This site contains affiliate links to products. I may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read my disclaimers page for more information.

Looking for some help to get out of debt quickly? Here’s our guide on our most popular debt snowball worksheets!

What is the debt snowball method?

With the debt snowball method, you pay off your debts one at a time- in order from the lowest balance owing to the highest. You’ll continue to make the minimum payments on all debts.

Should you pay off the smallest debt first?

Using the debt snowball method, you’ll pay off your smallest debt first. You’ll be able to check a debt off your list really quickly, boosting your motivation to keep going!

Once your first debt is paid off, you’ll roll its payment into the next debt. Each time a debt is paid off, you’ll have a larger and larger payment to roll into paying off the next one.

What is the best debt payoff method?

The debt snowball and debt avalanche methods are two of the most common debt payoff methods.

They both follow the same principle, which is focusing on just one debt at a time.

The debt avalanche method focuses on your highest interest rate debts first, followed by your debts with the lowest interest rates.

The debt snowball method will help to keep you motivated because you can pay off individual debts sooner.

The debt avalanche method is best if all of your debts have the same balance owing (or pretty close). In this scenario, you may be better off to focus on the higher interest rate debts first, because regardless of which one you start with- it will take you the same amount of time to pay that first one off.

Continue the process until you’re debt-free!

Here are 3 Debt Snowball Worksheets you can use to pay off your debt faster:

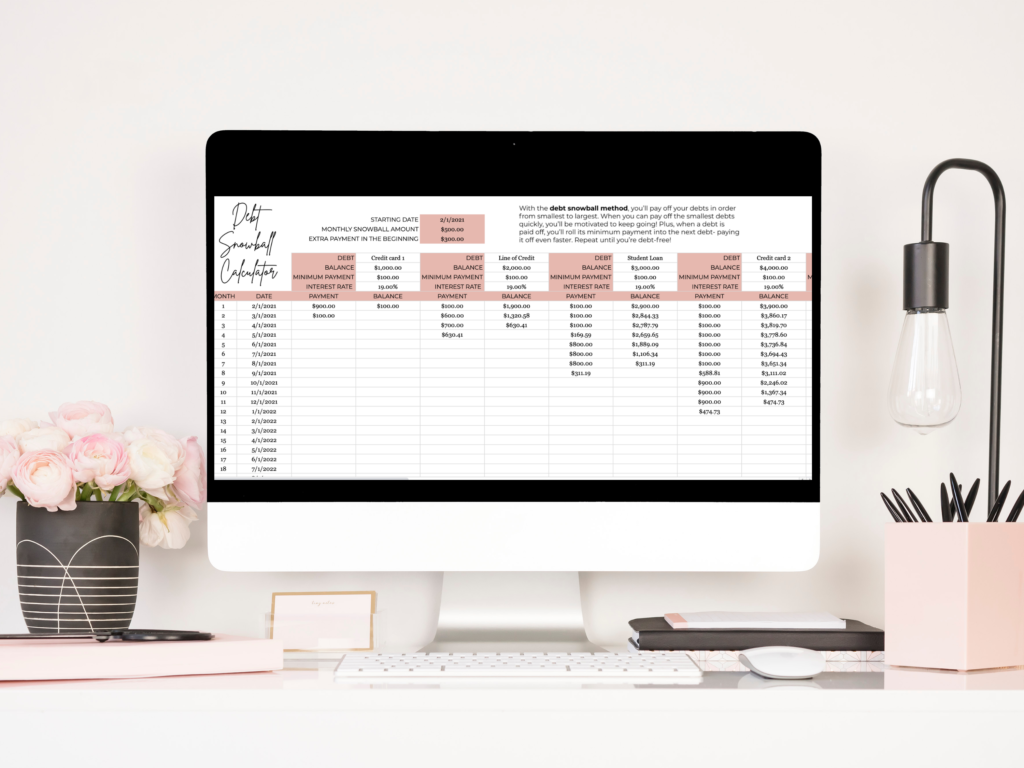

1. Debt Snowball Calculator (available for Google Sheets and Excel)

How it helps: Find out when you’ll be debt-free! This handy calculator takes all of the excuses out of starting to pay off your debt. Plug in each of your debts, and instantly see the date you’ll be debt-free.

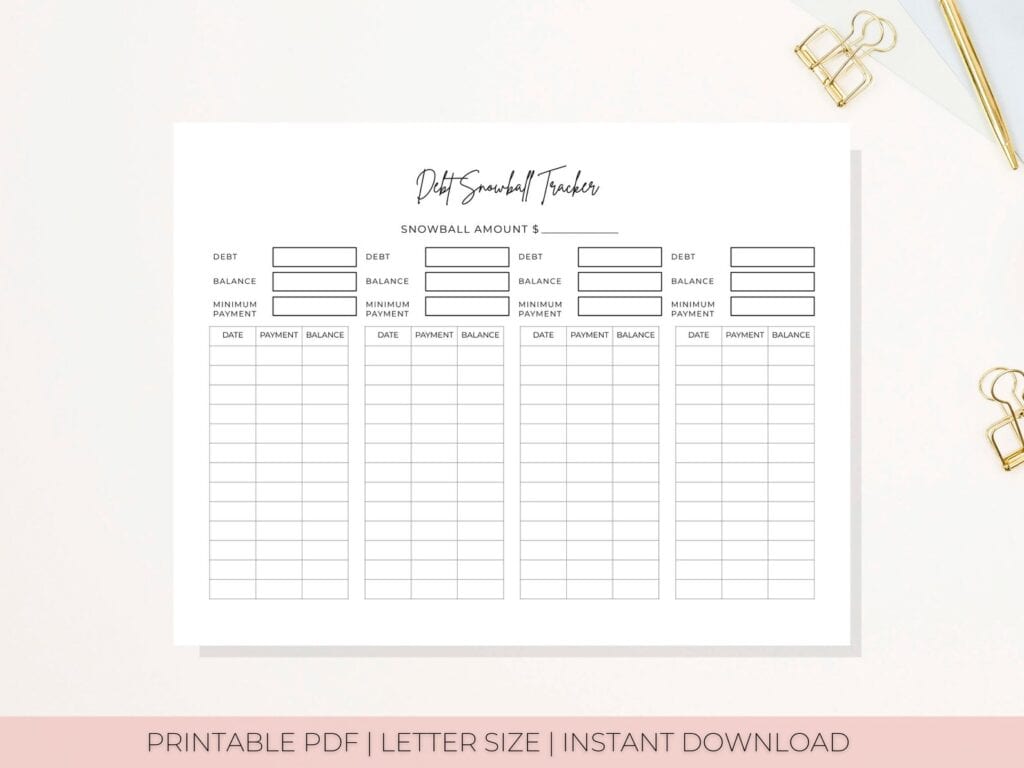

2. Debt Snowball Printable Worksheet (printable PDF)

How it helps: Find out when you’ll be debt-free + track your progress as you go! The pen and paper alternative to seeing how long it will take you to pay off your debt with the debt snowball method.

