought they were very helpful handy

Howdy! Do you use Twitter? I’d like to follow you if that would be ok. I’m undoubtedly enjoying your blog and look forward to new updates.

Whoa! This blog looks just like my old one! It’s on a completely different topic but it has pretty much the same page layout and design. Excellent choice of colors!

You completed several good points there. I did a search on the topic and found most people will agree with your blog.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

I just couldn’t leave your site prior to suggesting that I really enjoyed the usual information a person provide on your guests? Is gonna be again continuously in order to check out new posts

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

Hiya, I am really glad I have found this info. Nowadays bloggers publish just about gossips and web and this is really frustrating. A good blog with interesting content, that is what I need. Thank you for keeping this web-site, I will be visiting it. Do you do newsletters? Can’t find it.

Hello! I just would like to give a huge thumbs up for the great info you have here on this post. I will be coming back to your blog for more soon.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

Everyone loves what you guys are usually up too. This kind of clever work and coverage! Keep up the amazing works guys I’ve you guys to my blogroll.

Nitric Boost Ultra is a dietary supplement designed to enhance cardiovascular health, energy levels, and endurance by increasing nitric oxide (NO) production in the body.

As a Newbie, I am permanently browsing online for articles that can be of assistance to me. Thank you

I found your blog website on google and check a few of your early posts. Proceed to keep up the superb operate. I simply further up your RSS feed to my MSN News Reader. Looking for ahead to reading more from you afterward!…

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Have you ever considered publishing an e-book or guest authoring on other sites? I have a blog based upon on the same subjects you discuss and would really like to have you share some stories/information. I know my readers would appreciate your work. If you’re even remotely interested, feel free to send me an email.

Some truly great articles on this website , thankyou for contribution.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

very nice publish, i actually love this web site, carry on it

Some really prime blog posts on this website , saved to fav.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

Hi there! This article could not be written any better! Reading through this articlle reminds me of my previous roommate!

He continually kept talking about this. I most certainly will send this

post to him. Fairly certain he’ll have a good read.

Many thanks for sharing! https://menbehealth.wordpress.com/

Howdy! This post couldn’t be written any better! Reading through this post reminds me of my good old room mate! He always kept chatting about this. I will forward this post to him. Pretty sure he will have a good read. Many thanks for sharing!

I regard something genuinely special in this website .

Amazing! This blog looks just like my old one! It’s on a entirely different subject but it has pretty much the same layout and design. Wonderful choice of colors!

You actually make it appear so easy along with your presentation however I to find this topic to be really something that I think I might never understand. It seems too complex and very broad for me. I am taking a look ahead to your subsequent post, I will try to get the dangle of it!

I really like your writing style, excellent information, thanks for putting up :D. “Your central self is totally untouched By grief, confusion, desperation.” by Vernon Howard.

Hello, Neat post. There is an issue together with your site in internet explorer, would check this… IE still is the market leader and a large section of other folks will pass over your wonderful writing due to this problem.

Hello. Great job. I did not anticipate this. This is a splendid story. Thanks!

I don’t commonly comment but I gotta state appreciate it for the post on this amazing one : D.

Excellent site. A lot of useful info here. I am sending it to a few friends ans also sharing in delicious. And certainly, thanks for your sweat!

Very interesting points you have noted, regards for posting. “The thing always happens that you really believe in and the belief in a thing makes it happen.” by Frank Lloyd Wright.

I like what you guys are up also. Such intelligent work and reporting! Keep up the superb works guys I’ve incorporated you guys to my blogroll. I think it’ll improve the value of my site 🙂

Hmm is anyone else encountering problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

Hey just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

Regards for this rattling post, I am glad I detected this website on yahoo.

Hello there, You’ve done a great job. I will certainly digg it and in my view suggest to my friends. I’m confident they’ll be benefited from this website.

I am happy that I found this weblog, precisely the right info that I was searching for! .

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Excellent web site. Lots of useful information here. I’m sending it to a few friends ans additionally sharing in delicious. And certainly, thanks to your sweat!

excellent post, very informative. I wonder why the other specialists of this sector do not notice this. You should continue your writing. I’m sure, you’ve a huge readers’ base already!

