This site contains affiliate links to products. We may receive a commission for purchases made through these links, at no additional cost to you. As an Amazon Associate I earn from qualifying purchases. Read our disclaimers page for more information.

Sometimes, I love getting a second opinion.

Which colour shirt looks best on me?

Should I actually take the plunge and get more than a trim at the salon?

Sometimes there are just too many options to pick from. And sometimes I’m not confident in my ability to make the right decision.

After I talk it over with a friend, I feel better about it.

When it comes to your money, though, it’s really important to start to feel confident in your own decisions.

You will be the one who needs your retirement savings someday- no one else will!

You will be debt free and feeling financially comfortable, because that’s your goal. Your friends may not share the same goals, and that’s okay.

If you’ve been trying to budget, save more money, or pay off debt- and are getting some puzzling looks from your friends- here’s some things to keep in mind.

Your Finances are Super Personal

As you’ve probably noticed, finances aren’t a dinner table topic yet. We are often quite private when it comes to our money issues. Although it would be nice if the dialogue opened up more someday, we’re not there yet.

You probably don’t know that much about your friends’ financial situations, because they’re not talking about it very much. Likewise, they probably don’t know your situation very well, either.

Personal finances can be so complex. It’s so much more than how much money someone makes. How much does their salary fluctuate year to year? What are their expenses? What are their personal savings? Retirement savings? How much debt do they have, and how well are they managing it?

I think this is an important topic because we live in a consumerist society.

When someone is shopping or trying to keep up with the Jones’, it feels like thats what we’re supposed to do as we progress in life. You become more successful, you make more money, and then you spend more money.

But if you’re trying to live a life of financial freedom and escape debt and overspending- well, you’re not the norm! You may feel like you’re being judged by others in the process.

Why can’t you go out to dinner tonight? You already declined last week.

Remind yourself that they might not be fully aware of your situation, and that you probably know what is best for your budget.

Also remember that there a ton of free or low-cost activities you can recommend instead, like going for a walk, getting a coffee, or having a movie night in.

Don’t Feel Pressured to Over-Share About Your Finances, Either

You should absolutely be transparent with your friends and family if you are working on a financial goal right now.

If you’ve been working overtime to be debt-free, you can give them a heads up. Especially if you were okay going shopping with them before, and your attitude towards money has since changed.

It doesn’t mean they need to copy exactly what you’re doing. But maybe they’ll be more open to grabbing a coffee vs. going to the mall and spending the day shopping.

Keep these conversations within your comfort level. It’s not necessary to share specific numbers or details in order to be more open about money.

I tell people I’m paying off my student loans and I’m not going to be buying any extras at the moment. I’ve gotten some confused looks, especially when it’s something small like going out for lunch- but usually people are still understanding.

It’s Good to Practice Feeling Empowered about your Money

This brings me to an important point.

You are the most familiar with your money situation, and you know it best.

It doesn’t matter if you’ve made a million and one mistakes with your finances before. Honestly, this can be the best way to learn what you don’t want from your money.

After living with hefty student loan payments for years, I knew that I don’t want to owe people money for the rest of my life.

Once you have made a money decision, stand firm! Even if you don’t have all of the answers yet yourself.

Keep learning and educating yourself.

You will always be your best advocate!

You are also the only one who has to live with your choices- so it doesn’t matter if your choice isn’t a popular one.

Budgeting in real life can be hard- but it gets easier the longer you practice!