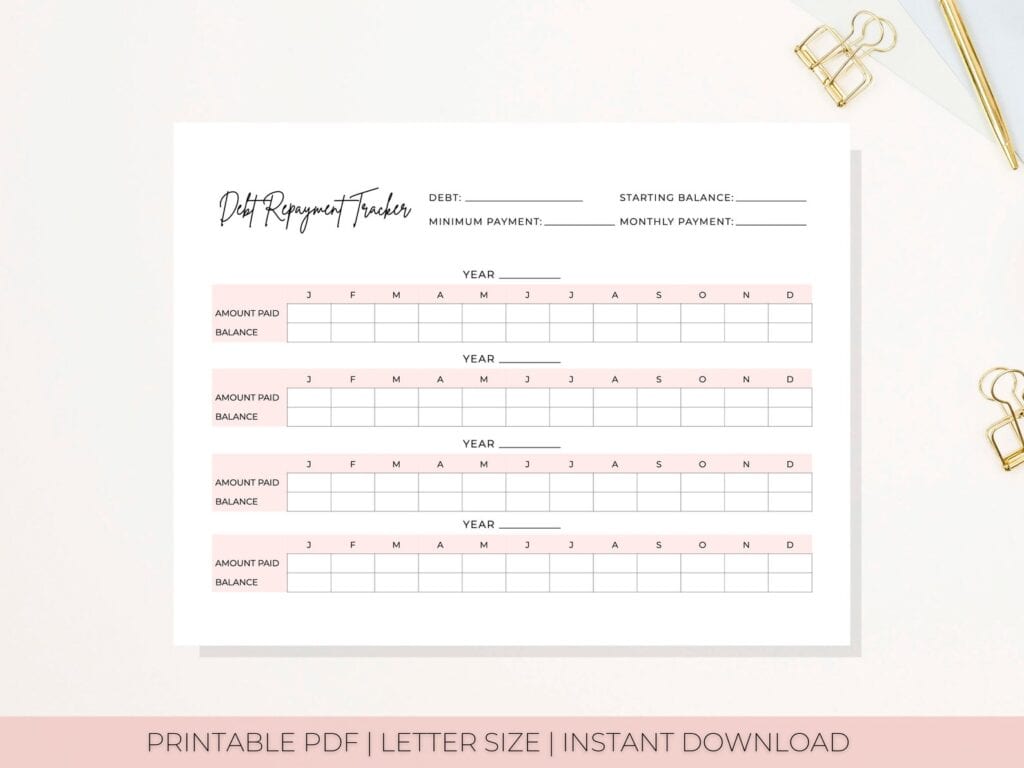

3. Debt Repayment Tracker (Printable PDF)

How it helps: This printable tracker makes paying off your debt a little more fun 😊 color in each block as you make payments, and watch your balance owing go down. You can use this one for both the Debt Snowball and Debt Avalanche methods.

Debt Snowball FAQs:

Should I pay off my debt before saving money?

Before paying off your debt, make sure you have an emergency fund saved to cover any unexpected expenses during your debt-free journey.

Without an emergency fund, you will need to use your credit card(s) when an unexpected cost arises, sending you further into debt.

The general recommendation for an emergency fund is 3-6 months worth of living expenses (in case you were to unexpectedly lose your job). It’s okay to start with a smaller amount, like $1000, before paying off your debt- just make sure to add more to it once you’re debt-free.

After your debt is paid off, you’ll have more money every month to save save save!

What can I do to pay off my debt as quickly as possible?

If you want to get out of debt as quickly as you can (as we all do!), here’s what you need to do:

- Focus on one debt at a time

- Reduce your spending habits, and put the money that you save on your debts

- Start a side hustle or second job, and add your earnings to your debt repayments

What tools do you use to keep track of your debt-free journey? Leave your best tips in the comments!

FMscPfYQC

YTDosgczxiHpXR

rhpXTGmqJILwQz

Thank you for sharing this insightful article! I found the information really useful and thought-provoking. Your writing style is engaging, and it made the topic much easier to understand. Looking forward to reading more of your posts!

e2kofg

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

What i don’t realize is actually how you are not really much more well-liked than you might be right now. You’re very intelligent. You realize therefore considerably relating to this subject, made me personally consider it from a lot of varied angles. Its like women and men aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs excellent. Always maintain it up!

hjulef

Hiya! I know this is kinda off topic however , I’d figured I’d ask. Would you be interested in trading links or maybe guest authoring a blog post or vice-versa? My blog addresses a lot of the same topics as yours and I feel we could greatly benefit from each other. If you’re interested feel free to shoot me an e-mail. I look forward to hearing from you! Awesome blog by the way!

I am really impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it is rare to see a great blog like this one today..

3zr93t

Great post. I am facing a couple of these problems.

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Thanks

What¦s Happening i’m new to this, I stumbled upon this I have found It positively useful and it has aided me out loads. I’m hoping to contribute & aid other users like its helped me. Good job.

Utterly written articles, Really enjoyed studying.

I really wanted to write down a simple remark to express gratitude to you for these stunning tactics you are placing on this website. My particularly long internet look up has finally been compensated with sensible content to share with my colleagues. I would suppose that we readers are really fortunate to be in a really good site with so many outstanding individuals with valuable pointers. I feel really happy to have used your website page and look forward to really more enjoyable times reading here. Thank you again for all the details.

Valuable info. Fortunate me I discovered your site unintentionally, and I am shocked why this accident did not happened earlier! I bookmarked it.

My brother suggested I might like this web site. He was totally right. This post truly made my day. You cann’t imagine just how much time I had spent for this information! Thanks!

I think this is among the most important info for me. And i’m glad reading your article. But wanna remark on some general things, The website style is perfect, the articles is really excellent : D. Good job, cheers

You are my intake, I have few blogs and sometimes run out from brand :). “No opera plot can be sensible, for people do not sing when they are feeling sensible.” by W. H. Auden.

I saw a lot of website but I conceive this one holds something extra in it in it

I am usually to blogging and i actually recognize your content. The article has actually peaks my interest. I am going to bookmark your site and keep checking for brand spanking new information.

Hey, you used to write excellent, but the last several posts have been kinda boringK I miss your super writings. Past few posts are just a little out of track! come on!

It’s actually a nice and useful piece of information. I am glad that you shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

I’m impressed, I have to say. Really rarely do I encounter a blog that’s each educative and entertaining, and let me let you know, you might have hit the nail on the head. Your concept is excellent; the problem is something that not enough individuals are talking intelligently about. I’m very comfortable that I stumbled throughout this in my seek for one thing relating to this.

Thanks for sharing superb informations. Your website is very cool. I’m impressed by the details that you’ve on this website. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found simply the info I already searched all over the place and just could not come across. What a great website.

I know this if off topic but I’m looking into starting my own weblog and was wondering what all is required to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web savvy so I’m not 100 sure. Any suggestions or advice would be greatly appreciated. Appreciate it

an86pm

Its great as your other blog posts : D, thankyou for posting. “Always be nice to people on the way up because you’ll meet the same people on the way down.” by Wilson Mizner.

I truly appreciate your work, Great post.