I’ve been surfing on-line greater than 3 hours these days, but I by no means discovered any attention-grabbing article like yours. It is beautiful value sufficient for me. Personally, if all site owners and bloggers made excellent content material as you did, the web can be a lot more helpful than ever before. “A winner never whines.” by Paul Brown.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

I am glad to be a visitor of this consummate web site! , thanks for this rare info ! .

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Hello! I’ve been reading your web site for some time now and finally got the courage to go ahead and give you a shout out from Humble Texas! Just wanted to mention keep up the excellent work!

Thanks for sharing excellent informations. Your web-site is very cool. I’m impressed by the details that you have on this blog. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found simply the information I already searched all over the place and just could not come across. What a perfect site.

The cosmos is said to be an ordered place, ruled by laws and principles, yet within that order exists chaos, unpredictability, and the unexpected. Perhaps true balance is not about eliminating chaos but embracing it, learning to see the beauty in disorder, the harmony within the unpredictable. Maybe to truly understand the universe, we must stop trying to control it and simply become one with its rhythm.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Absolutely indited content material, Really enjoyed examining.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.

Howdy! I know this is kind of off topic but I was wondering which blog platform are you using for this site? I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be awesome if you could point me in the direction of a good platform.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

whoah this blog is excellent i really like studying your articles. Keep up the good paintings! You understand, a lot of persons are hunting around for this information, you can aid them greatly.

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

Introducing to you the most prestigious online entertainment address today. Visit now to experience now!

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

I have read a few just right stuff here. Certainly value bookmarking for revisiting. I surprise how much effort you place to create such a great informative web site.

Some really excellent info , Gladiola I observed this.

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Great beat ! I wish to apprentice while you amend your website, how could i subscribe for a weblog site? The account helped me a applicable deal. I had been a little bit acquainted of this your broadcast provided shiny transparent concept

It is really a nice and useful piece of info. I am glad that you shared this useful information with us. Please stay us up to date like this. Thanks for sharing.

you are really a good webmaster. The site loading speed is incredible. It seems that you are doing any unique trick. In addition, The contents are masterpiece. you’ve done a great job on this topic!

I enjoy looking through a post that can make people think. Also, thanks for allowing me to comment.

Thanks for all of your labor on this website. Betty delights in carrying out internet research and it’s easy to understand why. All of us notice all of the powerful ways you present very helpful ideas via your website and as well attract contribution from website visitors on that point while our own girl is certainly being taught a lot of things. Have fun with the rest of the year. You are always conducting a terrific job.

F*ckin’ awesome things here. I am very glad to see your post. Thanks a lot and i’m looking forward to contact you. Will you please drop me a e-mail?

I like this website very much so much good info .

Some really interesting information, well written and generally user pleasant.

I really like what you guys are up too. This sort of clever work and exposure! Keep up the very good works guys I’ve included you guys to blogroll.

for the reason that here every material is quality based

so much fantastic information on here, : D.

I really like forgathering utile information , this post has got me even more info! .

Hey very nice blog!! Man .. Excellent .. Wonderful .. I’ll bookmark your website and take the feeds also…I am satisfied to find so many helpful info here in the publish, we’d like work out extra strategies on this regard, thanks for sharing.

Thanks a lot for sharing this with all of us you actually know what you are talking about! Bookmarked. Kindly also visit my website =). We could have a link exchange contract between us!

Some truly interesting info , well written and broadly speaking user friendly.

Good ?V I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related information ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or anything, site theme . a tones way for your client to communicate. Nice task..

It’s exhausting to find educated people on this topic, however you sound like you know what you’re speaking about! Thanks

Good – I should certainly pronounce, impressed with your site. I had no trouble navigating through all tabs and related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Reasonably unusual. Is likely to appreciate it for those who add forums or something, site theme . a tones way for your client to communicate. Excellent task.

hello there and thank you for your information – I have definitely picked up anything new from right here. I did however expertise some technical points using this website, since I experienced to reload the site a lot of times previous to I could get it to load properly. I had been wondering if your web host is OK? Not that I am complaining, but sluggish loading instances times will very frequently affect your placement in google and could damage your high quality score if advertising and marketing with Adwords. Anyway I am adding this RSS to my e-mail and could look out for much more of your respective fascinating content. Make sure you update this again very soon..