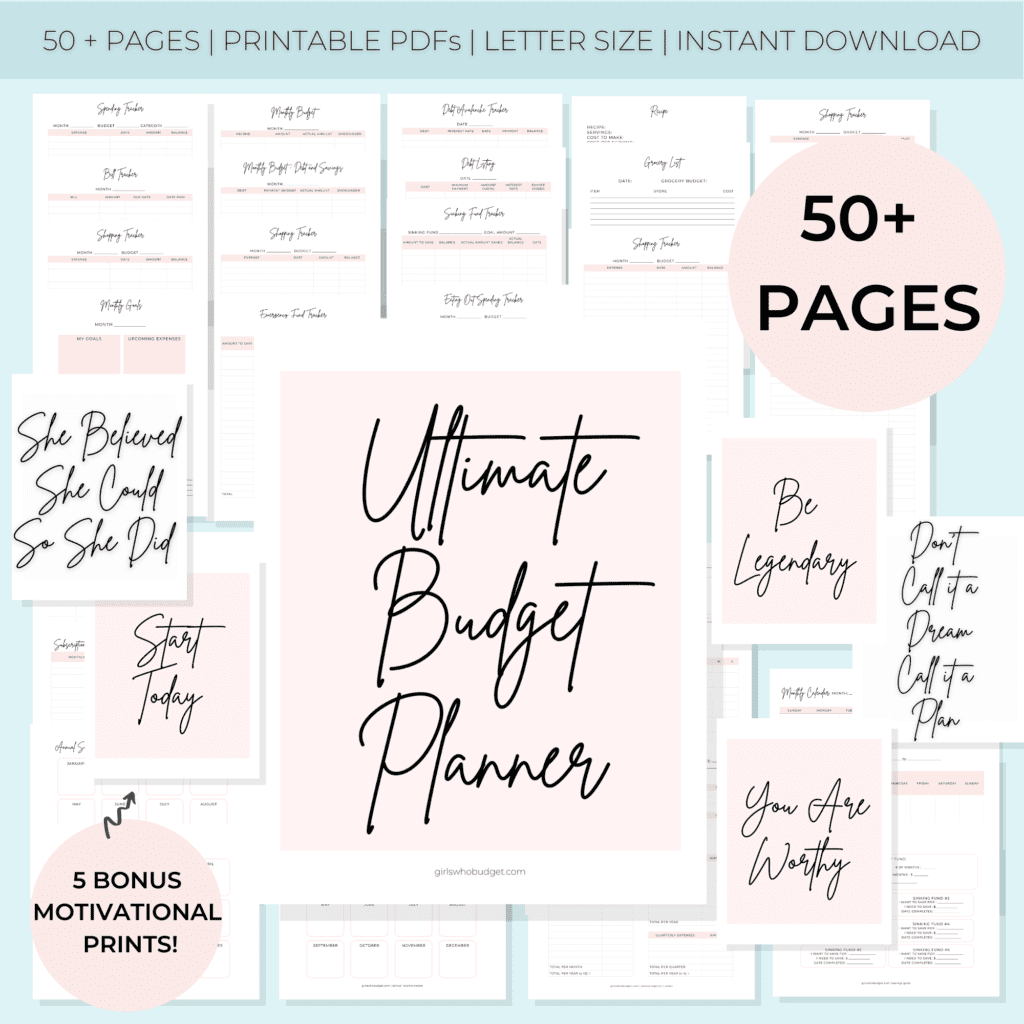

If you want to make budgeting a whole lot easier, we have an Ultimate Budget Planner system for you- 50+ printables that cover your monthly budget, bills, expenses, goals, savings, meal planning, and more!

Related Posts:

I am not positive where you are getting your information, however great topic. I needs to spend a while studying much more or figuring out more. Thanks for great information I used to be looking for this info for my mission.

Howdy! Do you use Twitter? I’d like to follow you if that would be ok. I’m absolutely enjoying your blog and look forward to new updates.

I was wondering if you ever considered changing the structure of your site? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 images. Maybe you could space it out better?

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your site? My blog site is in the exact same area of interest as yours and my users would really benefit from some of the information you present here. Please let me know if this okay with you. Thanks!

Hello. Great job. I did not expect this. This is a remarkable story. Thanks!

Very interesting subject, thanks for putting up. “We need not think alike to love alike.” by Francis David.

Whats Going down i’m new to this, I stumbled upon this I’ve discovered It positively useful and it has helped me out loads. I’m hoping to give a contribution & help different users like its aided me. Good job.