Hey! Do you use Twitter? I’d like to follow you if that would be okay. I’m definitely enjoying your blog and look forward to new updates.

I do agree with all the ideas you’ve presented in your post. They are really convincing and will definitely work. Still, the posts are too short for newbies. Could you please extend them a bit from next time? Thanks for the post.

hello!,I like your writing very much! share we communicate more about your article on AOL? I require a specialist on this area to solve my problem. Maybe that’s you! Looking forward to see you.

Some really choice blog posts on this web site, saved to my bookmarks.

My partner and I absolutely love your blog and find many of your post’s to be exactly what I’m looking for. Does one offer guest writers to write content for yourself? I wouldn’t mind composing a post or elaborating on a number of the subjects you write related to here. Again, awesome web log!

Hey, you used to write fantastic, but the last several posts have been kinda boringK I miss your great writings. Past few posts are just a bit out of track! come on!

My wife and i were quite lucky that Ervin could round up his homework by way of the precious recommendations he was given through your blog. It’s not at all simplistic to just possibly be giving freely hints which usually others might have been trying to sell. We really remember we now have the writer to appreciate because of that. The most important explanations you’ve made, the straightforward blog navigation, the friendships you help instill – it is most incredible, and it is letting our son and the family reason why this situation is entertaining, which is certainly pretty pressing. Many thanks for all the pieces!

You made some decent points there. I did a search on the topic and found most individuals will go along with with your blog.

I genuinely enjoy examining on this web site, it has good posts.

There are some interesting points in time on this article however I don’t know if I see all of them heart to heart. There’s some validity however I’ll take hold opinion until I look into it further. Good article , thanks and we want more! Added to FeedBurner as properly

Howdy this is kind of of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I’m starting a blog soon but have no coding know-how so I wanted to get advice from someone with experience. Any help would be enormously appreciated!

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something informative to read?

Your place is valueble for me. Thanks!…

Just desire to say your article is as astonishing. The clearness in your post is simply spectacular and i could assume you are an expert on this subject. Well with your permission allow me to grab your feed to keep updated with forthcoming post. Thanks a million and please keep up the rewarding work.

Some really wonderful articles on this site, regards for contribution.

Hello, i believe that i saw you visited my weblog so i came to “return the desire”.I’m trying to to find issues to enhance my web site!I guess its good enough to make use of a few of your concepts!!

I’ve been exploring for a little bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this info So i am happy to convey that I’ve a very good uncanny feeling I discovered exactly what I needed. I most certainly will make sure to do not forget this web site and give it a glance on a constant basis.

The next time I read a blog, I hope that it doesnt disappoint me as much as this one. I mean, I know it was my choice to read, but I actually thought youd have something interesting to say. All I hear is a bunch of whining about something that you could fix if you werent too busy looking for attention.

I gotta favorite this web site it seems handy handy

Heya i am for the primary time here. I came across this board and I to find It truly useful & it helped me out much. I hope to provide one thing back and aid others like you aided me.

Magnificent web site. Plenty of useful info here. I am sending it to a few buddies ans also sharing in delicious. And obviously, thank you on your sweat!

Keep functioning ,fantastic job!

This is a topic close to my heart cheers, where are your contact details though?

As a Newbie, I am continuously exploring online for articles that can aid me. Thank you

I am glad to be a visitor of this staring web site! , regards for this rare info ! .

Real clean website , regards for this post.

You have noted very interesting details! ps nice website.

I do agree with all the ideas you’ve introduced to your post. They’re very convincing and can definitely work. Nonetheless, the posts are too short for newbies. May you please lengthen them a bit from next time? Thanks for the post.

There is clearly a bunch to identify about this. I think you made certain good points in features also.

Real clean internet site, appreciate it for this post.

Amazing blog! Do you have any helpful hints for aspiring writers? I’m hoping to start my own site soon but I’m a little lost on everything. Would you advise starting with a free platform like WordPress or go for a paid option? There are so many options out there that I’m completely overwhelmed .. Any ideas? Thanks!

Great article and straight to the point. I am not sure if this is in fact the best place to ask but do you people have any thoughts on where to employ some professional writers? Thx 🙂

Hey there! I’m at work browsing your blog from my new apple iphone! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the great work!

Fantastic site. Plenty of useful info here. I’m sending it to some friends ans also sharing in delicious. And obviously, thanks for your effort!

This is precisely what I was hunting for; thanks for sharing with us this information.

Hi there! I know this is somewhat off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform. I would be fantastic if you could point me in the direction of a good platform.

Hello.This article was really interesting, especially since I was investigating for thoughts on this issue last Thursday.

I admire the way in which you present ideas. Thanks for sharing this informative article with your readers.

Hey, you used to write fantastic, but the last few posts have been kinda boring?K I miss your super writings. Past few posts are just a little out of track! come on!

Great – I should definitely pronounce, impressed with your site. I had no trouble navigating through all tabs and related info ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, website theme . a tones way for your client to communicate. Nice task..

I am curious to find out what blog system you’re utilizing? I’m experiencing some small security issues with my latest website and I would like to find something more risk-free. Do you have any suggestions?

I got what you intend,saved to favorites, very decent web site.

I like what you guys are up also. Such clever work and reporting! Carry on the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my website :).

It¦s actually a nice and helpful piece of info. I am satisfied that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.

I am extremely inspired together with your writing abilities and also with the layout in your weblog. Is this a paid subject or did you customize it yourself? Anyway stay up the excellent high quality writing, it is uncommon to look a great weblog like this one these days..

Hello there, You’ve done a great job. I will certainly digg it and personally recommend to my friends. I am sure they will be benefited from this site.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

Hiya, I’m really glad I’ve found this information. Nowadays bloggers publish just about gossips and internet and this is actually frustrating. A good website with exciting content, this is what I need. Thanks for keeping this website, I’ll be visiting it. Do you do newsletters? Can not find it.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Thank you, I’ve just been looking for information approximately this subject for ages and yours is the best I’ve found out so far. However, what in regards to the conclusion? Are you positive concerning the supply?

Hello there, just became alert to your blog through Google, and found that it is truly informative. I am gonna watch out for brussels. I’ll appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

There may be noticeably a bundle to know about this. I assume you made sure good factors in features also.

I’ve been surfing online greater than 3 hours these days, but I by no means discovered any interesting article like yours. It’s pretty worth sufficient for me. In my view, if all web owners and bloggers made just right content material as you did, the web shall be a lot more helpful than ever before.

Perfect piece of work you have done, this internet site is really cool with good info .

Thanks for your personal marvelous posting! I seriously enjoyed reading it, you could be a great author.I will be sure to bookmark your blog and will often come back in the foreseeable future. I want to encourage you continue your great writing, have a nice day!

It’s onerous to search out knowledgeable folks on this matter, but you sound like you know what you’re talking about! Thanks

Having read this I thought it was very informative. I appreciate you taking the time and effort to put this article together. I once again find myself spending way to much time both reading and commenting. But so what, it was still worth it!

The layout is visually appealing and very functional.