Nice weblog right here! Also your website so much up very fast! What host are you the usage of? Can I am getting your affiliate link on your host? I want my web site loaded up as fast as yours lol

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!

F*ckin’ amazing things here. I am very glad to see your post. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a mail?

I conceive this website holds some really excellent info for everyone :D. “Believe those who are seeking the truth doubt those who find it.” by Andre Gide.

This web site is my inhalation, very superb style and design and perfect subject matter.

Wonderful beat ! I wish to apprentice even as you amend your website, how could i subscribe for a blog site? The account aided me a acceptable deal. I had been a little bit familiar of this your broadcast provided vibrant transparent concept

What¦s Happening i’m new to this, I stumbled upon this I have found It positively useful and it has aided me out loads. I hope to contribute & help other users like its aided me. Good job.

very good post, i certainly love this website, keep on it

Loving the information on this site, you have done great job on the articles.

Good day! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

I love it when people come together and share opinions, great blog, keep it up.

Some truly good posts on this web site, thank you for contribution. “Give me the splendid silent sun with all his beams full-dazzling.” by Walt Whitman.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and everything. However imagine if you added some great visuals or video clips to give your posts more, “pop”! Your content is excellent but with pics and video clips, this blog could definitely be one of the greatest in its field. Great blog!

I precisely had to say thanks yet again. I do not know the things I might have done in the absence of the tactics documented by you over that concern. It became an absolute hard condition in my opinion, however , observing the expert approach you solved it took me to cry with contentment. I am just happier for your information and in addition hope you know what a great job you happen to be providing educating some other people using your websites. Most probably you’ve never met any of us.

Hello. excellent job. I did not anticipate this. This is a splendid story. Thanks!

wonderful put up, very informative. I ponder why the other experts of this sector don’t notice this. You should continue your writing. I am sure, you have a great readers’ base already!

I have not checked in here for some time since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my daily bloglist. You deserve it my friend 🙂

I will immediately grasp your rss as I can not find your email subscription link or e-newsletter service. Do you’ve any? Please let me know so that I may just subscribe. Thanks.

díky tomuto nádhernému čtení! Rozhodně se mi líbil každý kousek z toho a já

I’ve been absent for a while, but now I remember why I used to love this web site. Thanks, I will try and check back more often. How frequently you update your site?

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

Wonderful blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Cheers

I would like to thnkx for the efforts you have put in writing this blog. I’m hoping the same high-grade blog post from you in the upcoming also. In fact your creative writing abilities has encouraged me to get my own site now. Actually the blogging is spreading its wings quickly. Your write up is a great example of it.

Please let me know if you’re looking for a writer for your site. You have some really good posts and I think I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some material for your blog in exchange for a link back to mine. Please shoot me an e-mail if interested. Regards!

Rattling clean web site, thanks for this post.

I’m still learning from you, but I’m trying to achieve my goals. I certainly enjoy reading all that is posted on your site.Keep the tips coming. I liked it!

hi!,I like your writing very much! share we be in contact more approximately your article on AOL? I need an expert on this space to solve my problem. May be that is you! Having a look forward to peer you.

Awesome https://is.gd/tpjNyL

I appreciate your wp template, wherever would you obtain it from?

Hi I am so excited I found your site, I really found you by error, while I was browsing on Google for something else, Anyhow I am here now and would just like to say thank you for a tremendous post and a all round exciting blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have saved it and also added in your RSS feeds, so when I have time I will be back to read much more, Please do keep up the awesome work.

Hi there! Quick question that’s entirely off topic. Do you know how to make your site mobile friendly? My website looks weird when browsing from my apple iphone. I’m trying to find a theme or plugin that might be able to correct this problem. If you have any suggestions, please share. With thanks!

This is a topic close to my heart cheers, where are your contact details though?

Awesome https://is.gd/tpjNyL

hello!,I like your writing very much! share we communicate more about your post on AOL? I need an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

I conceive you have mentioned some very interesting points, thanks for the post.

I truly enjoy studying on this site, it has great posts.

I very delighted to find this web site on bing, just what I was searching for : D likewise saved to my bookmarks.