I?¦m no longer positive where you’re getting your info, but good topic. I needs to spend a while finding out more or understanding more. Thanks for magnificent information I used to be looking for this information for my mission.

Some truly nice stuff on this site, I love it.

It is really a nice and useful piece of information. I’m satisfied that you simply shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

WONDERFUL Post.thanks for share..more wait .. …

excellent publish, very informative. I wonder why the opposite specialists of this sector do not notice this. You must proceed your writing. I am confident, you have a huge readers’ base already!

Nice weblog here! Additionally your web site quite a bit up fast! What web host are you using? Can I get your associate link for your host? I wish my site loaded up as quickly as yours lol

It¦s actually a great and useful piece of information. I am happy that you just shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

Awesome blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog shine. Please let me know where you got your theme. Appreciate it

Fantastic site. A lot of useful information here. I am sending it to some friends ans also sharing in delicious. And obviously, thanks to your effort!

you have a great blog here! would you like to make some invite posts on my blog?

Very efficiently written article. It will be useful to everyone who employess it, including me. Keep doing what you are doing – for sure i will check out more posts.

Valuable information. Lucky me I found your web site by accident, and I’m shocked why this accident didn’t happened earlier! I bookmarked it.

Great post. I am facing a couple of these problems.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across. It extremely helps make reading your blog significantly easier.

you’ve gotten an ideal weblog right here! would you prefer to make some invite posts on my blog?

Thank you for sharing excellent informations. Your web site is so cool. I’m impressed by the details that you¦ve on this website. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for more articles. You, my friend, ROCK! I found just the information I already searched everywhere and simply couldn’t come across. What a perfect website.

I haven’t checked in here for some time because I thought it was getting boring, but the last several posts are good quality so I guess I’ll add you back to my daily bloglist. You deserve it my friend 🙂

I am impressed with this site, rattling I am a big fan .

You are a very capable person!

Excellent goods from you, man. I’ve understand your stuff previous to and you’re simply too magnificent. I actually like what you’ve received right here, really like what you are saying and the way in which in which you are saying it. You make it entertaining and you continue to take care of to stay it sensible. I can not wait to read far more from you. This is really a great site.

I see something really special in this website .

The crux of your writing whilst appearing reasonable initially, did not work well with me personally after some time. Someplace within the paragraphs you actually managed to make me a believer unfortunately only for a while. I nevertheless have got a problem with your jumps in assumptions and you might do nicely to help fill in all those breaks. If you can accomplish that, I would surely be amazed.

Some truly nice stuff on this internet site, I love it.

As a Newbie, I am permanently exploring online for articles that can aid me. Thank you

Hi there just wanted to give you a quick heads up. The text in your article seem to be running off the screen in Chrome. I’m not sure if this is a format issue or something to do with web browser compatibility but I figured I’d post to let you know. The design and style look great though! Hope you get the problem solved soon. Cheers

It?¦s actually a great and useful piece of information. I am satisfied that you just shared this helpful information with us. Please stay us informed like this. Thanks for sharing.

Yay google is my queen helped me to find this outstanding site! .

I couldn’t resist commenting

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

I as well believe thus, perfectly composed post! .

I truly enjoy reading through on this website , it has great posts.

Magnificent items from you, man. I’ve take note your stuff prior to and you’re just too magnificent. I really like what you’ve got right here, really like what you are saying and the best way through which you are saying it. You’re making it entertaining and you continue to take care of to keep it wise. I can not wait to learn much more from you. That is actually a tremendous website.

I?¦m now not positive the place you’re getting your info, however good topic. I needs to spend a while learning more or understanding more. Thank you for fantastic information I was on the lookout for this information for my mission.

wonderful post, very informative. I wonder why the other experts of this sector do not notice this. You should continue your writing. I’m confident, you have a huge readers’ base already!

As a Newbie, I am always browsing online for articles that can aid me. Thank you

Thanks for the good writeup. It in truth used to be a enjoyment account it. Look advanced to more introduced agreeable from you! However, how could we keep in touch?