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Merely wanna tell that this is very useful, Thanks for taking your time to write this.

wonderful points altogether, you simply gained a brand new reader. What would you suggest in regards to your post that you made a few days ago? Any positive?

FitSpresso is a dietary supplement designed to aid weight loss, improve energy levels, and promote overall wellness. It targets key areas of weight management by enhancing metabolism, controlling appetite, and supporting fat-burning processes.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Greetings from Colorado! I’m bored to tears at work so I decided to check out your site on my iphone during lunch break. I love the information you present here and can’t wait to take a look when I get home. I’m amazed at how fast your blog loaded on my phone .. I’m not even using WIFI, just 3G .. Anyways, fantastic blog!

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

The content is engaging and well-structured, keeping visitors interested.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

The Ice Water Hack has gained popularity as a simple yet effective method for boosting metabolism and promoting weight loss.

Hmm it appears like your website ate my first comment (it was super long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to everything. Do you have any recommendations for beginner blog writers? I’d certainly appreciate it.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

This website is amazing, with a clean design and easy navigation.

Youre so cool! I dont suppose Ive read something like this before. So good to find any person with some authentic thoughts on this subject. realy thanks for beginning this up. this website is something that’s wanted on the internet, somebody with slightly originality. useful job for bringing something new to the web!

ProstaVive is a dietary supplement designed to promote prostate health, support urinary function, and improve overall well-being in men, especially as they age.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed surfing around your blog posts. In any case I will be subscribing for your rss feed and I am hoping you write once more soon!

I’m really impressed by the speed and responsiveness.

excellent issues altogether, you just received a logo new reader. What would you recommend in regards to your put up that you made a few days ago? Any positive?

It provides an excellent user experience from start to finish.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

Thank you for every other informative blog. Where else may I get that type of information written in such a perfect way? I’ve a project that I am just now working on, and I’ve been at the look out for such info.

Hi there, simply become aware of your weblog thru Google, and located that it’s truly informative. I’m going to be careful for brussels. I’ll appreciate in the event you continue this in future. A lot of folks can be benefited out of your writing. Cheers!

Wow! Thank you! I continuously wanted to write on my blog something like that. Can I take a fragment of your post to my site?

Some truly quality content on this internet site, saved to fav.

Loving the information on this internet site, you have done outstanding job on the posts.

Hello, Neat post. There is an issue together with your site in web explorer, might test this… IE nonetheless is the marketplace leader and a big component to other folks will leave out your wonderful writing because of this problem.

рюкзак мужской

My spouse and i have been absolutely fortunate that Peter could conclude his investigation through your precious recommendations he made out of your web site. It’s not at all simplistic just to always be giving for free secrets a number of people have been making money from. We really fully grasp we now have the website owner to thank for this. All the illustrations you have made, the simple website navigation, the relationships you will help to instill – it’s got mostly terrific, and it’s really assisting our son and the family consider that this matter is satisfying, and that is very indispensable. Many thanks for everything!

I have been checking out many of your articles and it’s nice stuff. I will make sure to bookmark your site.

I’d have to examine with you here. Which is not one thing I usually do! I take pleasure in reading a post that may make folks think. Additionally, thanks for permitting me to comment!

AI is evolving so fast! I can’t wait to see how it transforms our daily lives in the next decade. The possibilities are endless, from automation to medical advancements.

It¦s really a nice and helpful piece of information. I¦m glad that you simply shared this useful info with us. Please stay us informed like this. Thank you for sharing.

of course like your web-site but you have to take a look at the spelling on quite a few of your posts. Several of them are rife with spelling problems and I in finding it very bothersome to tell the reality then again I’ll certainly come back again.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Do you have a spam issue on this site; I also am a blogger, and I was curious about your situation; many of us have developed some nice procedures and we are looking to trade methods with other folks, why not shoot me an email if interested.

Keep up the wonderful piece of work, I read few articles on this internet site and I believe that your web blog is rattling interesting and contains lots of wonderful information.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

I cling on to listening to the reports talk about receiving free online grant applications so I have been looking around for the most excellent site to get one. Could you advise me please, where could i get some?

Appreciating the persistence you put into your site and in depth information you present. It’s good to come across a blog every once in a while that isn’t the same unwanted rehashed information. Great read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

AI is evolving so fast! I can’t wait to see how it transforms our daily lives in the next decade. The possibilities are endless, from automation to medical advancements.

I’m often to blogging and i really recognize your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for new information.

Good info. Lucky me I reach on your website by accident, I bookmarked it.

I like this web blog so much, saved to my bookmarks.

8pamfy

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but instead of that, this is fantastic blog. A great read. I’ll certainly be back.

you’ve got a fantastic blog here! would you like to make some invite posts on my weblog?

I’m very happy to read this. This is the type of manual that needs to be given and not the accidental misinformation that’s at the other blogs. Appreciate your sharing this best doc.

Valuable information. Lucky me I found your site by accident, and I am shocked why this accident didn’t happened earlier! I bookmarked it.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Rattling excellent information can be found on weblog.

I know this if off topic but I’m looking into starting my own weblog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 certain. Any suggestions or advice would be greatly appreciated. Kudos

This is really interesting, You are a very skilled blogger. I have joined your rss feed and look forward to seeking more of your great post. Also, I’ve shared your web site in my social networks!

Hi there! I simply want to give a huge thumbs up for the great info you’ve here on this post. I will be coming again to your weblog for extra soon.

Hello.This post was extremely motivating, especially because I was searching for thoughts on this subject last Sunday.

This is the right weblog for anyone who desires to seek out out about this topic. You realize so much its virtually onerous to argue with you (not that I really would want…HaHa). You definitely put a new spin on a subject thats been written about for years. Great stuff, simply nice!

I am curious to find out what blog system you happen to be working with? I’m having some minor security problems with my latest site and I’d like to find something more safeguarded. Do you have any solutions?

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

I love your writing style truly loving this web site.

naturally like your web site however you have to check the spelling on quite a few of your posts. Many of them are rife with spelling issues and I find it very troublesome to tell the reality on the other hand I’ll surely come back again.

You got a very good website, Glad I discovered it through yahoo.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

This is the right blog for anyone who desires to search out out about this topic. You understand so much its virtually onerous to argue with you (not that I really would need…HaHa). You undoubtedly put a new spin on a topic thats been written about for years. Great stuff, simply nice!

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

As I website owner I conceive the content here is real fantastic, thankyou for your efforts.

Hello There. I found your blog using msn. This is a really well written article. I’ll be sure to bookmark it and return to read more of your useful info. Thanks for the post. I will certainly comeback.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Great – I should definitely pronounce, impressed with your web site. I had no trouble navigating through all the tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it in the least. Quite unusual. Is likely to appreciate it for those who add forums or anything, web site theme . a tones way for your client to communicate. Nice task..

You actually make it appear really easy along with your presentation however I find this topic to be really something which I feel I’d by no means understand. It sort of feels too complex and very extensive for me. I am looking forward for your next publish, I¦ll try to get the grasp of it!