Very interesting details you have noted, appreciate it for posting. “What is harder than rock, or softer than water Yet soft water hollows out hard rock. Persevere.” by Ovid.

Great website you have here but I was curious if you knew of any forums that cover the same topics discussed here? I’d really love to be a part of group where I can get advice from other experienced people that share the same interest. If you have any recommendations, please let me know. Bless you!

An interesting dialogue is price comment. I feel that you must write extra on this subject, it may not be a taboo topic however usually people are not enough to talk on such topics. To the next. Cheers

I’m curious to find out what blog platform you have been using? I’m having some minor security issues with my latest blog and I would like to find something more safeguarded. Do you have any suggestions?

Pretty nice post. I just stumbled upon your weblog and wanted to say that I’ve really enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I hope you write again very soon!

I haven’t checked in here for a while since I thought it was getting boring, but the last few posts are great quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂

Hmm it appears like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to the whole thing. Do you have any suggestions for first-time blog writers? I’d really appreciate it.

It’s exhausting to search out knowledgeable people on this topic, however you sound like you understand what you’re speaking about! Thanks

An fascinating discussion is worth comment. I think that it is best to write extra on this subject, it might not be a taboo topic however usually individuals are not enough to speak on such topics. To the next. Cheers

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a little bit, but instead of that, this is wonderful blog. A great read. I will certainly be back.

Lovely just what I was searching for.Thanks to the author for taking his time on this one.

Generally I do not learn post on blogs, however I would like to say that this write-up very pressured me to take a look at and do it! Your writing style has been surprised me. Thanks, quite great article.

Youre so cool! I dont suppose Ive read anything like this before. So nice to search out someone with some unique thoughts on this subject. realy thanks for starting this up. this website is one thing that’s wanted on the net, someone with a bit of originality. useful job for bringing one thing new to the web!

You are my intake, I possess few web logs and sometimes run out from to post : (.

I loved as much as you will receive carried out right here. The sketch is tasteful, your authored subject matter stylish. nonetheless, you command get bought an shakiness over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this increase.

Thanks , I have just been looking for info about this topic for ages and yours is the best I have discovered so far. But, what about the bottom line? Are you sure about the source?

Magnificent beat ! I would like to apprentice while you amend your website, how could i subscribe for a blog website? The account aided me a acceptable deal. I were a little bit acquainted of this your broadcast offered bright clear idea

The Salt Trick is a natural technique that involves using specific salts, such as Blue Salt, to enhance male performance

Hello, Neat post. There is an issue along with your web site in internet explorer, might test this?K IE still is the marketplace leader and a large component of other folks will omit your wonderful writing because of this problem.

Thank you, I’ve recently been looking for information about this subject for ages and yours is the greatest I’ve discovered till now. But, what about the bottom line? Are you sure about the source?

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

There is noticeably a bundle to realize about this. I consider you made certain nice points in features also.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Someone essentially help to make seriously posts I would state. This is the very first time I frequented your website page and thus far? I amazed with the research you made to make this particular publish amazing. Excellent job!

Excellent website. Plenty of helpful info here. I’m sending it to some pals ans additionally sharing in delicious. And of course, thank you in your sweat!

I actually wanted to jot down a quick note so as to express gratitude to you for the wonderful points you are giving out on this site. My prolonged internet look up has at the end been compensated with incredibly good insight to share with my neighbours. I ‘d suppose that most of us site visitors actually are very lucky to be in a magnificent site with many wonderful individuals with very beneficial plans. I feel very happy to have encountered your entire web site and look forward to plenty of more enjoyable moments reading here. Thanks a lot once again for all the details.

Fantastic post however , I was wanting to know if you could write a litte more on this topic? I’d be very thankful if you could elaborate a little bit more. Appreciate it!

Hello my loved one! I wish to say that this post is awesome, great written and come with almost all important infos. I would like to look more posts like this .

Hi there very cool site!! Guy .. Beautiful .. Superb .. I’ll bookmark your web site and take the feeds additionally?KI am satisfied to seek out so many helpful info right here within the put up, we’d like develop more techniques in this regard, thank you for sharing. . . . . .

I’ve been absent for some time, but now I remember why I used to love this website. Thanks , I will try and check back more frequently. How frequently you update your web site?