I as well as my buddies have already been reviewing the nice thoughts found on your site and so the sudden I had a terrible suspicion I had not expressed respect to the web blog owner for those tips. Most of the young boys were as a consequence very interested to learn all of them and have in effect clearly been using those things. Appreciation for being really thoughtful and also for using variety of essential themes millions of individuals are really eager to know about. Our sincere apologies for not expressing gratitude to sooner.

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I get four emails with the identical comment. Is there any method you may remove me from that service? Thanks!

I love your writing style really enjoying this internet site.

You could certainly see your enthusiasm within the work you write. The sector hopes for even more passionate writers such as you who are not afraid to say how they believe. At all times go after your heart. “Every man serves a useful purpose A miser, for example, makes a wonderful ancestor.” by Laurence J. Peter.

Glad to be one of the visitants on this awe inspiring site : D.

Once I initially commented I clicked the -Notify me when new feedback are added- checkbox and now each time a comment is added I get four emails with the identical comment. Is there any manner you’ll be able to take away me from that service? Thanks!

You are my breathing in, I have few web logs and infrequently run out from to post .

Really good info can be found on web blog.

I have been exploring for a little bit for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this site. Reading this information So i’m happy to convey that I’ve a very good uncanny feeling I discovered exactly what I needed. I most certainly will make certain to do not forget this web site and give it a look regularly.

But wanna state that this is handy, Thanks for taking your time to write this.

Definitely believe that which you stated. Your favorite justification seemed to be on the internet the simplest thing to be aware of. I say to you, I certainly get annoyed while people think about worries that they plainly do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side effect , people can take a signal. Will probably be back to get more. Thanks

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My blog is in the very same niche as yours and my visitors would really benefit from some of the information you present here. Please let me know if this okay with you. Many thanks!

Hmm it seems like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I too am an aspiring blog blogger but I’m still new to the whole thing. Do you have any tips and hints for newbie blog writers? I’d genuinely appreciate it.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. Nevertheless just imagine if you added some great graphics or video clips to give your posts more, “pop”! Your content is excellent but with pics and video clips, this site could undeniably be one of the most beneficial in its niche. Awesome blog!

Good – I should definitely pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related info ended up being truly simple to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your client to communicate. Nice task.

Great write-up, I?¦m regular visitor of one?¦s web site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

It’s hard to find knowledgeable people on this topic, but you sound like you know what you’re talking about! Thanks

This internet site is my inspiration , rattling wonderful layout and perfect content.

Great post, you have pointed out some great points, I also believe this s a very fantastic website.

hello there and thank you for your information – I have certainly picked up anything new from right here. I did however expertise a few technical points using this web site, since I experienced to reload the web site a lot of times previous to I could get it to load properly. I had been wondering if your hosting is OK? Not that I am complaining, but slow loading instances times will sometimes affect your placement in google and can damage your high-quality score if advertising and marketing with Adwords. Anyway I am adding this RSS to my email and can look out for much more of your respective fascinating content. Ensure that you update this again very soon..

Please let me know if you’re looking for a author for your blog. You have some really good posts and I believe I would be a good asset. If you ever want to take some of the load off, I’d absolutely love to write some content for your blog in exchange for a link back to mine. Please blast me an email if interested. Regards!

With everything which seems to be building throughout this specific area, many of your perspectives are generally fairly stimulating. Nevertheless, I appologize, but I do not give credence to your whole theory, all be it exciting none the less. It looks to me that your opinions are actually not completely rationalized and in fact you are yourself not even entirely confident of the assertion. In any case I did take pleasure in examining it.

I am impressed with this internet site, real I am a big fan .

Great post. I am facing a couple of these problems.

It is in reality a great and helpful piece of info. I am happy that you simply shared this helpful info with us. Please keep us up to date like this. Thank you for sharing.

I’m not that much of a internet reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your site to come back in the future. Cheers

You completed various fine points there. I did a search on the matter and found the majority of persons will agree with your blog.