I truly appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Hmm it looks like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to everything. Do you have any suggestions for novice blog writers? I’d certainly appreciate it.

Some really good information, Gladiola I noticed this.

hi!,I like your writing so much! share we communicate more about your post on AOL? I need a specialist on this area to solve my problem. May be that’s you! Looking forward to see you.

What’s Happening i’m new to this, I stumbled upon this I have found It positively helpful and it has helped me out loads. I hope to contribute & assist other users like its helped me. Good job.

Awsome blog! I am loving it!! Will be back later to read some more. I am taking your feeds also.

Just a smiling visitor here to share the love (:, btw outstanding style and design.

I couldn’t resist commenting

There is noticeably a bundle to find out about this. I assume you made certain nice factors in features also.

Terrific work! This is the type of info that should be shared around the web. Shame on the search engines for not positioning this post higher! Come on over and visit my website . Thanks =)

I’m typically to blogging and i actually appreciate your content. The article has actually peaks my interest. I am going to bookmark your website and hold checking for new information.

I found your blog web site on google and test a few of your early posts. Proceed to keep up the excellent operate. I just extra up your RSS feed to my MSN Information Reader. Looking for ahead to reading extra from you in a while!…

Only wanna input that you have a very nice web site, I like the layout it really stands out.

whoah this blog is great i like reading your articles. Keep up the great work! You recognize, many individuals are hunting around for this information, you could help them greatly.

I was wondering if you ever thought of changing the structure of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 images. Maybe you could space it out better?

You can certainly see your skills within the paintings you write. The world hopes for even more passionate writers like you who aren’t afraid to mention how they believe. Always go after your heart. “Golf and sex are about the only things you can enjoy without being good at.” by Jimmy Demaret.

I like this website its a master peace ! Glad I observed this on google .

Good info. Lucky me I reach on your website by accident, I bookmarked it.

Merely a smiling visitor here to share the love (:, btw outstanding design.

you’ve an awesome weblog right here! would you like to make some invite posts on my weblog?

Mit diesem Angebot erhältst du einen 50%

Bonus auf deine Einzahlung bis zu 700 € und zusätzlich 50 Freispiele.

I do trust all the ideas you have presented in your post. They are really convincing and can certainly work. Still, the posts are very quick for beginners. Could you please extend them a little from subsequent time? Thank you for the post.

Hello, you used to write great, but the last few posts have been kinda boring?K I miss your super writings. Past few posts are just a bit out of track! come on!

I was suggested this blog by means of my cousin. I’m not sure whether or not this put up is written by him as no one else understand such distinct approximately my difficulty. You are incredible! Thank you!

Every weekend i used to pay a visit this website, as i wish for enjoyment, since

this this site conations truly nice funny information too.

You could definitely see your skills within the paintings you write. The arena hopes for more passionate writers like you who are not afraid to say how they believe. All the time follow your heart. “We may pass violets looking for roses. We may pass contentment looking for victory.” by Bern Williams.

You are my aspiration, I possess few blogs and infrequently run out from to post .

Hi there, just became aware of your blog through Google, and found that

it is truly informative. I’m going to watch

out for brussels. I will appreciate if you continue this in future.

A lot of people will be benefited from your writing. Cheers!

naturally like your website but you have to take a look at the spelling on several of your posts. Several of them are rife with spelling problems and I find it very bothersome to tell the reality however I will surely come again again.

Excellent blog right here! Also your web site quite a bit up fast! What web host are you the use of? Can I get your associate hyperlink in your host? I want my site loaded up as fast as yours lol

My spouse and I stumbled over here different page and thought

I might check things out. I like what I see so now

i am following you. Look forward to checking out your web page repeatedly.

Everything is very open with a very clear clarification of the challenges.

It was really informative. Your site is useful. Many thanks for

sharing!

Thanks for another fantastic article. Where else could anyone get that kind of info in such a perfect way of writing? I’ve a presentation next week, and I’m on the look for such info.

fantastic put up, very informative. I wonder why

the other specialists of this sector don’t notice this. You should continue your writing.

I am sure, you have a great readers’ base already!

whoah this blog is excellent i love reading your posts.

Keep up the good work! You recognize, a lot of persons are looking round for this info,

you can aid them greatly.

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

We are a gaggle of volunteers and starting a new scheme in our

community. Your site provided us with useful info to work on.

You have done a formidable process and our entire group will likely be

grateful to you.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

Why people still make use of to read news papers when in this

technological world the whole thing is existing

on net?

Wonderful goods from you, man. I’ve understand your stuff previous to and you are just

extremely magnificent. I actually like what you have acquired here, really like what you are

stating and the way in which you say it. You make it entertaining and you still care for to

keep it sensible. I can’t wait to read much more from you.

This is actually a wonderful website.

Thank you for some other informative website. Where else could I

get that type of info written in such a perfect way?

I’ve a undertaking that I am just now working on, and I

have been at the look out for such information.

I’m still learning from you, while I’m improving myself. I definitely love reading everything that is posted on your website.Keep the aarticles coming. I loved it!

Golden Panda est licencié et réglementé par le gouvernement du Costa

Rica, ce qui garantit une expérience de jeu sécurisée et conforme aux normes de l’industrie.

Hurrah, that’s what I was looking for, what a information!

present here at this blog, thanks admin of this site.

Greetings! I know this is kinda off topic but I’d figured

I’d ask. Would you be interested in trading links or maybe guest writing a blog article or vice-versa?

My website addresses a lot of the same topics as yours and I feel we could greatly

benefit from each other. If you might be interested feel free to shoot me an email.

I look forward to hearing from you! Terrific

blog by the way!

Hi just wanted to give you a brief heads up and let you know a few of the images aren’t

loading properly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show the same results.

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Hello there! I could have sworn I’ve been to this blog before but after checking through some of the post I realized it’s new to me. Anyways, I’m definitely delighted I found it and I’ll be bookmarking and checking back often!

Hello, just wanted to tell you, I enjoyed this post.

It was inspiring. Keep on posting!

Привет! Друг посоветовал ваш блог – и он правда крутой!

Теперь у вас новый фанат.

Поделюсь в соцсетях, пусть все знают!

Very energetic article, I enjoyed that a lot.

Will there be a part 2?

What’s up, I desire to subscribe for this webpage to get most recent

updates, therefore where can i do it please help out.

I am curious to find out what blog system you’re working with?

I’m having some small security problems with my latest

website and I’d like to find something more safe. Do you have any suggestions?

This is a very good tips especially to those new to blogosphere, brief and accurate information… Thanks for sharing this one. A must read article.

Hi there! Do you know if they make any plugins to help

with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very

good success. If you know of any please share.

Appreciate it!

WOW just what I was looking for. Came here by searching for site

Useful info. Lucky me I found your web site accidentally, and I’m stunned why this accident did

not took place earlier! I bookmarked it.

Hi there would you mind letting me know which hosting company you’re

utilizing? I’ve loaded your blog in 3 different internet browsers and

I must say this blog loads a lot faster then most. Can you recommend a good hosting provider at a fair price?

Thanks, I appreciate it!

Have you ever considered publishing an e-book

or guest authoring on other websites? I have a blog based upon on the same ideas you

discuss and would really like to have you share some stories/information. I know my viewers would enjoy your work.

If you’re even remotely interested, feel free to send me an email.

I am regular reader, how are you everybody?

This paragraph posted at this site is really nice.

You can definitely see your skills in the article you write.

The world hopes for even more passionate writers like you who are not afraid to mention how they believe.

At all times follow your heart.

You are my aspiration, I have few web logs and sometimes run out from to brand.

I am not real great with English but I find this really leisurely to interpret.

Привет, не могли бы вы сообщить,

какой хостинг вы используете? Я загрузил ваш блог в

трех разных браузерах, и должен сказать, что он

загружается намного быстрее, чем большинство других.

Можете ли вы порекомендовать хорошего хостинг-провайдера по разумной цене?

Спасибо, я ценю это!

Some genuinely nice and utilitarian info on this website, also I think the style and design has superb features.

Hello, its nice paragraph regarding media print, we all understand media is a great source of data.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

It’s in fact very difficult in this full of activity life to listen news on TV, thus I only use

world wide web for that reason, and get the hottest news.

Its such as you learn my thoughts! Yoou appear to grasp

a lot about this, such as you wrote the e booik in it orr something.

I think that you could do with some % to drive the message hokme a little bit, buut

instead of that, that is magnificent blog. An excellent read.

I’ll certainly be back.

my web-site: click here

simontok,

bokep indonesia,

bokep viral,

bokep indo terkini,

porno,

tautan bokep,

film porno,

bokep terupdate,

vidio bokep,

situs bokep,

film bokep

bokeb,

video porno,

bokep korea,

bokep indonesia terbaru,

indo bokep,

nonton bokep,

bokep viral indo,

bokep indoh,

bokep live,

bokep abg,

bokep indonesia viral,

website porno,

aplikasi bokep,

bokep india,

indo porn,

bokep indo live,

video bokep jepang,

porno indonesia,

laman bokep indo,

bokep si montok,

bokep cindo,

ling bokep,

lingbokep,

xnxx bokep,

bokep asia,

bokep hd,

indonesia porn,

video bokep indo,

video porn,

download bokep,

bokep xnxx,

bokep xxx,

simontk,

si mont0k,

linkbokep.to,

ruangbokep,

bokep online,

video simontok,

bokep31

Very interesting info!Perfect just what I was searching for!

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

As a Newbie, I am permanently browsing online for articles that can help me. Thank you

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

WOW just what I was looking for. Came here by searching for cigars

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

Thank you for sharing with us, I conceive this website really stands out : D.

If you desire to obtain a good deal from this paragraph then you have to

apply these strategies to your won web site.

I like what you guys are up also. Such clever work and reporting! Carry on the superb works guys I’ve incorporated you guys to my blogroll. I think it’ll improve the value of my web site 🙂

Attractive part of content. I simply stumbled upon your website and in accession capital to say

that I acquire actually enjoyed account your weblog posts.

Anyway I will be subscribing on your feeds or even I success you get admission to consistently quickly.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Thanks for each of your work on this site. My daughter take interest in carrying out internet research and it’s easy to see why. All of us hear all about the dynamic manner you give very important strategies through your website and as well foster participation from some other people on this content while my child is without a doubt discovering a great deal. Take pleasure in the rest of the year. You’re the one performing a remarkable job.

Enjoyed examining this, very good stuff, thanks.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

Keep working ,fantastic job!

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Hello there, just became aware of your blog through Google, and found that it’s truly informative. I’m gonna watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

Do you have a spam issue on this blog; I also am a blogger, and I was wondering your situation; we have created some nice methods and we are looking to swap strategies with others, be sure to shoot me an email if interested.

Link exchange is nothing else but it is only placing

the other person’s blog link on your page at proper place and other person will

also do similar for you.

Regards for this howling post, I am glad I observed this site on yahoo.

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

F*ckin’ awesome things here. I’m very glad to see your article. Thanks a lot and i’m looking forward to contact you. Will you kindly drop me a mail?

These are truly wonderful ideas in on the topic of

blogging. You have touched some fastidious factors here.

Any way keep up wrinting.

Real clear internet site, thankyou for this post.

This is the main reason why we inspect all bonuses thoroughly and ensure

that they have reasonable terms attached.

Hi there just wanted to give you a quick heads up. The text in your article seem to be running off the screen in Opera. I’m not sure if this is a format issue or something to do with web browser compatibility but I figured I’d post to let you know. The layout look great though! Hope you get the issue resolved soon. Cheers

Fantastic website. Plenty of useful info here. I am sending it to several friends ans also sharing in delicious. And certainly, thanks for your effort!

You can definitely see your skills in the paintings you write. The sector hopes for even more passionate writers such as you who are not afraid to mention how they believe. At all times go after your heart.

Se você gosta de fazer compras online e quer pagar menos sem abrir mão da qualidade, o Cupom da Vez é a solução ideal!

I haven’t checked in here for some time since I thought it was getting boring, but the last few posts are good quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂

hi!,I really like your writing very so much!

percentage we keep up a correspondence more approximately

your post on AOL? I require an expert on this space to resolve my problem.

May be that’s you! Looking ahead to see you.

I’ve been browsing on-line greater than 3 hours these days, yet I never discovered any

attention-grabbing article like yours. It is lovely worth

enough for me. In my view, if all site owners and bloggers made excellent

content as you did, the net might be a lot more helpful than ever

before.

Heya i’m for the first time here. I came across this board and I

find It truly helpful & it helped me out a lot. I hope to

give something back and aid others such as

you aided me.

very good submit, i certainly love this web site, carry on it

Hey there! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really appreciate your content. Please let me know. Many thanks

O Pix My Dollar é um aplicativo de microtarefas: você realiza atividades simples no celular e acumula recompensas, que podem ser convertidas em dinheiro.

I genuinely enjoy reading on this site, it has got great content. “One should die proudly when it is no longer possible to live proudly.” by Friedrich Wilhelm Nietzsche.

of course like your web site however you have to test the spelling on several of your posts. Several of them are rife with spelling problems and I to find it very troublesome to inform the truth on the other hand I will certainly come again again.

Hi, i think that i saw you visited my website so i came to “return the favor”.I’m trying to find things to enhance my web site!I suppose its ok to use some of your ideas!!

Its great as your other posts : D, thankyou for posting.

Whats Taking place i am new to this, I stumbled upon this I have discovered It absolutely helpful and it has aided me out loads. I am hoping to contribute & assist different users like its aided me. Great job.

I love your blog.. very nice colors & theme. Did you create this website yourself? Plz reply back as I’m looking to create my own blog and would like to know wheere u got this from. thanks

Hi there, i read your blog from time to time and i own a similar one and i

was just wondering if you get a lot of spam responses? If so how do

you prevent it, any plugin or anything you can suggest?

I get so much lately it’s driving me mad so any assistance is very much appreciated.

Well I really liked reading it. This article offered by you is very practical for accurate planning.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Great blog! Do you have any suggestions for aspiring writers?