I like this weblog very much, Its a very nice spot to read and incur information.

Some truly superb information, Sword lily I discovered this.

What i do not understood is actually how you’re now not really much more well-favored than you might be right now. You are so intelligent. You understand thus significantly with regards to this topic, made me in my view believe it from numerous various angles. Its like women and men aren’t involved except it’s one thing to do with Woman gaga! Your personal stuffs outstanding. At all times handle it up!

I would like to thnkx for the efforts you’ve put in writing this website. I’m hoping the same high-grade blog post from you in the upcoming also. Actually your creative writing skills has inspired me to get my own site now. Actually the blogging is spreading its wings rapidly. Your write up is a great example of it.

My spouse and I stumbled over here from a different website and thought I should check things out. I like what I see so now i’m following you. Look forward to checking out your web page yet again.

Heya i’m for the first time here. I came across this board and I to find It really helpful & it helped me out much. I’m hoping to provide one thing again and help others such as you helped me.

I get pleasure from, result in I discovered just what I used to be taking a look for. You have ended my 4 day lengthy hunt! God Bless you man. Have a nice day. Bye

Hello there! Would you mind if I share your blog with my myspace group? There’s a lot of folks that I think would really enjoy your content. Please let me know. Many thanks

I am curious to find out what blog system you have been working with? I’m having some small security issues with my latest blog and I would like to find something more safeguarded. Do you have any suggestions?

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Very interesting info !Perfect just what I was looking for!

Today, I went to the beach front with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

very nice post, i actually love this web site, carry on it

It is in point of fact a great and helpful piece of info. I am satisfied that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

In the great scheme of things you’ll receive an A+ for effort and hard work. Exactly where you confused me was on the facts. As they say, details make or break the argument.. And that couldn’t be more accurate here. Having said that, permit me tell you what did give good results. Your text is definitely quite powerful and that is probably the reason why I am making the effort to comment. I do not really make it a regular habit of doing that. Secondly, despite the fact that I can easily see the leaps in reason you make, I am not necessarily sure of how you appear to connect your points which make the actual final result. For the moment I will, no doubt yield to your point however hope in the near future you actually link your dots better.

I don’t unremarkably comment but I gotta admit thanks for the post on this amazing one : D.

Hello, i think that i noticed you visited my site so i came to “return the desire”.I’m trying to find issues to enhance my web site!I assume its adequate to use some of your concepts!!

Rattling excellent information can be found on web blog.

Thanks for this terrific post, I am glad I detected this internet site on yahoo.

hello!,I really like your writing very much! share we be in contact more about your post on AOL? I need a specialist in this area to resolve my problem. Maybe that is you! Looking ahead to look you.

I was reading some of your posts on this internet site and I conceive this site is real informative ! Keep posting.

I visited a lot of website but I think this one holds something extra in it in it

Hello. excellent job. I did not anticipate this. This is a remarkable story. Thanks!

I have to show some appreciation to you for rescuing me from this particular crisis. After surfing throughout the world wide web and seeing concepts that were not pleasant, I believed my entire life was gone. Existing without the presence of approaches to the difficulties you have fixed as a result of your entire website is a crucial case, as well as the kind which may have negatively affected my career if I hadn’t encountered your site. Your personal expertise and kindness in dealing with every item was valuable. I’m not sure what I would’ve done if I hadn’t come upon such a stuff like this. I can at this moment look ahead to my future. Thanks very much for your skilled and amazing help. I won’t be reluctant to recommend the website to anybody who wants and needs counselling on this problem.

Aumente o público das suas transmissões! Compre visualizações para live no YouTube e ganhe mais engajamento, credibilidade e alcance na plataforma.

Some really nice and utilitarian info on this internet site, too I believe the pattern has got wonderful features.

Hello my family member! I want to say that this post is amazing, great written and come with almost all important infos. I would like to look more posts like this .

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

It provides an excellent user experience from start to finish.

Pretty great post. I just stumbled upon your blog and wished to say that I have really enjoyed browsing your weblog posts. In any case I’ll be subscribing on your feed and I hope you write again very soon!

The content is well-organized and highly informative.

he blog was how do i say it… relevant, finally something that helped me. Thanks

very nice submit, i definitely love this website, keep on it

obviously like your web-site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling issues and I find it very bothersome to tell the truth then again I?¦ll certainly come back again.

I love how user-friendly and intuitive everything feels.

I?¦ve recently started a web site, the info you offer on this site has helped me tremendously. Thank you for all of your time & work.

It provides an excellent user experience from start to finish.

FitSpresso is a dietary supplement designed to aid weight loss, improve energy levels, and promote overall wellness. It targets key areas of weight management by enhancing metabolism, controlling appetite, and supporting fat-burning processes.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Hello! I know this is somewhat off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

What i do not understood is actually how you’re not really much more well-liked than you may be right now. You are very intelligent. You realize thus considerably relating to this subject, made me personally consider it from numerous varied angles. Its like men and women aren’t fascinated unless it’s one thing to do with Lady gaga! Your own stuffs outstanding. Always maintain it up!

Youre so cool! I dont suppose Ive learn anything like this before. So nice to search out any person with some original ideas on this subject. realy thank you for beginning this up. this web site is something that is needed on the web, someone with a bit of originality. useful job for bringing one thing new to the internet!

I¦ve read some excellent stuff here. Definitely value bookmarking for revisiting. I wonder how much effort you put to make one of these fantastic informative website.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

Have you ever thought about adding a little bit more than just your articles? I mean, what you say is fundamental and all. But think about if you added some great graphics or videos to give your posts more, “pop”! Your content is excellent but with images and video clips, this site could undeniably be one of the best in its niche. Amazing blog!

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

I’ll immediately grab your rss feed as I can not find your email subscription link or newsletter service. Do you have any? Please let me know so that I could subscribe. Thanks.

Hello my friend! I wish to say that this article is amazing, nice written and include almost all vital infos. I’d like to see more posts like this.

Great beat ! I would like to apprentice while you amend your web site, how can i subscribe for a blog web site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast provided bright clear concept

Thanks for any other magnificent post. Where else could anyone get that type of info in such a perfect way of writing? I’ve a presentation next week, and I am at the look for such info.

Wow, amazing weblog format! How lengthy have you ever been blogging for? you made blogging glance easy. The entire look of your website is magnificent, let alone the content!

It’s actually a cool and useful piece of information. I’m glad that you shared this helpful info with us. Please keep us up to date like this. Thanks for sharing.

I was curious if you ever thought of changing the structure of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or two images. Maybe you could space it out better?

I’ve recently started a blog, the information you provide on this web site has helped me greatly. Thanks for all of your time & work.

You made some decent points there. I appeared on the web for the difficulty and found most people will go along with with your website.

I have fun with, result in I discovered exactly what I used to be having a look for. You’ve ended my four day long hunt! God Bless you man. Have a nice day. Bye

I am glad to be a visitor of this gross site! , regards for this rare info ! .

Hey very nice site!! Man .. Excellent .. Amazing .. I’ll bookmark your web site and take the feeds also…I am happy to find numerous useful info here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

I’ve been browsing online more than three hours today, yet I never found any interesting article like yours. It’s pretty worth enough for me. In my opinion, if all webmasters and bloggers made good content as you did, the internet will be much more useful than ever before.

You have mentioned very interesting points! ps nice site.

It’s a shame you don’t have a donate button! I’d without a doubt donate to this excellent blog! I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to new updates and will talk about this website with my Facebook group. Talk soon!

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your blog? My blog is in the very same area of interest as yours and my users would certainly benefit from some of the information you provide here. Please let me know if this okay with you. Cheers!

I truly enjoy looking at on this site, it holds good blog posts.

With havin so much content do you ever run into any problems of plagorism or copyright violation? My website has a lot of exclusive content I’ve either authored myself or outsourced but it looks like a lot of it is popping it up all over the web without my authorization. Do you know any techniques to help prevent content from being ripped off? I’d genuinely appreciate it.