I’m planning to start my own site soon but I’m a little lost on everything.

Would you advise starting with a free platform like WordPress or go for

a paid option? There are so many choices out there that I’m completely confused ..

Any suggestions? Bless you!

Hello! I’m at work surfing around your blog from my new iphone 3gs!

Just wanted to say I love reading through your blog and look forward to all your posts!

Carry on the great work!

Have you ever considered about including a little bit more than just your articles?

I mean, what you say is important and everything. However

just imagine if you added some great images or video clips

to give your posts more, “pop”! Your content is excellent but with

images and video clips, this site could certainly be one of

the very best in its field. Amazing blog!

I love it when people come together and share opinions, great blog, keep it up.

Hi, i think that i saw you visited my web site so i came to “return the

favor”.I’m trying to find things to improve my web site!I suppose its ok to

use a few of your ideas!!

This is the right blog for anyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I actually would want…HaHa). You definitely put a new spin on a topic thats been written about for years. Great stuff, just great!

I and also my pals came viewing the good thoughts from your web page and so the sudden got a terrible feeling I had not expressed respect to you for them. The young boys appeared to be consequently thrilled to learn them and have in effect quite simply been taking pleasure in those things. Thank you for turning out to be quite helpful and for selecting varieties of magnificent guides millions of individuals are really needing to be informed on. My personal sincere apologies for not expressing appreciation to sooner.

Hi, I think your site might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, fantastic blog!

Wonderful blog! I found it while searching on Yahoo

News. Do you have any tips on how to get listed in Yahoo News?

I’ve been trying for a while but I never seem to get

there! Many thanks

hello!,I really like your writing so much! share we communicate extra approximately your article on AOL? I need a specialist in this space to resolve my problem. May be that is you! Taking a look ahead to look you.

Wow, amazing blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your website is fantastic, as well as the content!

I like the valuable info you provide in your articles.

I will bookmark your blog and check again here frequently.

I’m quite certain I will learn many new stuff right here!

Good luck for the next!

Terrific work! This is the type of information that should be shared around the internet. Shame on Google for not positioning this post higher! Come on over and visit my site . Thanks =)

I could not resist commenting. Exceptionally well written!

Also visit my blog :: honey5.testedhoneypot.com

You made some nice points there. I did a search on the topic and found most individuals will approve with your website.

Well I really liked studying it. This subject provided by you is very practical for accurate planning.

I saw a lot of website but I believe this one has got something special in it in it

Spot on with this write-up, I really feel this website needs a lot

more attention. I’ll probably be returning to see more, thanks

for the advice!

This is a topic that’s close to my heart… Take care! Where are your contact details though?

Its wonderful as your other posts : D, thanks for posting. “History is a pact between the dead, the living, and the yet unborn.” by Edmund Burke.

Very interesting info!Perfect just what I was searching for!

Glad to be one of the visitors on this awesome web site : D.

I don’t normally comment but I gotta state regards for the post on this great one : D.

Hmm is anyone else having problems with the images on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any suggestions would be greatly appreciated.

hello there and thank you to your info – I have certainly picked up something new from right here. I did then again expertise some technical issues the use of this web site, as I skilled to reload the site lots of instances previous to I may get it to load correctly. I have been brooding about in case your hosting is OK? No longer that I am complaining, but sluggish loading instances times will often have an effect on your placement in google and can harm your quality score if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Well I’m adding this RSS to my e-mail and can glance out for a lot more of your respective exciting content. Ensure that you replace this again very soon..

Hi there, I found your site via Google while searching for a related topic, your web site came up, it looks good. I have bookmarked it in my google bookmarks.

Very interesting topic, thankyou for putting up.

Привет, я думаю, что это отличный сайт.

Я наткнулся на него;) Вернусь сюда снова,

так как добавил(а) его в закладки.

Деньги и свобода — лучший способ изменить жизнь, будьте богаты

и продолжайте помогать другим.

I¦ve recently started a blog, the information you offer on this site has helped me tremendously. Thanks for all of your time & work.

Thank you for another excellent article. The place else may just anybody get that kind of info in such a perfect means of writing? I’ve a presentation next week, and I’m on the search for such info.

Very interesting details you have noted, thanks for posting. “In a great romance, each person plays a part the other really likes.” by Elizabeth Ashley.

I have been browsing online more than 3 hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all web owners and bloggers made good content as you did, the web will be a lot more useful than ever before.

Hey there! Quick question that’s totally off topic. Do you know how to make your site mobile friendly?

My site looks weird when viewing from my iphone.

I’m trying to find a template or plugin that might be able to resolve this

problem. If you have any suggestions, please share. Many thanks!

You really make it appear really easy along with your presentation however I to find this topic to be actually one thing that I believe I might never understand. It sort of feels too complex and extremely wide for me. I’m having a look ahead in your subsequent submit, I’ll try to get the hold of it!

I gotta favorite this internet site it seems extremely helpful very useful

I just couldn’t depart your site prior to suggesting that I extremely enjoyed the standard info a person provide for your visitors? Is gonna be back often in order to check up on new posts

Det kan variera ordentligt mellan olika casino och det är kritiskt att förstå hur detta påverkar dina eventuella vinster.

I truly enjoy looking through on this website , it has got great articles.

I’ll right away snatch your rss as I can’t in finding your e-mail subscription link or e-newsletter service. Do you have any? Kindly let me know so that I could subscribe. Thanks.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

With havin so much content do you ever run into any issues of plagorism or copyright infringement? My blog has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the internet without my authorization. Do you know any solutions to help protect against content from being stolen? I’d certainly appreciate it.

3e4alj

Your means of telling all in this piece of writing is

actually fastidious, all be capable of effortlessly

be aware of it, Thanks a lot.

What i do not understood is in fact how you’re not actually a lot more neatly-preferred than you may be right now. You’re very intelligent. You recognize thus considerably on the subject of this topic, produced me for my part consider it from so many various angles. Its like men and women aren’t interested until it is something to do with Girl gaga! Your own stuffs nice. At all times care for it up!

Its like you read my thoughts! You seem to

know a lot about this, such as you wrote the book in it or something.

I feel that you could do with some p.c. to force the message home a

bit, but instead of that, this is excellent blog. An excellent read.

I’ll definitely be back.

You made a number of good points there. I did a search on the topic and found most persons will agree with your blog.

Spot on with this write-up, I truly assume this website wants far more consideration. I’ll most likely be once more to learn way more, thanks for that info.

There is apparently a bunch to know about this. I suppose you made some nice points in features also.

I have been browsing on-line greater than 3 hours nowadays, yet I by no means found any fascinating article like yours. It is pretty value enough for me. In my opinion, if all site owners and bloggers made just right content material as you probably did, the web will be a lot more useful than ever before. “Now I see the secret of the making of the best persons.” by Walt Whitman.

I¦ve recently started a website, the info you offer on this website has helped me tremendously. Thank you for all of your time & work.

I am no longer sure the place you’re getting your information, but great topic. I needs to spend a while finding out much more or understanding more. Thanks for excellent info I used to be looking for this info for my mission.

You need to take part in a contest for one of the best blogs on the web. I’ll advocate this web site!

Enjoyed looking through this, very good stuff, thankyou. “Golf isn’t a game, it’s a choice that one makes with one’s life.” by Charles Rosin.

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks a lot!

Great write-up, I am regular visitor of one¦s website, maintain up the excellent operate, and It is going to be a regular visitor for a lengthy time.

There is visibly a bundle to identify about this. I think you made certain good points in features also.

I like this website very much, Its a really nice berth to read and obtain info .

wonderful issues altogether, you just won a new reader. What may you suggest about your post that you made some days in the past? Any sure?

Respect to website author, some excellent entropy.

Hello. splendid job. I did not anticipate this. This is a great story. Thanks!

I really thankful to find this web site on bing, just what I was looking for : D also saved to favorites.

Nice post. I learn something more challenging on different blogs everyday. It will always be stimulating to read content from other writers and practice a little something from their store. I’d prefer to use some with the content on my blog whether you don’t mind. Natually I’ll give you a link on your web blog. Thanks for sharing.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

You are my intake, I have few web logs and often run out from to brand : (.

I’m not that much of a internet reader to be honest but your sites really nice, keep it

up! I’ll go ahead and bookmark your site to come back later.

Cheers

I have recently started a web site, the information you provide on this website has helped me greatly. Thanks for all of your time & work.

Very good https://is.gd/tpjNyL

I do agree with all the ideas you have presented in your post. They are really convincing and will definitely work. Still, the posts are too short for newbies. Could you please extend them a little from next time? Thanks for the post.

I’ve been surfing on-line more than three hours lately, but I never discovered any attention-grabbing article like yours. It¦s pretty value sufficient for me. Personally, if all website owners and bloggers made good content material as you did, the web might be a lot more helpful than ever before.

Hello my friend! I wish to say that this post is awesome, great written and include approximately all vital infos. I would like to see more posts like this .

I’m impressed, I must say. Seldom do I come across a blog that’s equally educative and amusing, and without a doubt, you’ve hit the nail on the head.

The problem is something not enough folks are speaking

intelligently about. I am very happy that I came across this in my search for something regarding this.

All of that is forgiveable, after all, because firstly, the Charge is a fitness tracker.

Here is my web-site https://www.good-play-game.com/

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get set up? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet smart so I’m not 100 sure. Any recommendations or advice would be greatly appreciated. Cheers

It is in point of fact a nice and useful piece of info. I¦m satisfied that you simply shared this useful information with us. Please keep us informed like this. Thanks for sharing.

Thanks for helping out, excellent info. “Considering how dangerous everything is, nothing is really very frightening.” by Gertrude Stein.

Hello everyone, it’s my first visit at this site, and piece of writing is in fact fruitful designed

for me, keep up posting these articles or reviews.

I was wondering if you ever considered changing the layout of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 pictures. Maybe you could space it out better?

My partner and I stumbled over here from a different web address

and thought I may as well check things out. I like what I see

so i am just following you. Look forward to checking out your web page

again.

Thank you for the good writeup. It in fact was a amusement account it. Look advanced to more added agreeable from you! However, how can we communicate?

I was just looking for this info for some time. After 6 hours of continuous Googleing, at last I got it in your site. I wonder what is the lack of Google strategy that don’t rank this type of informative sites in top of the list. Usually the top websites are full of garbage.

Your place is valueble for me. Thanks!…

I have been exploring for a little bit for any high quality articles or weblog posts on this kind of house . Exploring in Yahoo I finally stumbled upon this site. Reading this information So i’m glad to exhibit that I have a very just right uncanny feeling I found out just what I needed. I such a lot for sure will make sure to don’t omit this web site and give it a glance regularly.

hello!,I really like your writing so a lot! share we be in contact extra approximately your article on AOL? I require an expert on this house to solve my problem. May be that’s you! Looking ahead to peer you.

Hello there! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything

I’ve worked hard on. Any tips?

hi!,I love your writing very much! proportion we communicate more approximately your article on AOL? I need an expert in this space to resolve my problem. Maybe that is you! Having a look forward to see you.

I really like your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to create my own blog and would like to find out where u got this from. thank you

Outstanding post, you have pointed out some fantastic points, I too believe this s a very fantastic website.

Hi there, just became alert to your blog through Google, and found that it’s truly informative. I’m gonna watch out for brussels. I’ll be grateful if you continue this in future. Many people will be benefited from your writing. Cheers!

I think this is among the most important info for me. And i am glad reading your

article. But want to remark on few general things, The web site style

is great, the articles is really nice : D. Good job, cheers

It is the best time to make some plans for the future and it is time to be happy. I have read this post and if I could I wish to suggest you some interesting things or tips. Maybe you can write next articles referring to this article. I desire to read even more things about it!

Pretty! This was a really wonderful post. Thank you for your provided information.

Thankyou for helping out, good information.

You made some clear points there. I looked on the internet for the subject matter and found most people will agree with your blog.

I enjoy reading through an article that will make men and women think.

Also, thanks for permitting me to comment!

Thank you for the auspicious writeup. It in fact was a amusement account it. Look advanced to far added agreeable from you! By the way, how could we communicate?

I enjoy reading through and I think this website got some truly useful stuff on it! .

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

Thank you for the auspicious writeup. It in fact used to be a entertainment account it. Look advanced to more brought agreeable from you! However, how can we be in contact?

Good day! This post could not be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this page to him. Pretty sure he will have a good read. Thank you for sharing!

Hi just wanted to give you a brief heads up and let

you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue.

I’ve tried it in two different internet browsers and both show the same outcome.

ProDentim is a chewable oral probiotic supplement formulated with a unique mix of probiotics, prebiotics, herbs, and nutrients.

Today, while I was at work, my sister stole my iphone and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83 views. I know this is totally off topic but I had to share it with someone!

Excellent read, I just passed this onto a colleague who was doing some research on that. And he actually bought me lunch as I found it for him smile Therefore let me rephrase that: Thanks for lunch!

I went over this website and I believe you have a lot of good info, saved to bookmarks (:.

I’ll immediately snatch your rss feed as I can’t to find your email subscription link or newsletter service. Do you have any? Please allow me know in order that I could subscribe. Thanks.

I’ve read a few good stuff here. Certainly worth bookmarking for revisiting. I surprise how much effort you put to make such a wonderful informative website.

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again

Hey, you used to write wonderful, but the last few posts have been kinda boring?K I miss your super writings. Past several posts are just a little out of track! come on!

Good blog! I truly love how it is simple on my eyes and the data are well written. I’m wondering how I might be notified when a new post has been made. I’ve subscribed to your RSS feed which must do the trick! Have a nice day!

Hello. excellent job. I did not imagine this. This is a excellent story. Thanks!

I am continuously invstigating online for articles that can benefit me. Thanks!

Hello. splendid job. I did not anticipate this. This is a remarkable story. Thanks!

Only wanna input that you have a very decent website , I enjoy the layout it really stands out.