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

Hi there, You’ve performed an incredible job. I’ll certainly digg it and individually recommend to my friends. I’m sure they will be benefited from this website.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

Great write-up, I am normal visitor of one¦s site, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

I wish to show thanks to the writer just for rescuing me from such a incident. Right after checking throughout the the net and getting proposals that were not powerful, I thought my entire life was over. Being alive devoid of the solutions to the difficulties you’ve resolved by way of your entire website is a serious case, and the kind that might have adversely damaged my career if I hadn’t noticed your web blog. Your good talents and kindness in dealing with all the pieces was very helpful. I don’t know what I would have done if I had not come upon such a stuff like this. I can also at this time relish my future. Thanks a lot very much for your reliable and results-oriented help. I will not be reluctant to recommend the website to any individual who should have guidelines on this situation.

پارتیشن سازه ، تولید کننده انواع پارتیشن اداری و سایر دکوراسیون اداری، با حدود سه دهه سابقه. با افتخار مجرئ انواع پروژهها در اکثریت شرکتها و ادارات. سفارش مستقیم از تولید کننده بدون واسطه

I besides believe hence, perfectly composed post! .

Would love to forever get updated great weblog! .

I conceive other website owners should take this website as an example , very clean and superb user pleasant style.

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

It’s in reality a nice and useful piece of info. I’m happy that you shared this helpful information with us. Please keep us up to date like this. Thank you for sharing.

I have been absent for some time, but now I remember why I used to love this site. Thank you, I’ll try and check back more often. How frequently you update your website?

Mitolyn is a cutting-edge natural dietary supplement designed to support effective weight loss and improve overall wellness.

I really like your writing style, wonderful information, thankyou for putting up : D.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

Great website! I am loving it!! Will come back again. I am bookmarking your feeds also.

PrimeBiome is a dietary supplement designed to support gut health by promoting a balanced microbiome, enhancing digestion, and boosting overall well-being.

Its great as your other blog posts : D, regards for posting.

Hey just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different web browsers and both show the same results.

I gotta bookmark this website it seems very beneficial extremely helpful

The Natural Mounjaro Recipe is more than just a diet—it’s a sustainable and natural approach to weight management and overall health.

I have recently started a website, the info you offer on this website has helped me greatly. Thank you for all of your time & work.

Hi there very nice blog!! Man .. Beautiful .. Amazing .. I will bookmark your web site and take the feeds additionally…I am glad to seek out so many useful info here in the put up, we want develop extra strategies on this regard, thanks for sharing.

Hi there would you mind sharing which blog platform you’re working with? I’m planning to start my own blog soon but I’m having a tough time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I’m looking for something unique. P.S Apologies for being off-topic but I had to ask!

Some truly superb info , Gladiola I observed this. “I know God will not give me anything I can’t handle. I just wish that He didn’t trust me so much.” by Mother Theresa.

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely helpful and it has aided me out loads. I hope to contribute & assist other users like its helped me. Great job.

I feel this is one of the such a lot important information for me. And i’m satisfied studying your article. However want to statement on some common things, The site style is perfect, the articles is truly excellent : D. Excellent job, cheers

I¦ve recently started a blog, the information you offer on this website has helped me tremendously. Thanks for all of your time & work.

I am glad to be one of the visitors on this great site (:, thankyou for putting up.

You are a very bright person!

It’s a shame you don’t have a donate button! I’d most certainly donate to this brilliant blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this site with my Facebook group. Chat soon!

Hi! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no backup. Do you have any solutions to protect against hackers?

Some times its a pain in the ass to read what website owners wrote but this web site is very user genial! .

Your style is so unique compared to many other people. Thank you for publishing when you have the opportunity,Guess I will just make this bookmarked.2

I feel that is among the so much significant information for me. And i’m glad reading your article. But wanna observation on some general issues, The site style is great, the articles is truly great : D. Excellent activity, cheers